- United States

- /

- Healthcare Services

- /

- NYSE:MD

Why Pediatrix Medical Group (MD) Is Up 20.9% After Swinging to Unexpected Q3 Profitability

Reviewed by Sasha Jovanovic

- Pediatrix Medical Group reported third quarter 2025 earnings, with net income rising to US$71.71 million from US$19.44 million a year earlier, despite a decline in sales to US$492.88 million from US$511.16 million.

- This dramatic turnaround in profitability occurred even as year-to-date revenue fell and net income shifted from a large loss to a significant profit.

- We'll explore how Pediatrix Medical Group's strong rebound in earnings affects the company's outlook for sustained profitability and future growth.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Pediatrix Medical Group Investment Narrative Recap

For investors in Pediatrix Medical Group, confidence centers on the ability to maintain consistent profitability while managing recent revenue headwinds linked to ongoing portfolio restructuring. The sharp rebound in earnings this quarter highlights operational improvements and cost controls, yet the biggest near-term catalyst, continued efficiency in revenue cycle management, remains tightly balanced against the persistent risk of revenue contraction from practice divestitures. This quarter’s profit recovery is supportive but has not fundamentally changed the most significant short-term risk to the business.

Among recent announcements, Pediatrix’s Q3 2025 earnings result is especially relevant, as it marks a dramatic swing from loss to profit over the nine-month period despite ongoing top-line pressure. This result signals some resilience in underlying margins and operating cash flow, directly relating to the company’s efforts to offset lower sales through more efficient operations and portfolio management, a critical factor as investors consider both the catalysts and vulnerabilities in the near-term outlook.

However, despite the strong bottom-line recovery, investors should be mindful of the risk that ongoing portfolio restructuring could further constrain...

Read the full narrative on Pediatrix Medical Group (it's free!)

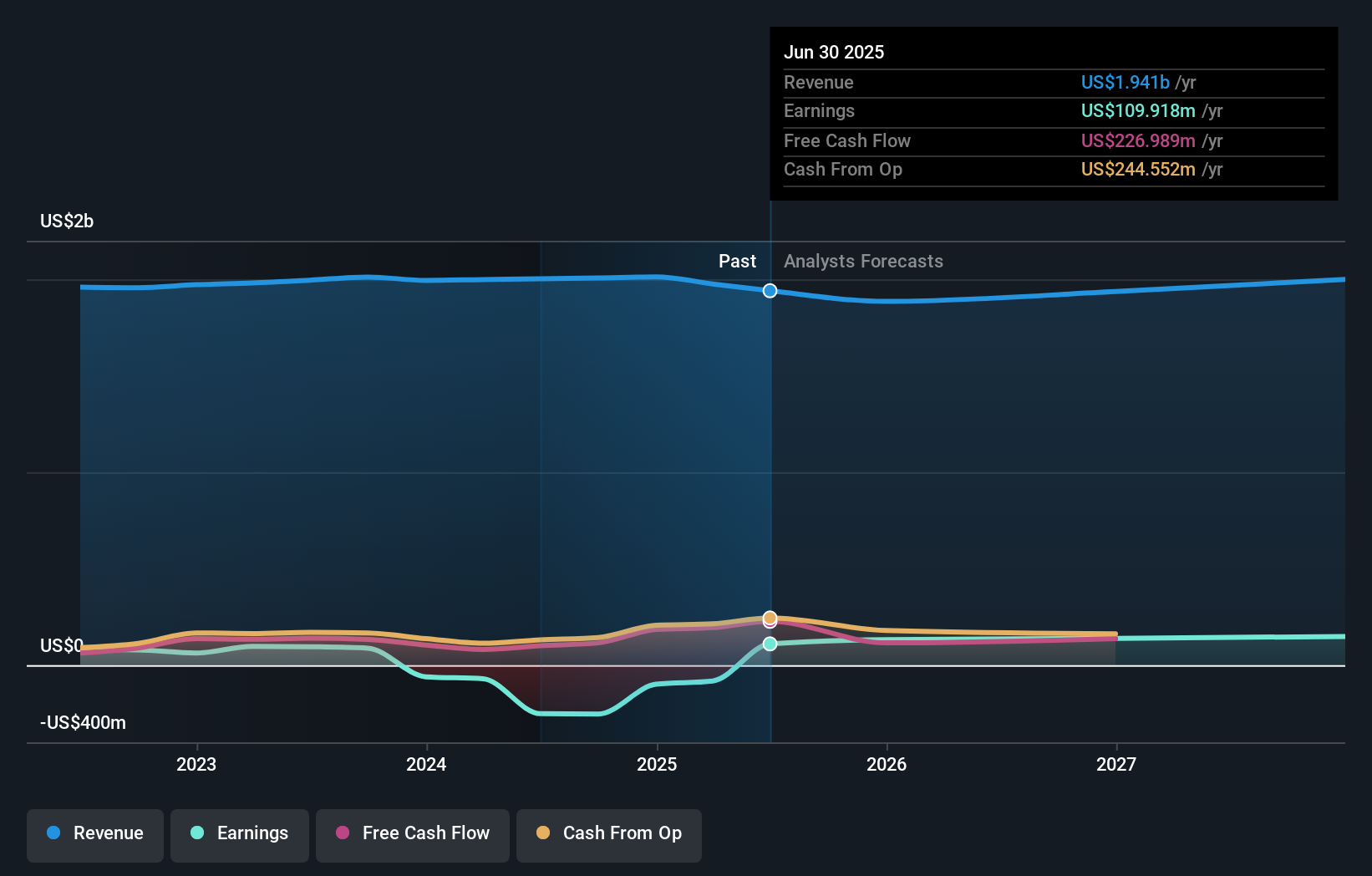

Pediatrix Medical Group's narrative projects $2.1 billion in revenue and $145.1 million in earnings by 2028. This requires 2.5% yearly revenue growth and a $35.2 million earnings increase from the current $109.9 million.

Uncover how Pediatrix Medical Group's forecasts yield a $16.71 fair value, a 21% downside to its current price.

Exploring Other Perspectives

Four recent fair value estimates from the Simply Wall St Community span from US$0.16 to US$22.79, underscoring broad differences in outlook. While many focus on efficiency gains as a catalyst, you may want to consider how revenue declines could affect long-term stability, see how other investors view it before forming your own opinion.

Explore 4 other fair value estimates on Pediatrix Medical Group - why the stock might be worth as much as 8% more than the current price!

Build Your Own Pediatrix Medical Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pediatrix Medical Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pediatrix Medical Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pediatrix Medical Group's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MD

Pediatrix Medical Group

Provides newborn, maternal-fetal, and other pediatric subspecialty care services in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives