- United States

- /

- Healthcare Services

- /

- NYSE:MCK

McKesson (MCK): Evaluating Valuation After Double-Digit Growth and Strong Share Price Rally

Reviewed by Simply Wall St

McKesson (MCK) has delivered double-digit growth across revenue and net income over the past year, reflecting solid demand trends in the healthcare distribution space. Shares have climbed 14% in the past 3 months, outpacing the broader market.

See our latest analysis for McKesson.

McKesson’s robust momentum has drawn attention, with the stock posting a 43% year-to-date share price return and delivering an impressive 54.8% total shareholder return over the past year. This climb reflects renewed confidence following recent results and an ongoing sector tailwind for healthcare distributors.

If McKesson’s strong run has you curious about other sector leaders, now is the perfect moment to discover See the full list for free.

With shares riding a remarkable rally, the big question now is whether McKesson remains undervalued or if the recent surge already reflects all of its future growth and leaves little room for further upside.

Most Popular Narrative: 3% Undervalued

McKesson’s widely followed narrative pegs its fair value at $836.71, slightly above the last close of $811.34. The market is taking these projections seriously, raising questions about what is driving this premium over the current price.

Expanding value-added services, such as pharmacy management, patient access/adherence solutions, and commercialization support for biopharma customers, allow for stronger customer relationships, greater recurring revenue streams, and improved revenue visibility.

Curious what is powering that narrow pricing gap? The answer comes down to bold forecasts on where profits and revenues may head next. Analysts are betting on a future that relies on expanding premium services, scaling operating efficiencies, and commanding a valuation multiple similar to the fastest-growing players. See which ambitious financial assumptions back this narrative’s target and why the market is listening in.

Result: Fair Value of $836.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory scrutiny on drug pricing and ongoing industry consolidation could undermine McKesson’s growth story if these headwinds become more pronounced.

Find out about the key risks to this McKesson narrative.

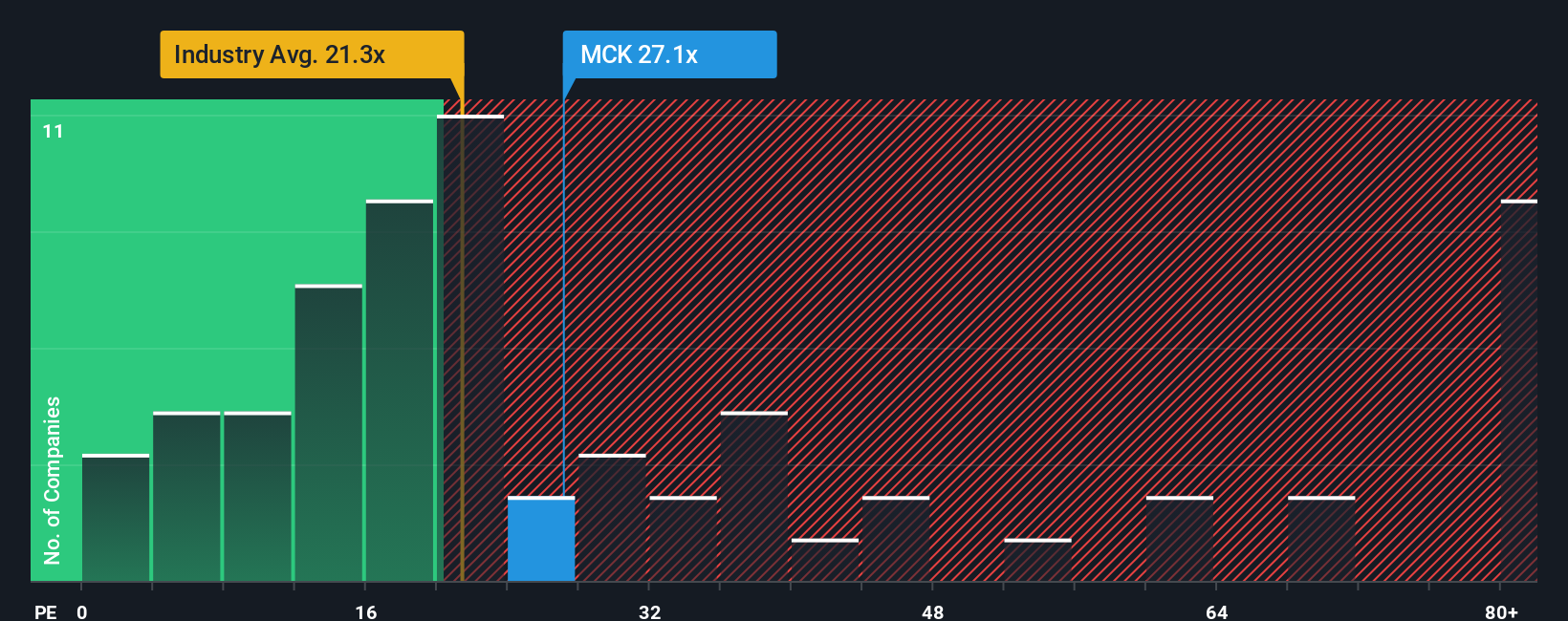

Another View: Multiples Paint a Pricier Picture

While the earlier narrative suggests McKesson looks undervalued, comparing its price-to-earnings ratio of 31.9x to the healthcare industry average of 21.2x and a peer average of 24.8x reveals shares trade at a premium. This is only slightly below the calculated fair ratio of 33.9x, highlighting hefty expectations built into the price. Does this gap signal long-term upside or leave investors with little margin for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own McKesson Narrative

If you have a different perspective or want to run the numbers your own way, you can craft your personal McKesson story in just a few minutes. Do it your way

A great starting point for your McKesson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize your chance to get ahead by unlocking new opportunities. Target companies with real upside and keep your watchlist stocked with tomorrow’s market movers.

- Access steady income potential by zeroing in on these 22 dividend stocks with yields > 3%, where robust yields and consistency can strengthen your portfolio’s foundation.

- Turn your attention to the future of artificial intelligence by tracking emerging leaders through these 26 AI penny stocks, capturing growth where innovation never slows.

- Boost your value strategy and spot notable price gaps with these 840 undervalued stocks based on cash flows, revealing stocks the market has yet to fully appreciate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCK

McKesson

Provides healthcare services in the United States and internationally.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives