- United States

- /

- Healthcare Services

- /

- NYSE:SEM

Evaluating Select Medical Holdings (SEM) Valuation After Recent Tight Trading Range

Reviewed by Simply Wall St

Select Medical Holdings (SEM) shares have hovered in a tight range recently, catching the eye of investors following healthcare trends. With returns up 3% in the past month, interest around the stock’s valuation remains in focus.

See our latest analysis for Select Medical Holdings.

The latest 90-day share price return of 13.19% for Select Medical Holdings comes after a tough stretch, with its year-to-date share price still down 28%. Over the past twelve months, total shareholder return has lagged at -33.7%. Its three-year total shareholder return of nearly 23% suggests the company has rebounded before. Momentum appears to be building again as investors weigh potential value after a challenging period.

Curious about what other healthcare stocks are showing signs of strength? See the full list for free: See the full list for free.

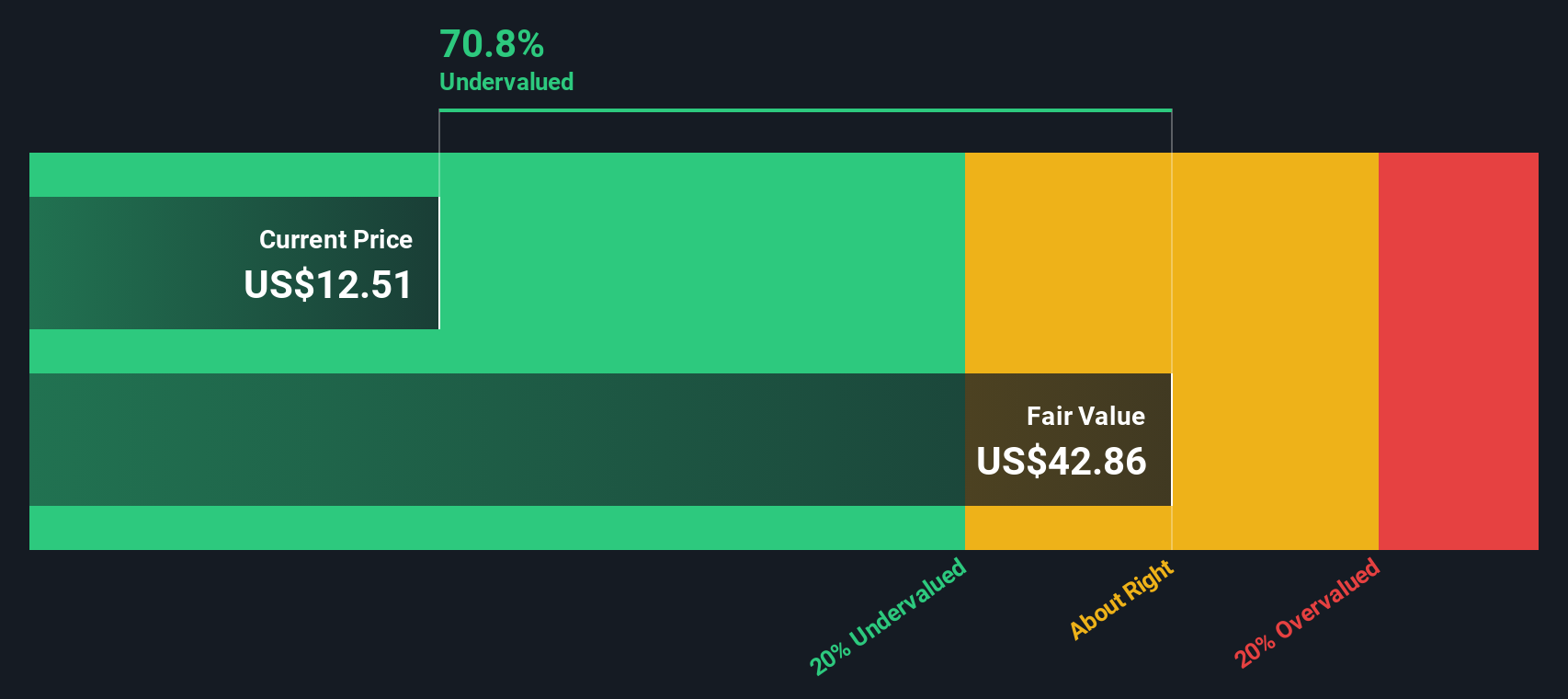

With shares trading at a discount to analyst price targets and recent signs of improving momentum, is Select Medical Holdings currently undervalued in the market? Or are investors already factoring in the company’s future growth prospects?

Most Popular Narrative: 24.5% Undervalued

Compared to the last close of $13.47, the most widely followed narrative sets fair value at $17.83 per share. This sharp gap highlights diverging expectations between analyst price targets and recent market action.

Operational improvements and healthcare policy trends position post-acute and rehab offerings for sustained revenue and margin growth. Ongoing regulatory pressures, high debt, and shifts toward home-based care are compressing margins and threatening revenue stability across key Select Medical business segments.

Want the details behind this pricing disconnect? The narrative is powered by bold growth assumptions and a margin recovery story that challenges recent results. Wondering what aggressive projections drive this bullish fair value? The full narrative breaks it all down.

Result: Fair Value of $17.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent Medicare reimbursement cuts and growing trends toward home-based care could curb patient volumes and profitability. These factors pose real challenges for Select Medical’s outlook.

Find out about the key risks to this Select Medical Holdings narrative.

Another View: What Does Our DCF Model Show?

Taking a different approach, our DCF model puts Select Medical Holdings’ fair value much lower than the current share price. This suggests the stock is actually overvalued by this metric. Why is there such a sharp disconnect between the DCF results and analyst price targets? Is one of these views missing something in the company's story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Select Medical Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Select Medical Holdings Narrative

If the current outlook does not fit your perspective or you prefer hands-on analysis, dive into the numbers and develop your own view in just a few minutes. Do it your way.

A great starting point for your Select Medical Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not just settle for one opportunity when there are so many untapped ideas within reach. Stay ahead of the market by checking out these handpicked strategies:

- Uncover high yield opportunities and secure dependable income by checking out these 20 dividend stocks with yields > 3% offering above-average returns for your portfolio.

- Tap into the potential growth surge by browsing these 26 AI penny stocks as these companies pave the way in artificial intelligence innovation and dynamic business models.

- Spot companies trading well below their worth by reviewing these 840 undervalued stocks based on cash flows to get in before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEM

Select Medical Holdings

Through its subsidiaries, operates critical illness recovery hospitals, rehabilitation hospitals, and outpatient rehabilitation clinics in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives