- United States

- /

- Medical Equipment

- /

- NYSE:PEN

Penumbra (PEN): Assessing Valuation Following a 14% Share Price Climb

Reviewed by Simply Wall St

See our latest analysis for Penumbra.

Penumbra’s strong 14% share price return in the past month marks an acceleration of the positive momentum investors have seen over the year, with the company achieving a robust 17.8% total shareholder return over the past 12 months. While the latest move reflects renewed optimism about future growth, it also comes on the heels of a solid track record over several years. This suggests confidence in Penumbra’s long-term potential remains intact.

If strong momentum like this has you thinking bigger, now is a great time to broaden your search and discover See the full list for free.

But with shares trading near their analyst targets and following a strong run-up, the key question becomes whether Penumbra is actually undervalued right now or if the market has already accounted for the company’s future growth prospects.

Most Popular Narrative: 6% Undervalued

With Penumbra’s fair value from the most widely followed narrative now at $306.79 and a share price just under $290, there is a modest gap between where consensus thinks the stock should trade and where it sits today. This close alignment suggests investor expectations are running nearly in lockstep with analyst forecasts, a sign of heightened interest and high stakes for coming earnings and clinical milestones.

The soon-to-be-released STORM-PE randomized trial is poised to provide Level 1 evidence comparing Penumbra's thrombectomy technology to standard anticoagulation for pulmonary embolism. A positive outcome could expand guideline adoption, significantly accelerate procedure volumes, and drive substantial revenue growth by rapidly increasing penetration in a very underpenetrated, large market.

Want to know why this story has Wall Street buzzing? The narrative hinges on a massive clinical catalyst and bold financial projections for growth. The secret to this valuation is hidden in anticipated trial results and aggressive margin expansion assumptions. Don’t miss what could redefine the outlook. See which numbers fuel the current target before the rest of the market catches up.

Result: Fair Value of $306.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stiffening competition and any disappointing trial results could quickly shift sentiment. This may cause investors to reconsider Penumbra's current valuation and outlook.

Find out about the key risks to this Penumbra narrative.

Another View: What Do Valuation Ratios Say?

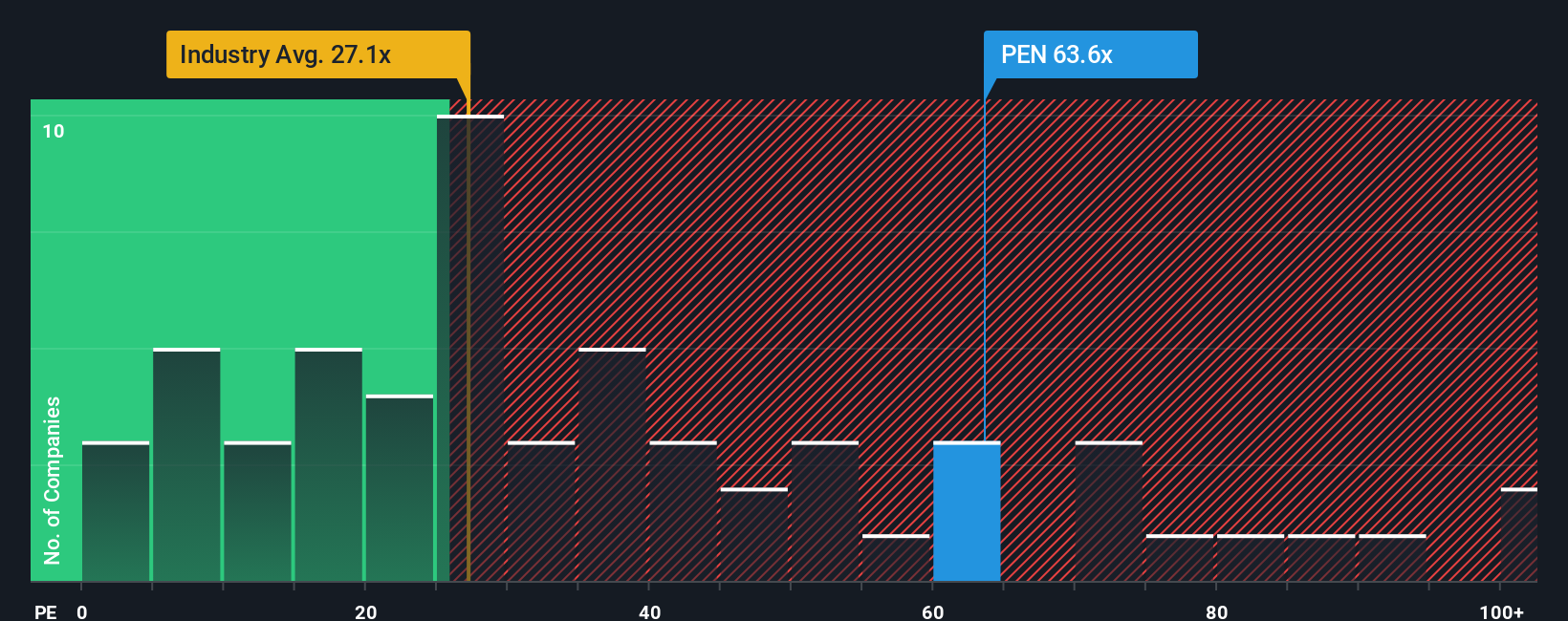

Looking at valuation ratios, Penumbra currently trades at 68.9 times earnings. That is far higher than the US Medical Equipment industry average of 27.7 times and above the peer group’s 44.3. The fair ratio, based on market trends, is just 28.7. This gap makes Penumbra look expensive by most standards, potentially increasing valuation risk if market sentiment shifts. Could high expectations built into this valuation be vulnerable to any future disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Penumbra Narrative

If you see things differently or would rather dive into the numbers on your own terms, the tools are here to help you craft your own story in just minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Penumbra.

Looking for More Smart Investing Opportunities?

Never settle for just one great idea when the market hides so many gems. Confidently put your curiosity to work by checking out these hand-picked stock picks.

- Boost your income potential with these 15 dividend stocks with yields > 3%, which offers consistent yields greater than 3% for stronger returns.

- Spot tomorrow’s standout names by checking out these 26 AI penny stocks as artificial intelligence changes the investing landscape.

- Tap into remarkable bargains with these 927 undervalued stocks based on cash flows to secure quality stocks priced below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PEN

Penumbra

Designs, develops, manufactures, and markets medical devices in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives