- United States

- /

- Medical Equipment

- /

- NYSE:TFX

Teleflex (TFX) Is Down 5.2% After Major Goodwill Impairment and Lowered 2025 Outlook – What's Changed

Reviewed by Sasha Jovanovic

- Teleflex Incorporated recently reported third quarter results that included a very large non-cash goodwill impairment of US$403.9 million and a narrowed full-year 2025 earnings and revenue outlook, driven by lower-than-expected demand for intra-aortic balloon pumps and adjustments related to the Italian payback measure.

- These announcements were accompanied by the affirmation of Teleflex’s quarterly dividend, reflecting the company’s ongoing commitment to shareholder returns even amid financial headwinds.

- We'll explore how this significant goodwill impairment impacts the company's evolving investment narrative and long-term growth outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Teleflex Investment Narrative Recap

To be a shareholder in Teleflex right now, you need to believe in the company’s ability to rebound from significant headwinds, including the recent US$403.9 million goodwill impairment and a narrowed 2025 outlook amid softer demand for intra-aortic balloon pumps. These developments add focus to the risk of long-term weakness in major product lines and margin pressure from macroeconomic factors, which continue to be the central short-term catalysts and potential obstacles for sustainable recovery. Based on the details, the recent news meaningfully reinforces concerns rather than shifting them.

Among recent announcements, the third quarter’s massive non-cash goodwill impairment charge stands out as most directly relevant. This write-off sharply underscores challenges around the company’s acquisition performance and may heighten scrutiny over future integration efforts and their impact on net margins, a sensitive area as Teleflex integrates the BIOTRONIK Vascular Interventions business, where realizing synergies remains key to the growth story.

Yet while revenue remains supported by innovations and global expansion, investors should keep a close eye on...

Read the full narrative on Teleflex (it's free!)

Teleflex's outlook suggests $3.9 billion in revenue and $553.0 million in earnings by 2028. This requires an annual revenue growth rate of 8.9% and a $361.1 million increase in earnings from the current level of $191.9 million.

Uncover how Teleflex's forecasts yield a $127.71 fair value, a 21% upside to its current price.

Exploring Other Perspectives

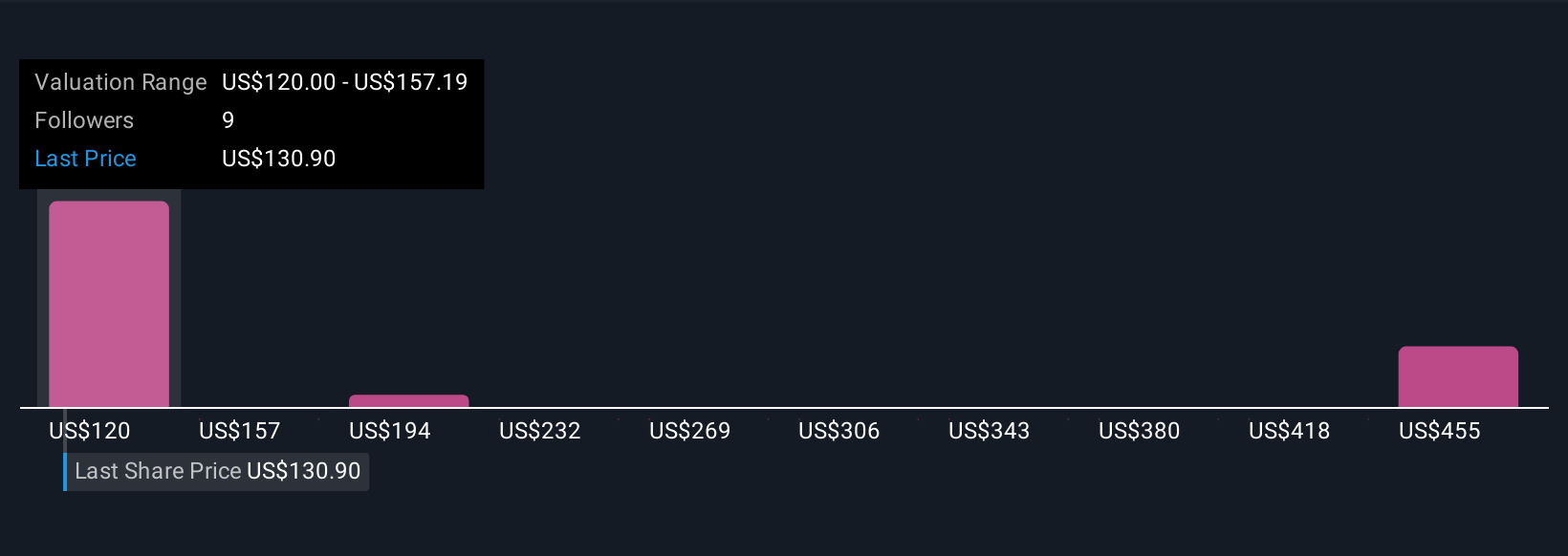

Five members of the Simply Wall St Community valued Teleflex at between US$120 and US$444,529 per share, reflecting widely differing outlooks. Some see acquisition integration as either a turning point or a persistent risk, shaping future returns in very different ways.

Explore 5 other fair value estimates on Teleflex - why the stock might be worth over 4x more than the current price!

Build Your Own Teleflex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teleflex research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Teleflex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teleflex's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teleflex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFX

Teleflex

Designs, develops, manufactures, and supplies single-use medical devices for common diagnostic and therapeutic procedures in critical care and surgical applications worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives