- United States

- /

- Healthcare Services

- /

- NYSE:THC

Tenet Healthcare (THC): Assessing Valuation Following $2 Billion Debt Refinance and Upbeat 2025 Outlook

Reviewed by Simply Wall St

Tenet Healthcare (THC) has drawn the spotlight after announcing a new $2 billion debt refinancing. This move comes just as management recently raised its 2025 earnings guidance, indicating optimism about the company’s operational momentum.

See our latest analysis for Tenet Healthcare.

These updates are landing as Tenet Healthcare’s stock rides a wave of strong momentum, climbing nearly 66% in 2025 alone. This has outpaced most healthcare peers. While short-term share price returns have been solid, the company’s three- and five-year total shareholder returns above 400% and 500% respectively show the longer-term story is one of compounding gains and renewed confidence.

If the pace of change at Tenet has you interested in what else the sector is offering, take a look at other healthcare stocks through our curated screener: See the full list for free.

With Tenet’s shares jumping higher and management boosting forecasts, the key question now is whether strong fundamentals are still undervalued by the market or if future growth is already fully reflected in the stock price.

Price-to-Earnings of 13.5x: Is it justified?

Tenet Healthcare is trading at a price-to-earnings (P/E) ratio of 13.5, which positions its current valuation well below typical industry and peer averages. The last close price of $207.73 indicates a solid earnings yield compared to competitors.

The price-to-earnings ratio is a common measure of how much investors are willing to pay per dollar of a company's earnings. For healthcare providers like Tenet, the P/E ratio reflects both growth outlook and market sentiment toward sustained profitability.

At 13.5x, Tenet’s P/E is substantially lower than both the US Healthcare industry average of 20.7x and the average among its peers at 20.3x. This difference suggests the market is underpricing Tenet’s expected earnings, despite its sizable improvements over the last several years. Compared to an estimated fair P/E of 23.5x, there is potential for re-rating if growth momentum persists and concerns ease around debt and cyclicality.

Explore the SWS fair ratio for Tenet Healthcare

Result: Price-to-Earnings of 13.5x (UNDERVALUED)

However, persistent concerns over debt levels or slower than expected revenue growth could quickly challenge the optimism surrounding Tenet Healthcare’s recent gains.

Find out about the key risks to this Tenet Healthcare narrative.

Another View: Discounted Cash Flow Offers a Wider Lens

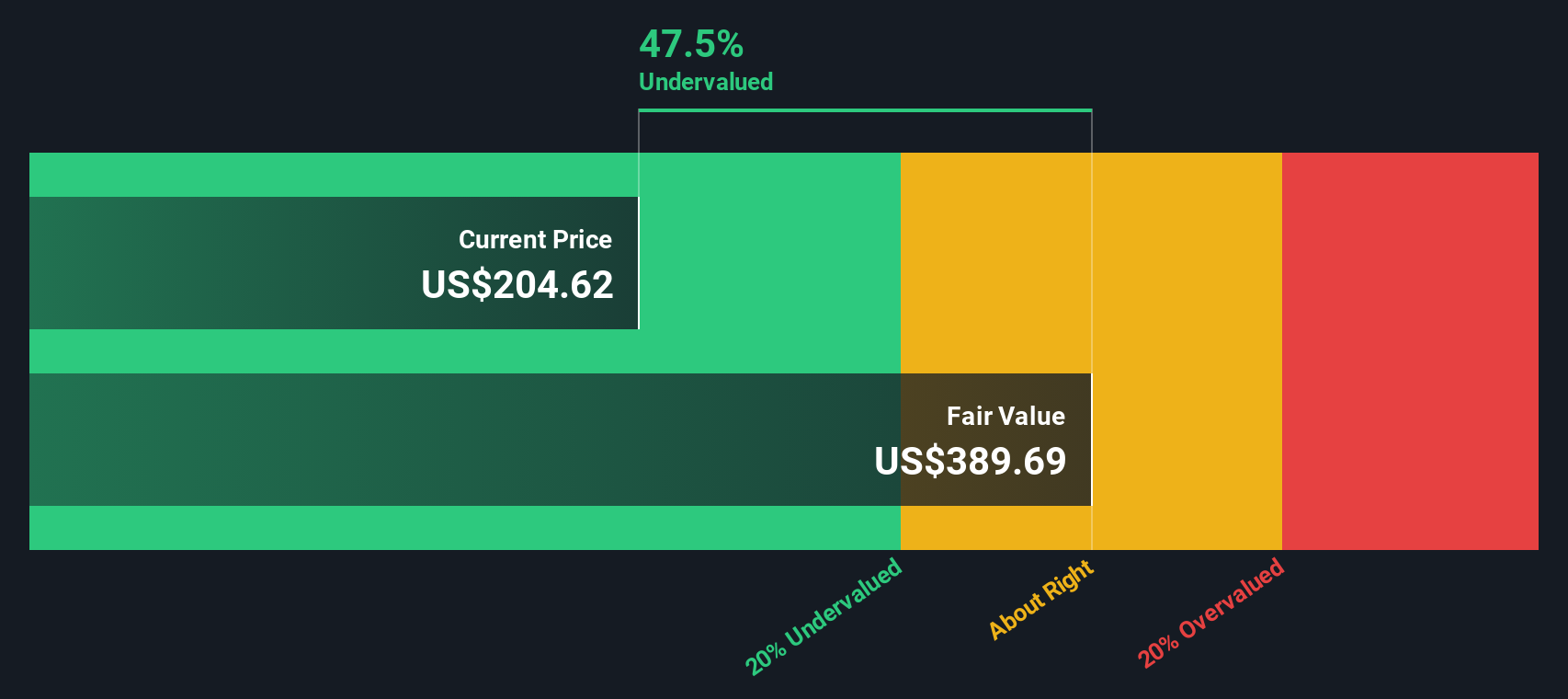

While the current price-to-earnings ratio signals value, a different picture emerges from our DCF model. According to this approach, Tenet Healthcare’s shares are trading about 44% below their fair value estimate. Could this wide gap mean the market is missing further upside, or are there risks the multiples model overlooks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tenet Healthcare for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 844 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tenet Healthcare Narrative

Keep in mind, if you see things differently or want to analyze the numbers for yourself, you can craft your own narrative in just a few minutes: Do it your way

A great starting point for your Tenet Healthcare research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your investment perspective and uncover fresh opportunities you might be missing. There are standout stocks beyond the healthcare sector that could help fuel your portfolio's growth.

- Maximize your search for undervalued gems by targeting companies with strong future cash flows through these 844 undervalued stocks based on cash flows.

- Capture big payouts by sifting for top-yielding companies in these 20 dividend stocks with yields > 3% that meet strict financial strength requirements.

- Ride the digital currency wave and spot emerging leaders in blockchain innovation with these 82 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tenet Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THC

Tenet Healthcare

Operates as a diversified healthcare services company in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives