- United States

- /

- Healthtech

- /

- NYSE:TDOC

Teladoc Health, Inc. (NYSE:TDOC) Looks Inexpensive After Falling 26% But Perhaps Not Attractive Enough

Teladoc Health, Inc. (NYSE:TDOC) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 34% share price drop.

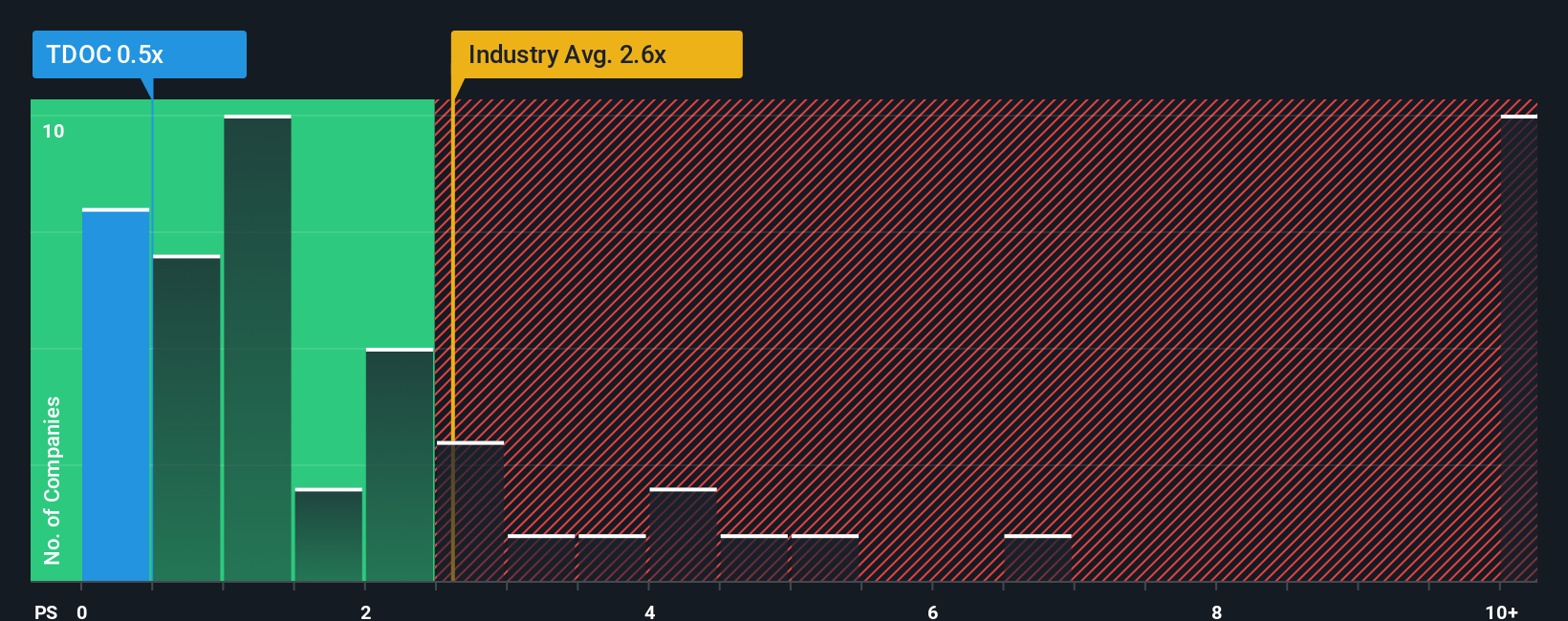

Following the heavy fall in price, Teladoc Health may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Healthcare Services industry in the United States have P/S ratios greater than 2.6x and even P/S higher than 12x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Teladoc Health

How Teladoc Health Has Been Performing

Teladoc Health hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Teladoc Health.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Teladoc Health would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 2.4% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 8.8% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 2.2% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 13% per annum, which is noticeably more attractive.

In light of this, it's understandable that Teladoc Health's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Having almost fallen off a cliff, Teladoc Health's share price has pulled its P/S way down as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Teladoc Health maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Teladoc Health you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Teladoc Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TDOC

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives