- United States

- /

- Healthcare Services

- /

- NYSE:MCK

Does McKesson’s (MCK) Dividend Hike Reflect Strength in Its Broader Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- On October 30, 2025, McKesson’s Board of Directors declared a regular dividend of US$0.82 per share, payable on January 2, 2026, to shareholders of record as of December 1, 2025.

- This announcement comes as analysts grow increasingly optimistic about McKesson’s upcoming quarterly earnings, with the Most Accurate Estimate surpassing the Zacks Consensus Estimate.

- We’ll explore how heightened analyst optimism ahead of quarterly earnings could influence McKesson’s broader investment narrative going forward.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

McKesson Investment Narrative Recap

To be a McKesson shareholder, you need to believe in the long-term demand for pharmaceutical distribution and value-added healthcare services, underpinned by demographic shifts and the complexity of the healthcare supply chain. The recent dividend affirmation of US$0.82 per share signals consistency, but it does not materially influence the key short-term catalyst, the upcoming quarterly earnings report, nor does it significantly change the primary risk of regulatory pressure on drug pricing. Among recent announcements, McKesson’s July 2025 dividend increase, which raised the payout by 15%, stands out as most relevant. This move reinforces the company’s focus on shareholder returns, supporting its investment narrative, yet future earnings growth and margin expansion remain closely tied to both evolving industry conditions and quarterly results. However, investors should also weigh the elevated risk of increased government action on drug pricing, as this is information you need to be aware of...

Read the full narrative on McKesson (it's free!)

McKesson's narrative projects $478.8 billion revenue and $5.3 billion earnings by 2028. This requires 8.2% yearly revenue growth and a $2.1 billion earnings increase from $3.2 billion today.

Uncover how McKesson's forecasts yield a $836.71 fair value, in line with its current price.

Exploring Other Perspectives

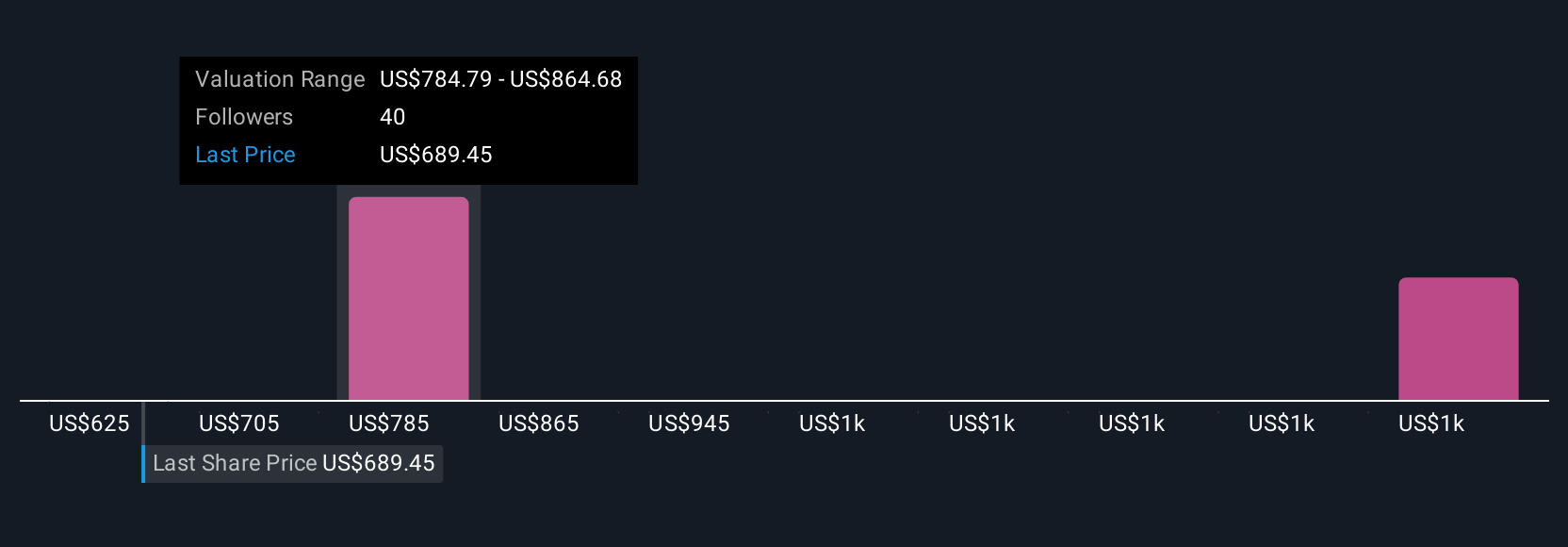

Four fair value estimates from the Simply Wall St Community range from US$665 to US$1,365.91 per share. These varied perspectives reflect how differing views on regulatory risk could shape market expectations and the path ahead for McKesson; explore a range of community viewpoints.

Explore 4 other fair value estimates on McKesson - why the stock might be worth as much as 67% more than the current price!

Build Your Own McKesson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McKesson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free McKesson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McKesson's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCK

McKesson

Provides healthcare services in the United States and internationally.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives