- United States

- /

- Healthcare Services

- /

- NYSE:MD

Pediatrix Medical Group (MD): Evaluating Valuation After Outperforming Revenue Expectations on Improved Payor Mix

Reviewed by Simply Wall St

Pediatrix Medical Group (MD) outperformed expectations in its most recent quarter, reporting revenue that topped analyst forecasts by 3%. The company benefited from improved reimbursement rates, increased patient acuity, and a stronger payor mix.

See our latest analysis for Pediatrix Medical Group.

Pediatrix Medical Group’s share price has nearly doubled since the start of the year, posting an 89% year-to-date gain. Momentum has been especially strong over the past month and quarter. The stock’s 1-year total shareholder return of 67% underscores renewed investor confidence in the business’s turnaround potential.

If you’re interested in what else is making waves in healthcare, now’s a great moment to explore other standout names with our curated See the full list for free.

With shares having surged so sharply this year, investors now face a critical question: does Pediatrix Medical Group remain undervalued, or is the market already factoring in all of its future growth prospects?

Most Popular Narrative: 8.7% Overvalued

Pediatrix Medical Group’s fair value, according to the most widely followed narrative, is now estimated at $22.67. With shares last closing at $24.65, the narrative suggests the market is pricing in more aggressive growth and margins than analysts expect. Here is what is behind that viewpoint.

Ongoing operational improvements, such as enhancements in revenue cycle management and tightly controlled salary expenses, are improving working capital efficiency and holding down expense growth. This is supporting higher net earnings and cash flow conversion. A strong balance sheet and cash position (with potential for buybacks, debt paydown, or strategic acquisitions) provide optionality for future earnings growth, margin improvement, and increased shareholder value in a consolidating healthcare landscape.

Curious about the math behind Pediatrix’s valuation? The debate centers on margin upgrades, revenue projections, and an earnings runway that could reshape how investors see its future. Only by reading further will you discover which bullish assumptions are fueling that higher price tag and just how far the consensus thinks management can push profitability in this fast-changing healthcare sector.

Result: Fair Value of $22.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued challenges in hospital fee negotiations or unfavorable changes in reimbursement rates could quickly test management’s ability to sustain improving margins.

Find out about the key risks to this Pediatrix Medical Group narrative.

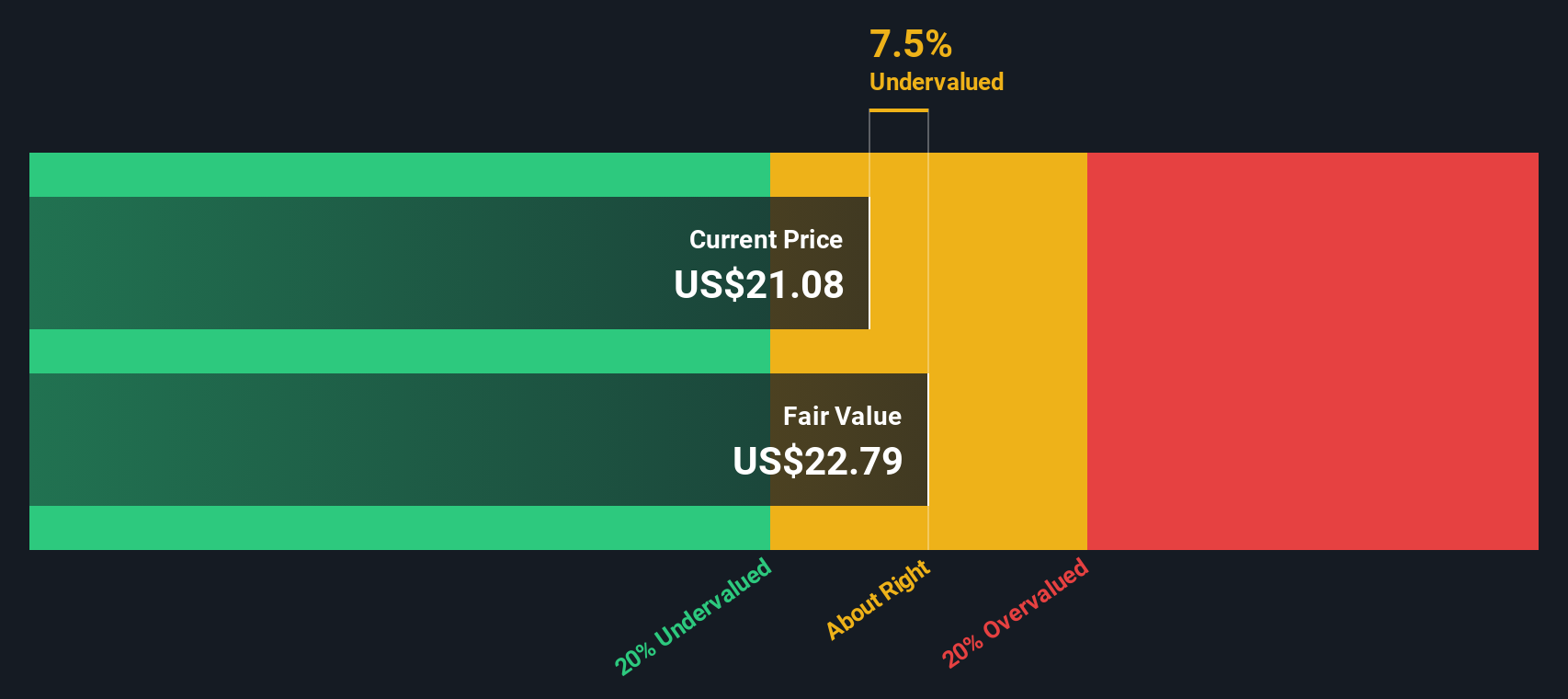

Another View: Discounted Cash Flow Points to Undervaluation

While the most popular valuation perspective sees Pediatrix Medical Group as slightly overvalued, our SWS DCF model takes a different stance. Based on forecast cash flows, the DCF model suggests the stock is trading well below its estimated fair value. Could the market be overlooking Pediatrix’s true long-term earnings power?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Pediatrix Medical Group Narrative

If you see things differently or want to dive into the numbers yourself, you can shape your own narrative in under three minutes. Do it your way.

A great starting point for your Pediatrix Medical Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by while others move ahead. Use these tailored stock picks to sharpen your next investing move and gain an edge.

- Watch your portfolio’s income grow when you browse these 14 dividend stocks with yields > 3%, which consistently offer attractive yields over 3% and weather market volatility with stability.

- Capitalize on artificial intelligence innovation now by targeting these 26 AI penny stocks, which are set to shape the future of automation, data, and smart technology solutions.

- Tap into market mispricings by zeroing in on these 933 undervalued stocks based on cash flows, which present untapped upside based on solid cash flows and underlying value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MD

Pediatrix Medical Group

Provides newborn, maternal-fetal, and other pediatric subspecialty care services in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success