- United States

- /

- Medical Equipment

- /

- NYSE:SOLV

Is Solventum’s (SOLV) Billion-Dollar Buyback a Signal of Strength or Strategic Caution?

Reviewed by Sasha Jovanovic

- Solventum Corporation (NYSE:SOLV) recently announced a share repurchase program authorizing the repurchase of up to US$1.00 billion of its common stock, with no expiration date, and as of October 31, 2025, had approximately 173.4 million shares outstanding.

- This substantial buyback, combined with ongoing acquisition activity, reflects Solventum’s intent to enhance shareholder value while bolstering its position in the healthcare sector.

- We will now explore how the share repurchase plan strengthens Solventum's investment narrative and capital allocation outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Solventum Investment Narrative Recap

Owning Solventum shares means believing the company can drive steady healthcare growth through portfolio optimization, operational improvements and disciplined capital allocation. The US$1.00 billion share repurchase plan, while meaningful for returns, does not materially alter the key short-term catalyst, ongoing momentum from new product innovation, or the most pressing risk, which remains execution on the 3M separation and ERP transition. The buyback adds support to the investment case, but doesn’t overshadow the operational hurdles currently in focus.

Among Solventum’s recent updates, the September 2025 sale of its Purification & Filtration business for US$4 billion stands out. This transaction not only repaid debt but enhanced capital flexibility, providing resources for the share repurchase program and recent acquisitions, aligning with the company’s goals for balance sheet strength and shareholder returns.

However, against this progress, investors should not lose sight of unresolved execution risks related to the ongoing ERP system implementation and separation from 3M that...

Read the full narrative on Solventum (it's free!)

Solventum's narrative projects $8.2 billion revenue and $981.9 million earnings by 2028. This requires a 0.7% annual revenue decline and a $601.9 million earnings increase from $380.0 million today.

Uncover how Solventum's forecasts yield a $84.11 fair value, in line with its current price.

Exploring Other Perspectives

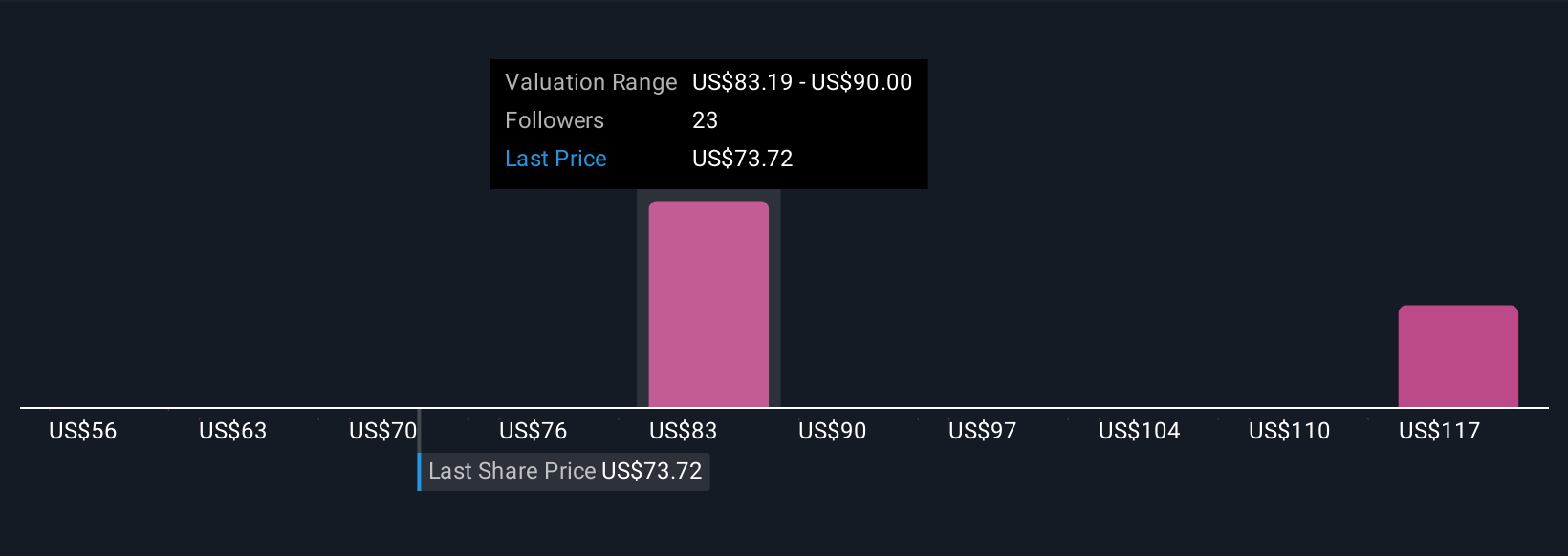

Fair value views from three Simply Wall St Community members span US$55.96 up to US$133.24 per share. While optimism about international expansion and product innovation persists, you’ll find some see risk in the pace of operational integration and future margin performance.

Explore 3 other fair value estimates on Solventum - why the stock might be worth as much as 56% more than the current price!

Build Your Own Solventum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Solventum research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Solventum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Solventum's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOLV

Solventum

A healthcare company, develops, manufactures, and commercializes a portfolio of solutions to address critical customer and patient needs in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success