- United States

- /

- Medical Equipment

- /

- NYSE:PEN

Penumbra (PEN) Profit Margin Surge Reinforces Bullish Growth Narrative Despite Premium Valuation

Reviewed by Simply Wall St

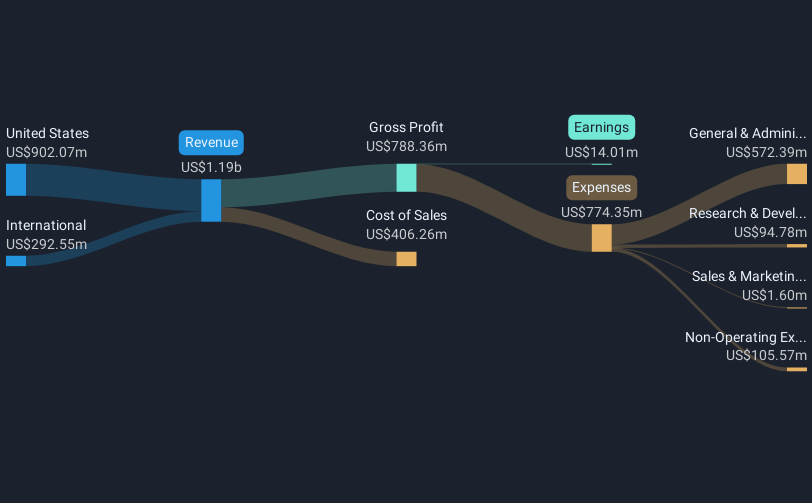

Penumbra (PEN) reported revenue growth at 12% per year, ahead of the US market's 10.4%, and delivered EPS growth at an impressive 18.7% per year, outpacing the US average. Net profit margins have climbed to 12.3% from 3%, and the past year’s profit growth of 374.8% stands well above the five-year trend of 60.2% per year. Supported by consistently rising margins and strong profit momentum, this earnings release highlights both outperformance and a premium valuation. This may invite a closer look from investors focused on sustainability of current multiples.

See our full analysis for Penumbra.Now, we will see how these headline results hold up when compared to the dominant market narratives for Penumbra, highlighting where the story aligns and where it surprises.

See what the community is saying about Penumbra

Profit Margins Reach New Highs

- Net profit margin has increased to 12.3%, a sharp jump from the previous 3%, highlighting enhanced cost control and a more profitable product mix.

- Analysts' consensus view highlights that the rising margin supports the thesis that new clinical trials and innovative product launches, such as RUBY XL and Thunderbolt, are positioning Penumbra for stronger future profitability.

- The product mix shift bolsters longer-term margin and earnings growth, directly aligning with expectations for margins to improve further to 14.6% over the next three years.

- Success in ongoing clinical trials, especially the STORM-PE study, could accelerate guideline adoption and support sustained high margins as new products displace older technologies.

- Investors who want to see how these margin moves support long-term forecasts and analyst perspectives should dive into the full consensus narrative for Penumbra. 📊 Read the full Penumbra Consensus Narrative.

Valuation Sits Far Above Peers

- Penumbra trades on a Price-to-Earnings ratio of 62.9x, well above the US Medical Equipment industry average of 29x and peer average of 44x. This reflects the market’s confidence in its growth and innovation story.

- Analysts' consensus narrative underscores that despite the company’s high margins and robust growth, the current share price of $264.61 remains above both the DCF fair value of $108.06 and is not far from the analyst price target of $306.74.

- This premium valuation signals investors are paying up for strong revenue forecasts and future earnings potential, but leaves less upside if any projected growth stumbles.

- Consensus commentary points out that to justify the analyst price target, Penumbra would need to sustain a PE ratio of 54.8x on 2028 earnings, which is substantially richer than industry benchmarks, even as profit pools expand.

Growth Forecasts Lead the Industry

- Penumbra’s revenue is projected to grow by 13.6% annually over the next three years, beating the US market average of 10.4%, and earnings are expected to expand at 18.65% per year compared to the national 15.8% rate.

- Analysts' consensus narrative emphasizes that upcoming catalysts, such as successful product launches and broader international expansion, could drive upside for revenue and profits. Share dilution is also factored in with shares outstanding anticipated to rise 1.62% annually.

- Consensus also spotlights that if international regulatory headwinds or competitive threats intensify, projected growth and high multiples could be at risk, making execution against these forecasts critical for investors.

- The ongoing investments in clinical trials, sales teams, and technology integration are identified as levers both for sustaining growth and for defending current premium valuations despite increasing industry competition.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Penumbra on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the results from another angle? Share your perspective and shape your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Penumbra.

See What Else Is Out There

Despite impressive top-line and margin growth, Penumbra’s high valuation leaves little room for error if future earnings or growth projections fall short.

Prefer to focus on better value opportunities with more upside? Find stocks trading below fair value and showing stronger risk-adjusted potential in these 853 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PEN

Penumbra

Designs, develops, manufactures, and markets medical devices in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives