- United States

- /

- Healthcare Services

- /

- NYSE:MD

Pediatrix Medical Group (MD) Returns to Profitability, Challenging Bearish Narratives on Margin Quality

Reviewed by Simply Wall St

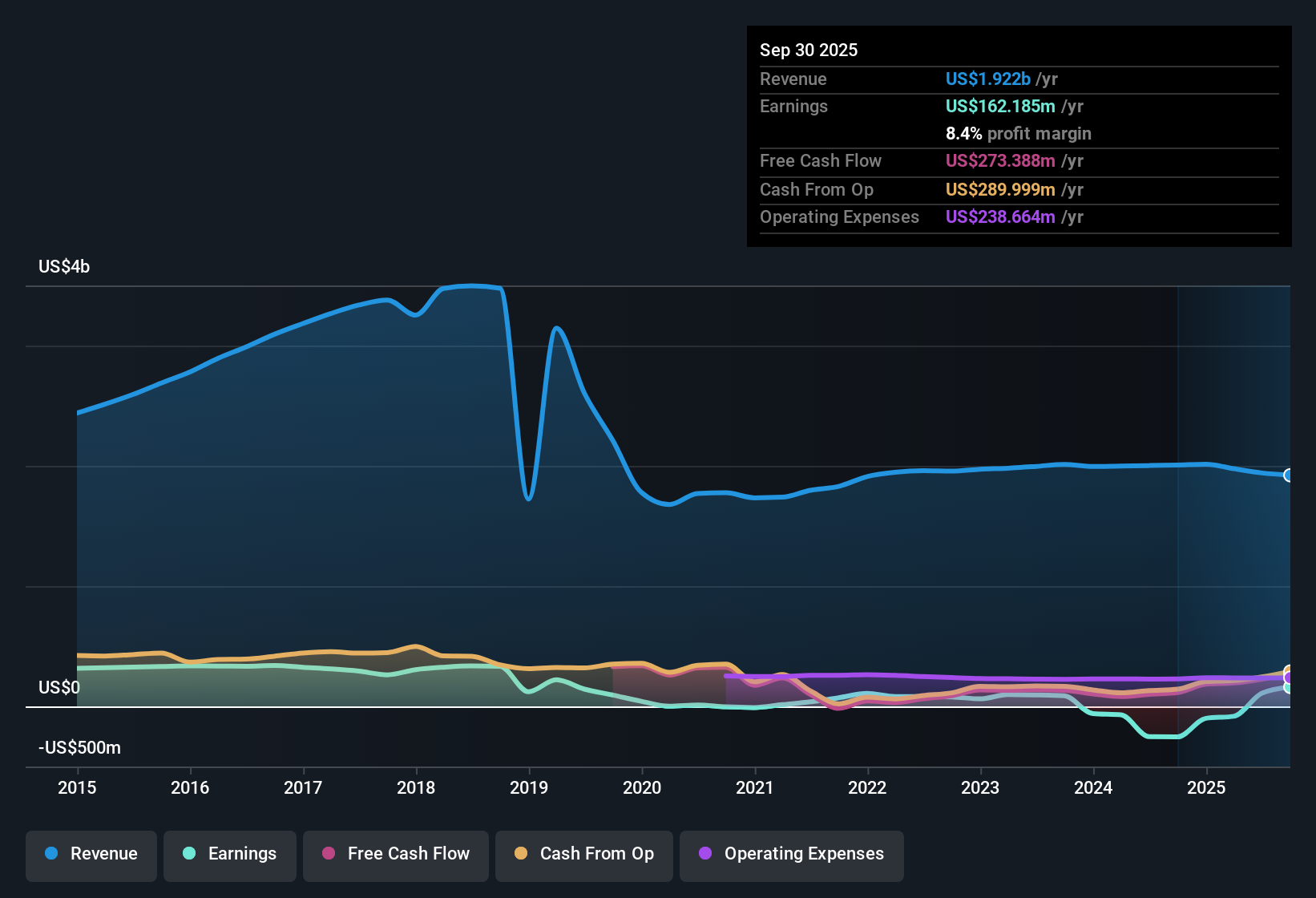

Pediatrix Medical Group (MD) turned profitable in the past year, with its net profit margin showing improvement compared to the previous year. Over the last five years, the company averaged a negative 21.2% annual earnings growth rate, but has now established consistent profitability. While projected revenue and earnings growth of 3.4% and 0.2% per year, respectively, lag the broader US market, a good value profile and a history of profit support a constructive outlook for investors focused on quality margins and relative value.

See our full analysis for Pediatrix Medical Group.Next up, we will see how the headline numbers compare to the most widely followed narratives around Pediatrix, what gets confirmed, and what new questions are raised for investors.

See what the community is saying about Pediatrix Medical Group

Margins Build on Operational Gains

- Pediatrix's net profit margin has improved, supporting a transition to consistent profitability after five years of lumpy negative earnings growth averaging -21.2% annually.

- Analysts’ consensus view highlights that margin expansion has been made possible by operational efficiencies and financial flexibility,

- with improvements in revenue cycle management and salary discipline helping to raise working capital efficiency and convert more revenue into cash flow.

- This progress aligns with ongoing improvements reported in the company’s filings, which suggest sustainability even as anticipated earnings growth of 0.2% per year remains modest compared to healthcare peers.

DCF Fair Value Trails Share Price

- The current share price of $21.44 stands well above both the DCF fair value of $15.25 and the consensus analyst price target of $19.92, implying that the stock trades at a premium to modeled fair value expectations.

- According to analysts’ consensus view, Pediatrix trades near their target on recent results,

- as forecast earnings of $145.1 million and EPS of $1.68 by 2028 support a price target of $19.92, using a 12.3x PE, which is well below the healthcare industry average of 20.9x and peer multiples.

- The low gap between current price and consensus reinforces the belief that the market broadly sees Pediatrix as fairly valued, despite lagging revenue and earnings growth versus the wider market.

P/E Ratio Signals Relative Bargain

- Pediatrix’s price-to-earnings ratio of 11.1x is less than half the US healthcare industry average of 20.7x and far below the peer average of 127.6x, supporting a relative value story for margin-focused investors.

- Analysts’ consensus view contends that a good value profile, when paired with stable recurring revenue from specialized pediatric and neonatal services,

- sets a foundation for stable cash flows as demographic and policy trends drive a steady need for NICU and related care, reinforcing value through reliability as well as price.

- Portfolio restructuring and rising healthcare costs remain potential roadblocks, but the PE discount and history of profitability keep Pediatrix attractive versus many sector alternatives.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Pediatrix Medical Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different interpretation of the figures? Use your insight to craft your unique narrative in under three minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pediatrix Medical Group.

See What Else Is Out There

While Pediatrix shows margin gains and an appealing P/E, its slow earnings and revenue growth leave it trailing industry peers and the broader US market.

If you want companies delivering steadier upward results, focus on stable growth stocks screener (2077 results) to see businesses demonstrating consistent revenue and earnings expansion every year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MD

Pediatrix Medical Group

Provides newborn, maternal-fetal, and other pediatric subspecialty care services in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives