- United States

- /

- Medical Equipment

- /

- NYSE:SYK

Stryker (SYK): $1.8B One-Off Loss Pulls Margins Below Bullish Growth Narrative

Reviewed by Simply Wall St

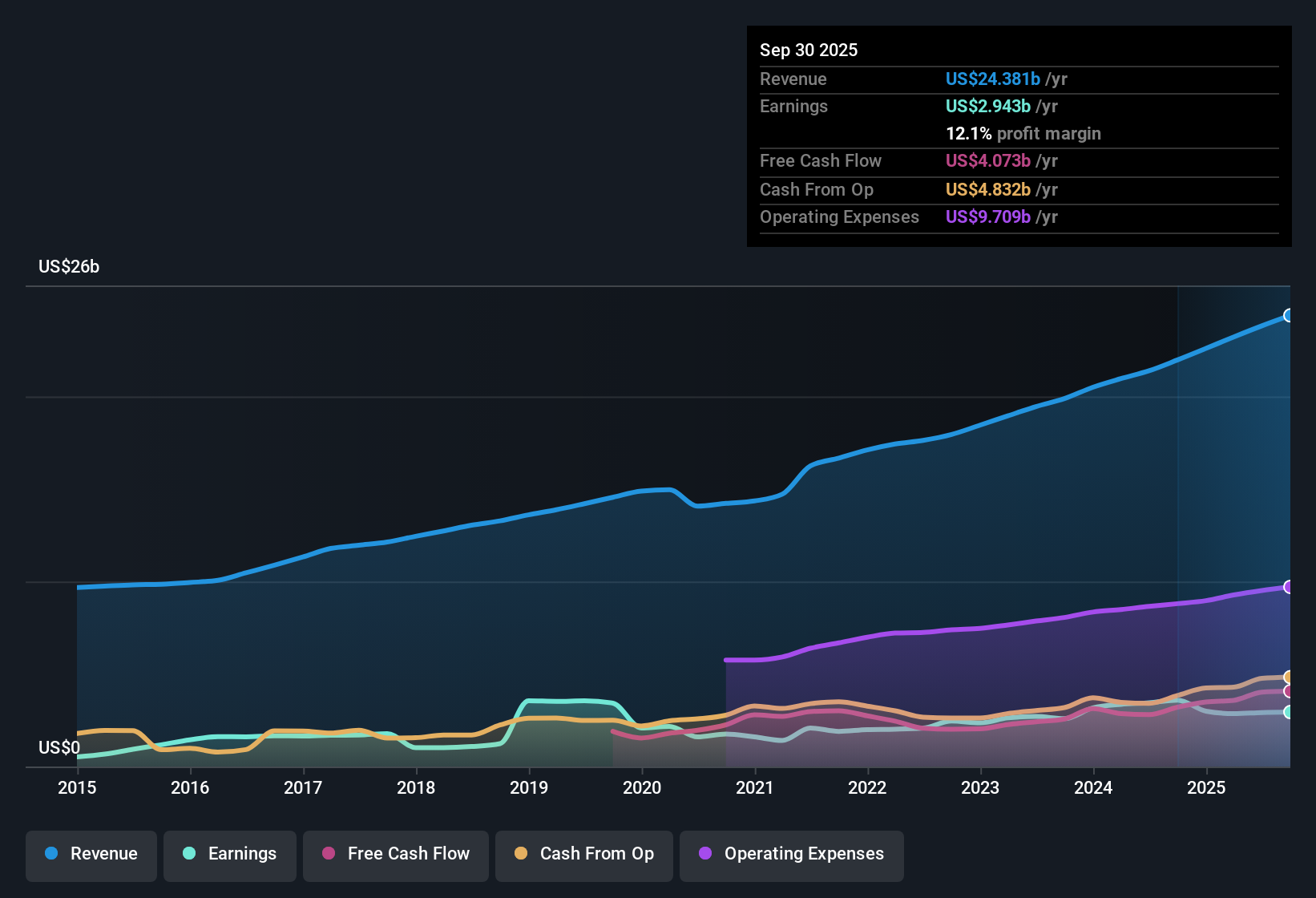

Stryker (SYK) posted earnings with forecasts calling for 17.1% per year growth, outstripping the broader US market's expected 15.9%. Over the past five years, earnings rose by 14.1% per year, but trailing 12-month net profit margins slipped to 12.1% from last year's 16.3%, weighed down by a notable one-off $1.8 billion loss. While revenue is projected to grow at 7.8% per year, which is slower than the US market’s 10.4%, the share price of $356.24 sits below many analyst fair value estimates and targets. The stock remains expensive relative to both peers and industry averages on a price-to-earnings basis. Investors now face a mix of strong earnings growth potential, recent profit margin pressure, and discussion about whether the valuation still makes sense for the longer-term story.

See our full analysis for Stryker.The next section puts Stryker’s headline numbers side by side with the key narratives shaping market sentiment, highlighting where consensus is confirmed and where new questions arise.

See what the community is saying about Stryker

Margins Shake Off $1.8 Billion Hit

- Stryker’s trailing 12-month net profit margin stands at 12.1%, pulled down from last year’s 16.3% by a sizeable one-off $1.8 billion loss. This illustrates just how much a single event can weigh on even an established growth story.

- Analysts' consensus view points to Stryker pushing through this downturn, expecting future margin improvement as new product launches and digital health investments ramp up.

- The integration of recent acquisitions and focus on operating efficiencies are projected to lift margins over the next three years, heading toward 17.7% by 2028.

- This anticipated rebound is notable given recent regulatory delays and ongoing supply chain disruptions. If unresolved, these challenges could push margins in the opposite direction and restrain earnings growth.

Analysts see long-term margin recovery as Stryker rolls out new devices and capitalizes on an aging global population, but regulatory and cost pressures mean that path could be bumpy. 📊 Read the full Stryker Consensus Narrative.

Premium Price Tag Versus Fair Value

- Stryker trades at 46.3x price-to-earnings, significantly higher than both its peer group average of 40.7x and the US medical equipment industry average of 27.7x. This is despite the current share price of $356.24 sitting below DCF fair value of $417.33 and the latest analyst target of $428.71.

- Analysts' consensus view spotlights a classic valuation dilemma: bulls see the discounted price relative to targets as an opportunity for long-term buyers.

- However, holding a valuation premium above sector norms puts pressure on Stryker to meet or exceed aggressive profit and revenue forecasts over the next several years.

- The company will need to drive earnings up to $5.4 billion while lowering its PE to 38.7x by 2028 to justify today’s optimism about the shares. Otherwise, potential upside may be limited even if revenue and profit growth materialize.

Growth Guidance Puts Focus on Top Line

- Forward revenue growth is forecast at 7.8% per year, falling short of the US market’s 10.4% pace. However, the consensus view expects Stryker to reach $30.4 billion in revenue and $14.2 earnings per share by 2028, as long as key product launches and expansion in emerging markets deliver as planned.

- Analysts' consensus view contends these growth drivers anchor the bullish thesis.

- The combination of innovation in robotic-assisted surgery and expansion in outpatient procedures is expected to widen Stryker’s moat and boost revenue, offsetting regulatory delays and cost inflation.

- Sharper pricing pressures and integration costs from acquisitions are cited as real hurdles that could limit the pace of top line expansion and test just how much room Stryker has for long-term outperformance.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Stryker on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Curious if your perspective stands out from the consensus? Take a couple of minutes to turn your analysis into a clear narrative and stand behind your view. Do it your way

A great starting point for your Stryker research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Stryker’s premium valuation and recent margin pressures mean future gains depend on strong execution in both profitability and growth.

If these concerns leave you uneasy, use our these 838 undervalued stocks based on cash flows to find companies trading at more attractive valuations and with upside potential that stands on firmer ground.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYK

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives