- United States

- /

- Healthcare Services

- /

- NYSE:THC

Tenet Healthcare (THC): Evaluating Valuation Following Major Debt Refinancing and Strengthened Balance Sheet

Reviewed by Simply Wall St

Tenet Healthcare (THC) recently completed a major debt refinancing by raising $1.5 billion in senior secured first lien notes and $750 million in senior notes. The fresh capital enables Tenet to redeem higher-cost obligations, improving its balance sheet and near-term flexibility.

See our latest analysis for Tenet Healthcare.

Following the refinancing news, Tenet Healthcare continues to attract attention for its robust performance. The stock’s 53.3% year-to-date share price return and three-year total shareholder return of 316.85% highlight strong momentum. Investors appear optimistic about the company’s strategic maneuvers and operational improvements, despite broader industry uncertainties.

Curious what else is showing this kind of momentum? Explore innovation and resilience in the health sector by discovering See the full list for free.

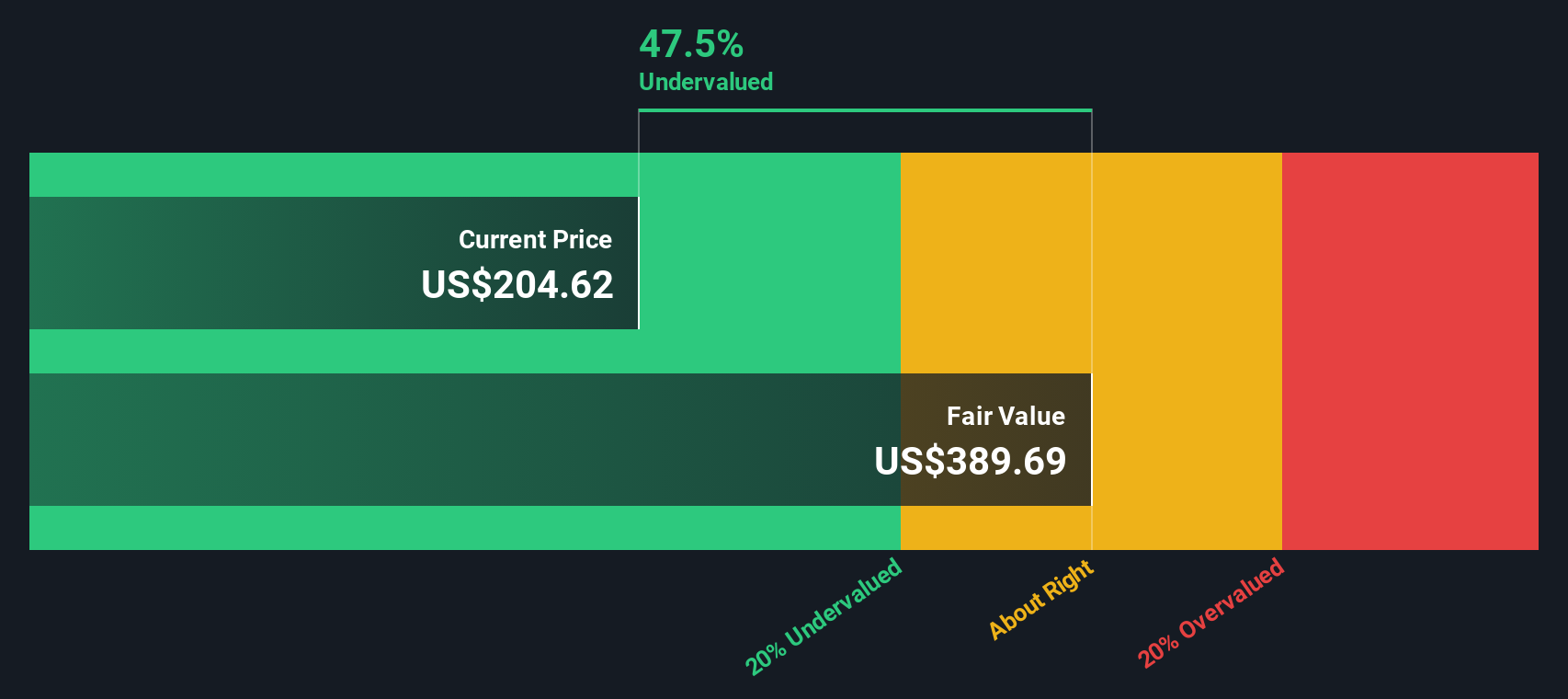

With shares trading below analyst targets and a sizable intrinsic discount, investors now face a pivotal question: is Tenet Healthcare undervalued and positioned for further gains, or has the market already priced in future growth?

Price-to-Earnings of 12.5x: Is it justified?

Tenet Healthcare’s shares are trading at a price-to-earnings (P/E) ratio of 12.5x, which positions the stock well below comparative industry and peer valuations. This may indicate potential market undervaluation relative to profits.

The P/E ratio for a company measures how much investors are willing to pay for each dollar of earnings. It is particularly relevant in healthcare, where profitability and growth outlook often drive valuation premiums. A lower P/E could signal that the market is discounting future challenges or questioning the sustainability of past earnings growth.

Compared to the broader US Healthcare industry’s average of 22.4x, and a fair price-to-earnings level of 23.3x suggested by our model, Tenet’s current multiple is considerably below both benchmarks. This leaves meaningful room for market re-rating if confidence in future earnings improves.

Explore the SWS fair ratio for Tenet Healthcare

Result: Price-to-Earnings of 12.5x (UNDERVALUED)

However, slower revenue and net income growth, or a reversal in recent share price momentum, could challenge the bullish outlook for Tenet Healthcare.

Find out about the key risks to this Tenet Healthcare narrative.

Another View: What Does the DCF Model Suggest?

Taking a different angle, our DCF model points to an even larger disconnect. It estimates Tenet Healthcare's fair value at $378.64, making today's price nearly half of what the model suggests. This raises the question of whether the market is underrating Tenet's true potential or if there are risks not captured by this method.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tenet Healthcare for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tenet Healthcare Narrative

If these results do not align with your perspective, you can take a hands-on approach and develop your own view using our tools in just a few minutes. Do it your way

A great starting point for your Tenet Healthcare research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock tomorrow’s winners before the crowd with Simply Wall Street’s specialist stock screens. Don’t let the best opportunities slip away. See which trends and companies are gaining real traction right now:

- Unearth hidden potential and strong balance sheets by reviewing these 3598 penny stocks with strong financials set to outperform traditional blue chips.

- Ride the wave of artificial intelligence disruption by getting ahead with these 26 AI penny stocks reshaping industries across the globe.

- Grow your income stream by checking out these 16 dividend stocks with yields > 3% designed to deliver healthy yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tenet Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THC

Tenet Healthcare

Operates as a diversified healthcare services company in the United States.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives