- United States

- /

- Healthcare Services

- /

- NYSE:MOH

How Legal and Financial Headwinds at Molina Healthcare (MOH) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In the past week, Molina Healthcare announced it has priced US$850 million in 6.500% senior notes due 2031, with proceeds intended to repay delayed draw term loans and for other corporate needs.

- This announcement follows legal developments, including class action lawsuits alleging securities violations tied to the company’s financial guidance and recent admission of a dislocation between premium rates and medical cost trends.

- We'll explore how the legal challenges and concerns about Molina's financial outlook may shape its future earnings and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Molina Healthcare Investment Narrative Recap

To invest in Molina Healthcare, you need to believe in the company’s ability to balance strong contract wins and disciplined cost controls against pressures from rising medical expenses and regulatory uncertainty. While the newly announced US$850 million debt financing provides liquidity and flexibility, it does not materially alter the immediate catalyst: successful execution and integration of new state Medicaid contracts; nor does it reduce the principal risk from ongoing legal proceedings and elevated medical costs.

Among recent announcements, Molina’s exclusive Medicaid contract award in Florida stands out as a significant catalyst. The deal is set to bring in approximately US$5 billion in 2025 premiums, further strengthening Molina’s market position and recurring revenue base, yet ongoing litigation and rate adequacy concerns still weigh on near-term sentiment.

On the flip side, shareholders should be alert to the unresolved legal challenges, which could ultimately...

Read the full narrative on Molina Healthcare (it's free!)

Molina Healthcare's narrative projects $50.7 billion in revenue and $1.3 billion in earnings by 2028. This requires 6.8% yearly revenue growth and a $0.2 billion increase in earnings from $1.1 billion today.

Uncover how Molina Healthcare's forecasts yield a $172.53 fair value, a 22% upside to its current price.

Exploring Other Perspectives

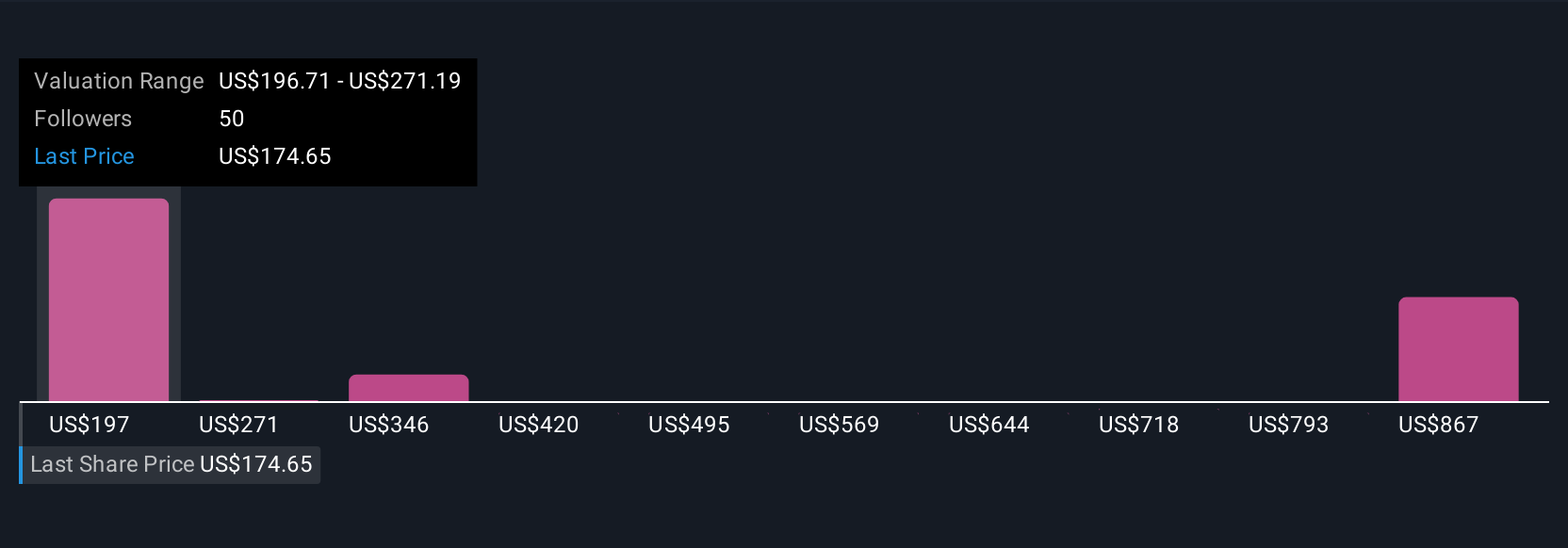

Nine fair value estimates from the Simply Wall St Community range from US$172 to nearly US$992 per share, highlighting sharply different expectations. While many see opportunity in contract-driven growth, some caution that legal and cost risks could impact future performance, be sure to weigh these diverse viewpoints.

Explore 9 other fair value estimates on Molina Healthcare - why the stock might be worth just $172.53!

Build Your Own Molina Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Molina Healthcare research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Molina Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Molina Healthcare's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOH

Molina Healthcare

Provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives