- United States

- /

- Healthcare Services

- /

- NYSE:SNDA

After Leaping 27% Sonida Senior Living, Inc. (NYSE:SNDA) Shares Are Not Flying Under The Radar

Sonida Senior Living, Inc. (NYSE:SNDA) shareholders have had their patience rewarded with a 27% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 28%.

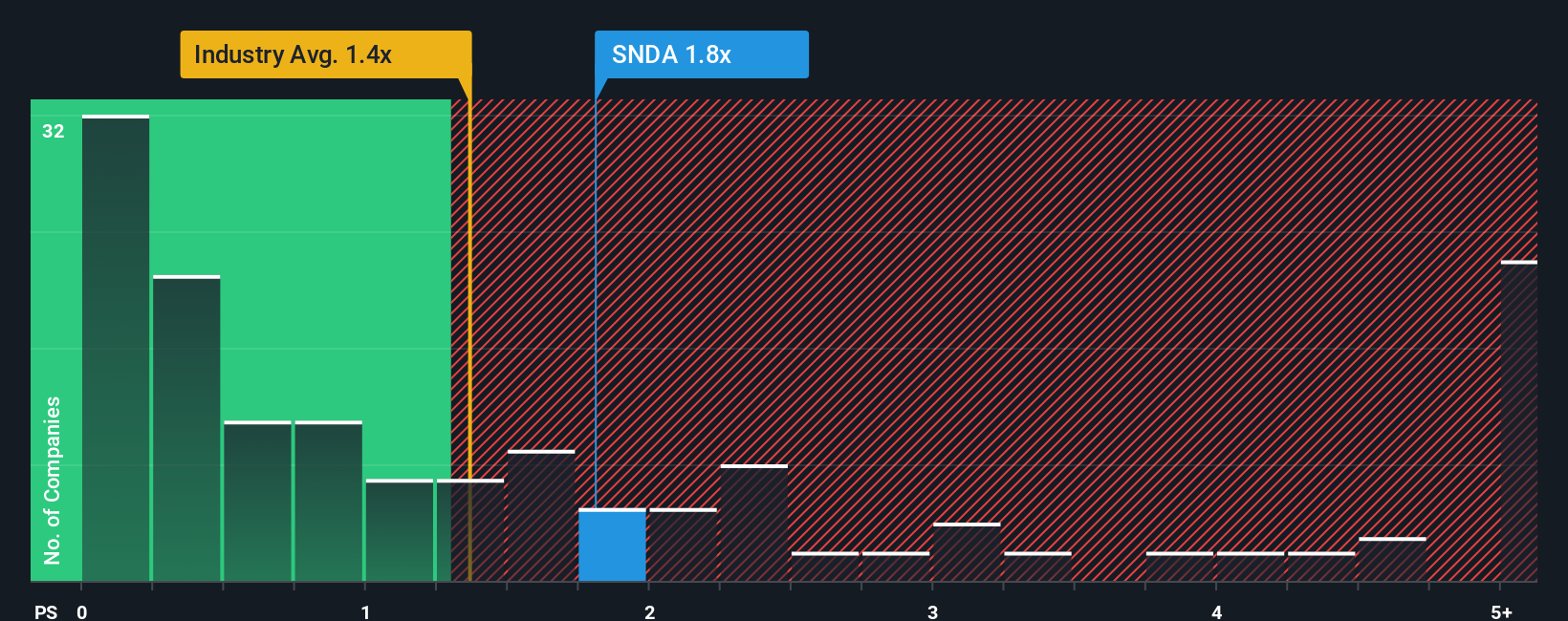

Even after such a large jump in price, there still wouldn't be many who think Sonida Senior Living's price-to-sales (or "P/S") ratio of 1.8x is worth a mention when the median P/S in the United States' Healthcare industry is similar at about 1.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Sonida Senior Living

How Sonida Senior Living Has Been Performing

With revenue growth that's superior to most other companies of late, Sonida Senior Living has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sonida Senior Living.How Is Sonida Senior Living's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sonida Senior Living's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 29% last year. Pleasingly, revenue has also lifted 58% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 7.1% over the next year. Meanwhile, the rest of the industry is forecast to expand by 6.4%, which is not materially different.

With this information, we can see why Sonida Senior Living is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Sonida Senior Living's P/S?

Its shares have lifted substantially and now Sonida Senior Living's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Sonida Senior Living's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Sonida Senior Living with six simple checks.

If these risks are making you reconsider your opinion on Sonida Senior Living, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SNDA

Sonida Senior Living

Owns and operates senior housing communities in the United States.

Mediocre balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success