- United States

- /

- Healthcare Services

- /

- NYSE:MOH

Does Molina Healthcare’s 52.5% Drop Signal a Hidden Opportunity for 2025?

Reviewed by Bailey Pemberton

- Wondering whether Molina Healthcare is a bargain or a bust right now? Let’s dig into what truly drives its value and whether its price makes sense for savvy investors.

- The stock price recently rebounded 3.5% in the last week, even after a rough month with a -13.3% drop. Losses across the past year totaling -52.5% point to shifting market sentiment.

- Recent headlines highlight both the ongoing challenges in the healthcare sector and Molina's push to expand Medicaid contracts. Investors are weighing regulatory uncertainty against the opportunity from state program wins. This backdrop helps explain the increased volatility in share price and investor appetite for more clarity on valuation.

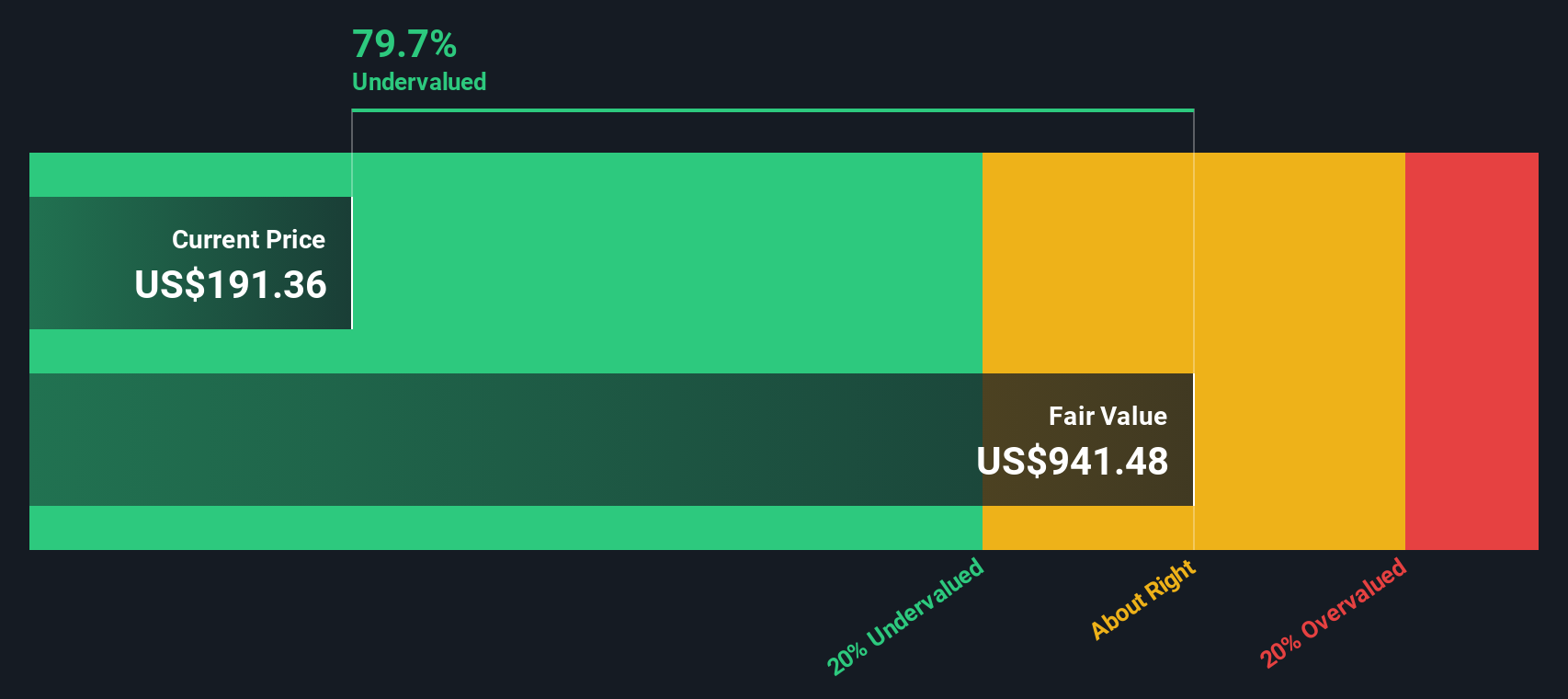

- By our checks, Molina Healthcare scores a perfect 6 out of 6 for being undervalued. This suggests the stock could be trading well below its fair price. Before you decide if this score tells the whole story, we will break down the major valuation approaches and reveal an even smarter way to weigh the numbers at the end of this article.

Find out why Molina Healthcare's -52.5% return over the last year is lagging behind its peers.

Approach 1: Molina Healthcare Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model forecasts a company’s future cash flows and discounts them back to today’s value to estimate what the company is really worth. This approach helps investors look beyond short-term noise and focus on the underlying earning power of a business.

For Molina Healthcare, the current Free Cash Flow stands at -$573 Million, indicating a recent outflow. However, projections by analysts and extrapolations from Simply Wall St suggest a strong turnaround, with expected Free Cash Flow reaching $1.23 Billion by 2029. The annual estimates show a clear progression from $847 Million in 2026 up to $1.70 Billion in 2035. Estimates beyond 2029 are extrapolated rather than directly issued by analysts.

Based on these future cash flows and using the 2 Stage Free Cash Flow to Equity model, the DCF model calculates Molina Healthcare’s intrinsic value at $649.18 per share. This is substantially higher than the stock’s current market price, suggesting Molina is approximately 78.2% undervalued according to the DCF methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Molina Healthcare is undervalued by 78.2%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Molina Healthcare Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular tool for valuing established, profitable companies like Molina Healthcare because it links a company’s current share price to its per-share earnings. For investors, it provides a quick sense of how much you are paying for every dollar of profit a company generates.

Growth expectations and risk play a big role in what makes a “normal” PE ratio. Companies expected to grow faster or with steadier earnings usually deserve a higher PE, while those facing higher risk or slower growth typically see a lower one. That is why comparing PE ratios in isolation can be misleading.

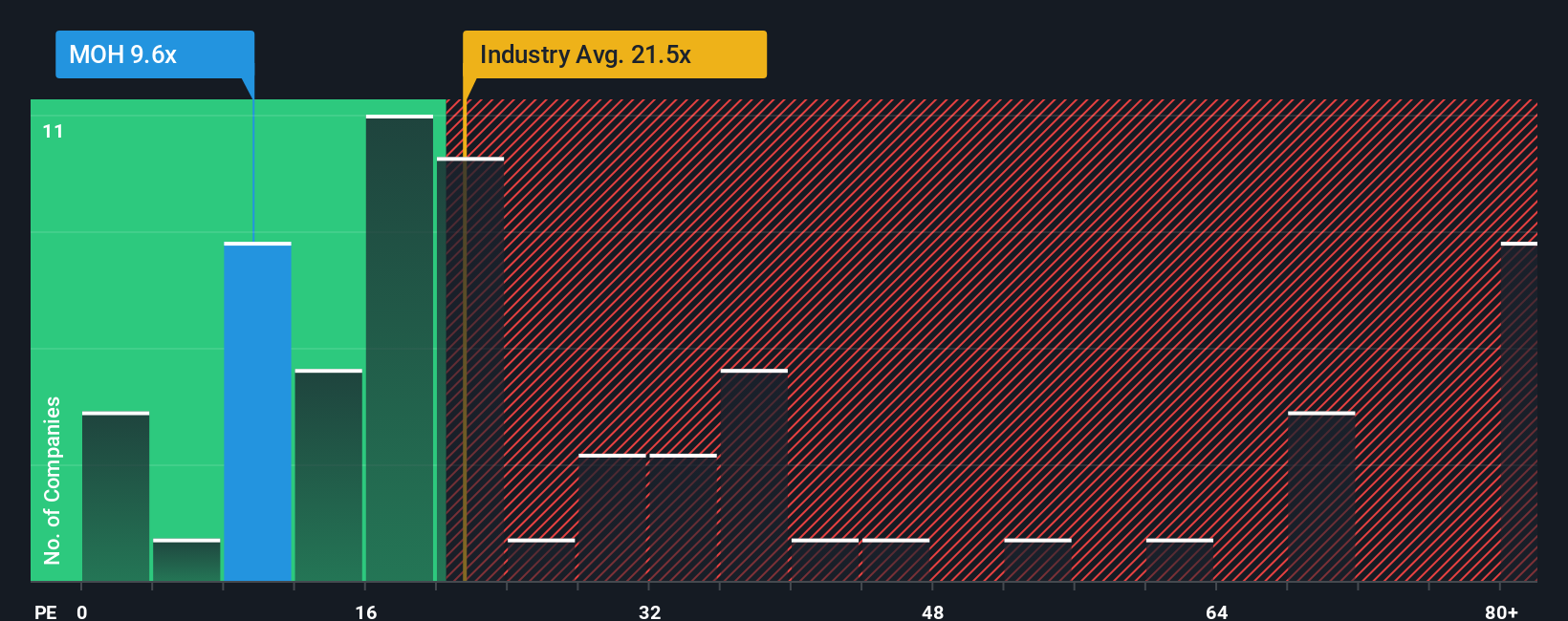

As of now, Molina Healthcare trades at a PE ratio of 8.24x. This stands out when compared to the Healthcare industry’s average of 22.35x, as well as the average among similar peers at 33.42x. However, Simply Wall St calculates a “Fair Ratio” for Molina at 19.78x. This Fair Ratio factors in more than just simple comparisons. It blends in expectations for earnings growth, profitability, risk, company size, and industry trends to set a personalized benchmark for what the PE should be.

Relying on the Fair Ratio is often more reliable than industry or peer comparisons since it incorporates Molina Healthcare’s unique earnings outlook and risk profile. With the current PE at 8.24x and the Fair Ratio much higher at 19.78x, Molina Healthcare appears significantly undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Molina Healthcare Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter, more personal approach to investment decisions. A Narrative is simply your own storyline or big-picture perspective about a company, built from the facts: you bring together your assumptions about future revenue, earnings, and margins and connect them to a fair value. With Narratives, you do not just look at numbers in isolation; you link Molina Healthcare’s unique story to its financial forecast and see how that translates into what the stock is really worth.

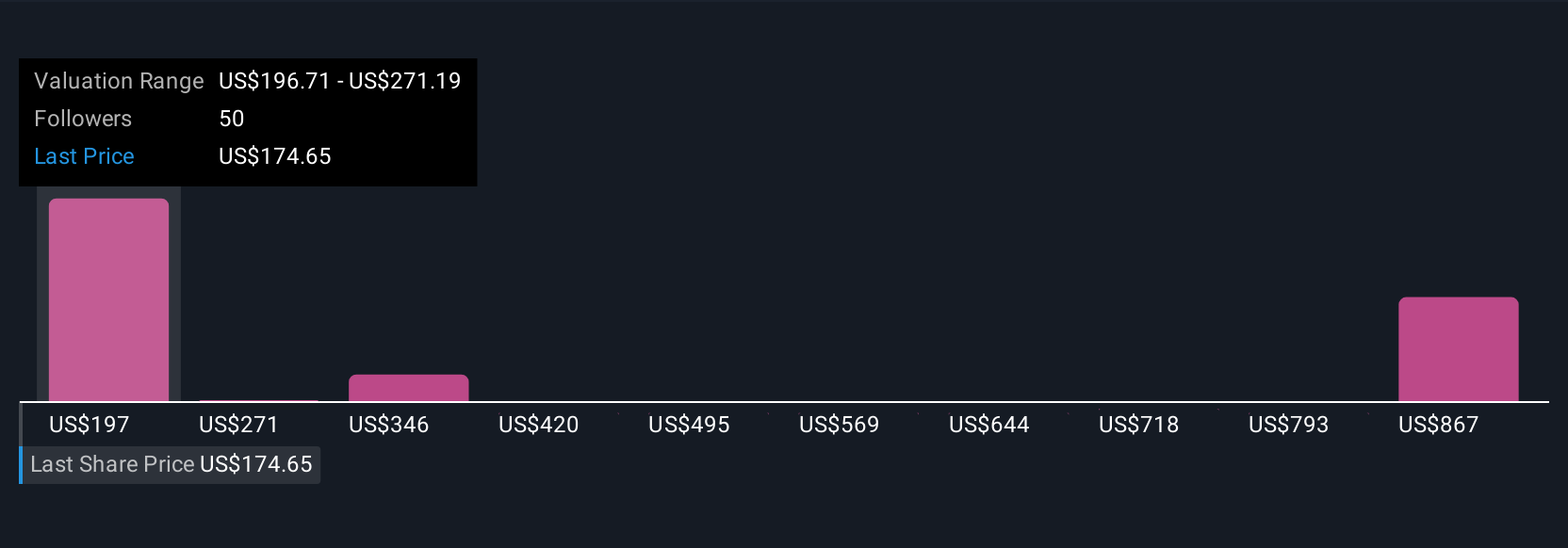

Narratives are available to everyone on Simply Wall St’s Community page, where millions of investors share their views. They are designed to be easy to use and are constantly kept up to date as new information or news is released. Rather than guessing when to buy or sell, Narratives let you compare your Fair Value with the actual share price, making your decisions much more informed. For example, one investor may be optimistic, believing Molina’s new Medicaid contracts and acquisitions will fuel premium growth and push its fair value up to $330, while another may focus on regulatory headwinds and forecast just $153. Narratives help you decide which story fits your own outlook.

Do you think there's more to the story for Molina Healthcare? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOH

Molina Healthcare

Provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives