- United States

- /

- Medical Equipment

- /

- NYSE:SYK

Stryker (SYK): Exploring Valuation Following Strong Q3 Results and Raised 2025 Outlook

Reviewed by Simply Wall St

Stryker (SYK) shares attracted attention after the company reported strong third quarter results and raised its full-year 2025 outlook. The positive update was driven by solid sales growth and continued operational momentum.

See our latest analysis for Stryker.

Stryker’s upbeat third quarter and higher sales outlook have certainly turned heads, but the share price tells a nuanced story. After a modest pullback in recent weeks, Stryker trades at $362.61, with a 1-year total shareholder return of -1.1%. Its longer-term momentum remains powerful, boasting a 78% gain over three years. Confidence is being fueled by positive analyst sentiment and growth investments, even as investors weigh near-term margin pressure against the bigger growth narrative.

Inspired by Stryker’s growth story? Discover other leading healthcare stocks shaping the future See the full list for free.

Yet with the stock near all-time highs and analysts broadly optimistic, investors now face a crucial question: is Stryker’s growth story undervalued by the market, or is all the good news already priced in?

Most Popular Narrative: 16.3% Undervalued

Stryker's most followed narrative suggests the consensus fair value is $433.19, well above the last close of $362.61. The case rests on continued growth across emerging markets, margin expansion, and successful integration of acquisitions that could accelerate earnings in ways the market may not yet fully expect.

Robust innovation pipeline, particularly in robotic-assisted surgery (Mako platform) and next-generation devices, is driving greater market share, higher average selling prices, and service revenues, which is expected to accelerate both revenue and margin expansion over time.

Want to know what ambitious growth rates and financial milestones support this high fair value? Find out which catalysts and projections are setting Wall Street’s expectations sky-high. Dive into the assumptions powering Stryker’s future. The drivers may surprise you.

Result: Fair Value of $433.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain disruptions and challenging regulatory delays could quickly undermine even the most optimistic projections for Stryker’s growth story.

Find out about the key risks to this Stryker narrative.

Another View: What Do Market Multiples Say?

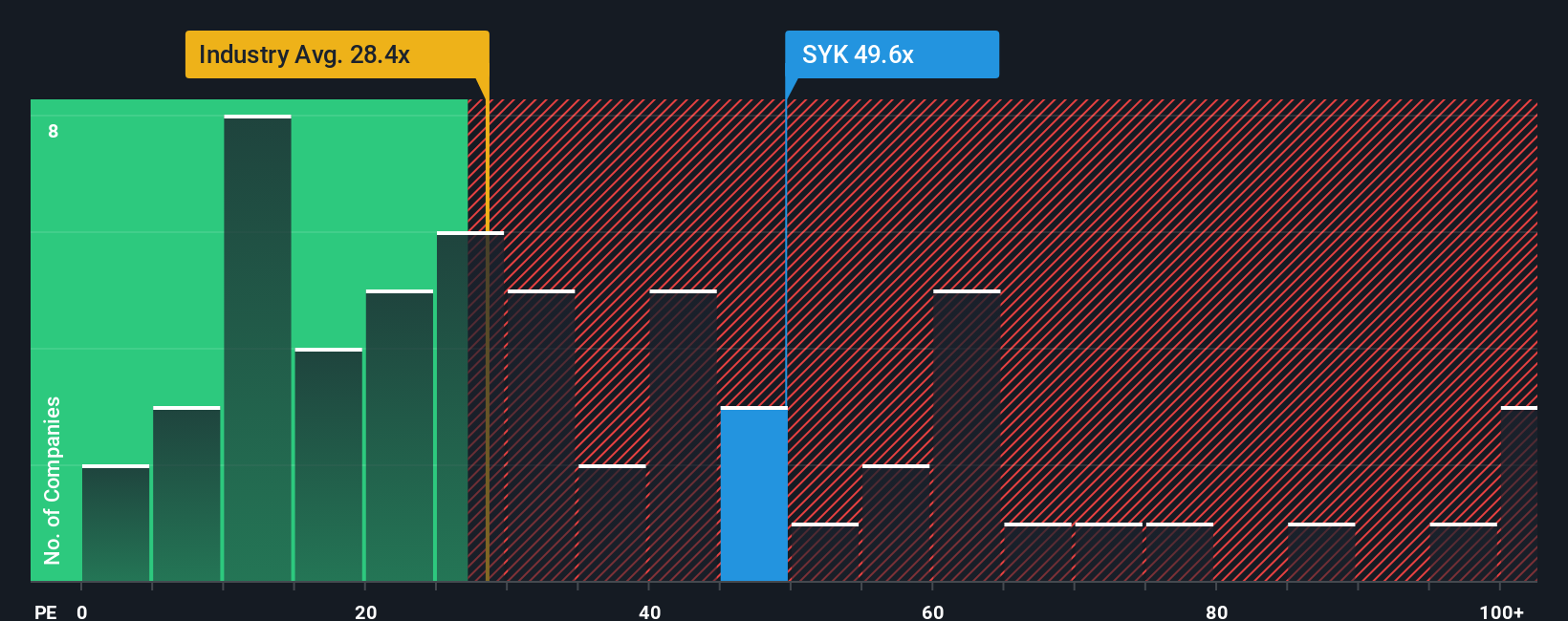

Looking at valuation through earnings multiples paints a different picture. Stryker’s price-to-earnings ratio is 47.1x, which is much higher than both the US Medical Equipment industry average (28.1x) and its peers (40.7x). The fair ratio, based on regression analysis, is 36.9x. This premium pricing suggests investors are banking on ambitious growth, but it leaves little margin for disappointment. Is the optimism truly justified, or could sentiment change quickly?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stryker Narrative

If you’re keen to challenge the consensus or would rather chart your own course, you can craft a personal Stryker valuation in just minutes. Do it your way

A great starting point for your Stryker research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next standout opportunity could be just a click away. Use these powerful screens to give yourself an investing edge and stay informed about what's coming next.

- Tap into tomorrow’s most promising innovations with these 26 AI penny stocks, which are redefining industries and driving the new AI era.

- Uncover high-yield potential and add steady income streams by checking out these 20 dividend stocks with yields > 3%, offering attractive returns above 3%.

- Get ahead on the digital frontier and capture upside with these 82 cryptocurrency and blockchain stocks, focused on cryptocurrency and blockchain breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYK

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives