- United States

- /

- Healthcare Services

- /

- NYSE:USPH

U.S. Physical Therapy (USPH): Exploring Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

Shares of U.S. Physical Therapy (USPH) have struggled over the past month, falling 16%. The stock is down 17% for the past year. However, underlying revenue and net income have continued to post positive annual growth, which might catch investors’ attention.

See our latest analysis for U.S. Physical Therapy.

After tumbling more than 15% in the past month, U.S. Physical Therapy's share price is clearly losing momentum, even as the company posts steady revenue and net income gains. Over the past year, its total shareholder return has slipped nearly 17%, which suggests investor perception may be shifting away from its long-term growth potential.

If recent volatility has you curious about other opportunities in healthcare, check out our curated selection with the See the full list for free.

With U.S. Physical Therapy's share price lagging despite steady financial growth, is the market overlooking an undervalued opportunity, or has it already factored in all the upside for future gains?

Most Popular Narrative: 30% Undervalued

With the most closely followed fair value estimate at $106.83, U.S. Physical Therapy's shares appear meaningfully discounted compared to the last close of $74.39. This wide gap draws attention to the future growth projections that underpin the bullish consensus among market-watchers.

Sustained growth in patient volumes and record-high clinic visits per day, driven by the growing need for physical therapy among older adults and those with chronic conditions, positions the company for continued revenue growth, as healthcare demand demographics work in its favor.

Want to know which financial leaps justify this aggressive valuation? The narrative is powered by ambitious revenue trajectories and bold assumptions about future profitability. Curious how these projections measure up? Discover the precise benchmarks and inflection points that could unlock further upside for the stock by reading the full narrative.

Result: Fair Value of $106.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reimbursement pressures or rising clinician shortages could quickly dampen growth expectations and challenge the outlook for U.S. Physical Therapy's long-term gains.

Find out about the key risks to this U.S. Physical Therapy narrative.

Another View: What Do Multiples Suggest?

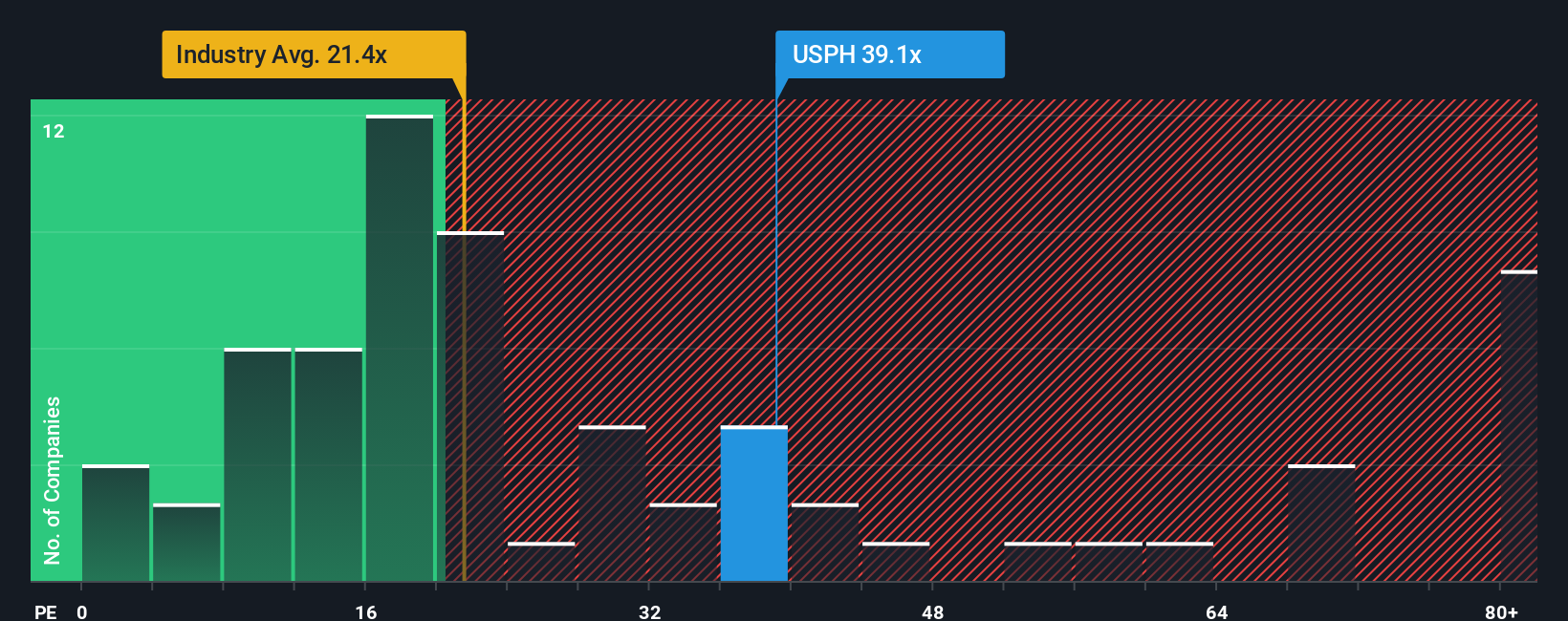

While analyst forecasts paint U.S. Physical Therapy as undervalued, its price-to-earnings ratio sits at 31.4x, well above both its industry average of 21.4x and a fair ratio of 16.7x. This could mean investors are paying a premium, which raises questions about future upside versus valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own U.S. Physical Therapy Narrative

If you have your own perspective or want to dive deeper into the numbers, you can quickly create your own narrative and test your assumptions using Do it your way.

A great starting point for your U.S. Physical Therapy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t pass up real opportunities to get ahead. There is a world of high-potential stocks you can act on right now. Find your next move with these handpicked themes below.

- Capture stellar yields and reliable income streams by checking out these 15 dividend stocks with yields > 3% offering dividends above 3% in today’s market.

- Ride the next wave of technological advancement by screening these 25 AI penny stocks that are pushing boundaries in artificial intelligence and automation.

- Spot high-value opportunities instantly with these 854 undervalued stocks based on cash flows selected for strong cash flow and attractive valuations before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USPH

U.S. Physical Therapy

Operates and manages outpatient physical therapy clinics.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives