- United States

- /

- Healthcare Services

- /

- NYSE:MOH

Molina Healthcare (MOH) Is Down 6.3% After Class Action Lawsuits, Rising Costs and Lower Profit Outlook - Has the Investment Thesis Changed?

Reviewed by Sasha Jovanovic

- Molina Healthcare recently reported third quarter results showing strong revenue growth to US$11.48 billion, but net income fell significantly due to persistent, elevated medical cost trends, particularly in its Marketplace segment.

- In the wake of ongoing medical cost pressures and a lowered full-year profit outlook, several law firms announced securities class actions alleging the company misled investors about its underlying cost trends and financial expectations.

- We’ll examine how Molina Healthcare’s medical cost challenges and legal headwinds are now reshaping its investment outlook and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

Molina Healthcare Investment Narrative Recap

To be a Molina Healthcare shareholder, you need confidence in the company's ability to grow its Medicaid and Marketplace business while effectively managing costs, even as medical expenses climb. The sharp profit decline and legal action following recent earnings reinforce that the immediate catalyst, managing medical cost trends, remains tightly linked to the largest risk: continued margin pressure if costs outpace premium adjustments.

Among the latest company moves, Molina's completion of a US$499.99 million share buyback, representing 5.28% of outstanding shares, stands out. While such actions signal management's belief in the firm’s underlying value, the short-term narrative is still dominated by medical cost trends and the implications for future earnings.

But on the other hand, shareholders should also be aware of unresolved legal risks related to recent disclosures and earnings guidance that could ...

Read the full narrative on Molina Healthcare (it's free!)

Molina Healthcare's outlook anticipates $50.7 billion in revenue and $1.3 billion in earnings by 2028. This is based on a forecast yearly revenue growth rate of 6.8% and a $0.2 billion increase in earnings from $1.1 billion today.

Uncover how Molina Healthcare's forecasts yield a $197.53 fair value, a 29% upside to its current price.

Exploring Other Perspectives

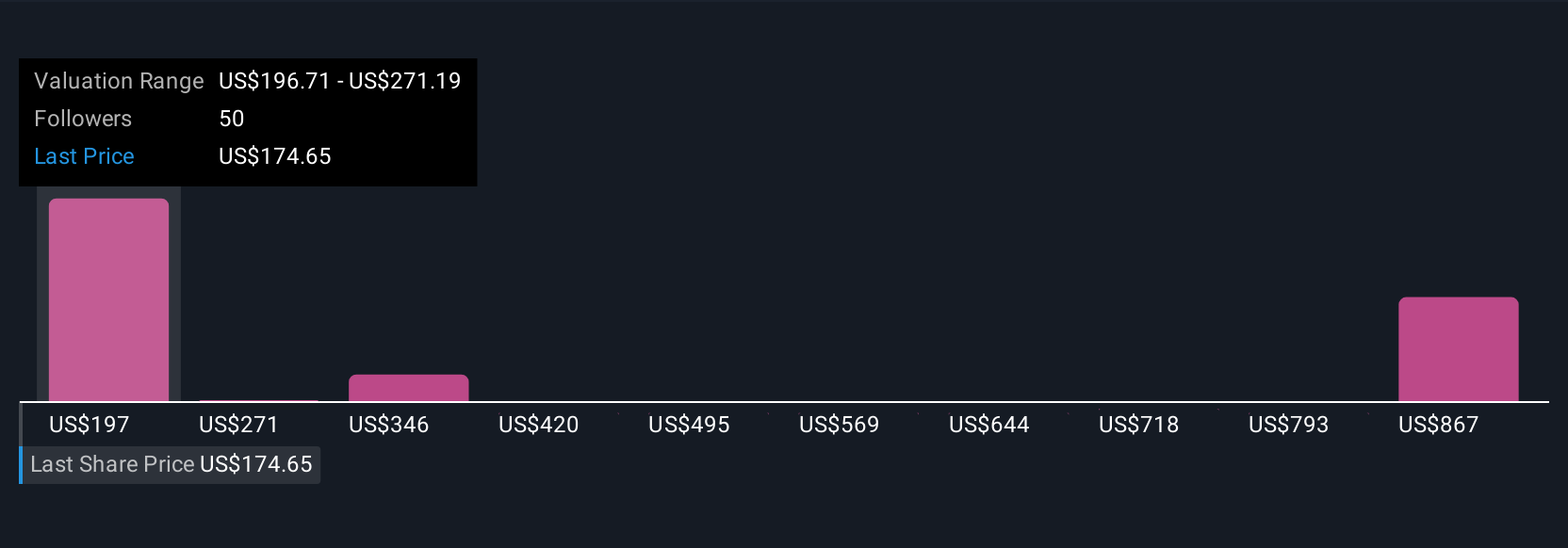

Community members at Simply Wall St have published nine fair value estimates ranging from US$197.53 to US$990.58 per share. With ongoing concern over medical cost inflation, it is clear that investor views differ widely so be sure to explore several viewpoints.

Explore 9 other fair value estimates on Molina Healthcare - why the stock might be worth over 6x more than the current price!

Build Your Own Molina Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Molina Healthcare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Molina Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Molina Healthcare's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOH

Molina Healthcare

Provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives