- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Inspire Medical Systems (INSP): Fresh Valuation Insight as Strong Q3 and Raised Outlook Restore Investor Optimism

Reviewed by Simply Wall St

Inspire Medical Systems reported third-quarter results that beat expectations, while management reaffirmed and raised its outlook for the year. The company’s confidence was reinforced by healthy patient growth and continued progress in physician training.

See our latest analysis for Inspire Medical Systems.

Despite headline-grabbing legal challenges and a sharply reduced 2025 guidance earlier this year, Inspire Medical Systems’ recent earnings beat and brighter outlook have helped the share price bounce 14.7% over the past week. Even so, the stock’s one-year total shareholder return sits near -58%, highlighting how much ground remains to be recovered for long-term investors. With renewed operational momentum and signs of stabilizing demand, attention is shifting back to the company’s ongoing turnaround potential.

For those eyeing other healthcare innovators with fresh products and shifting fortunes, now is a good time to see the full list: See the full list for free.

Given a recent flurry of upbeat announcements, yet a still-heavy loss over the past year, the central question now is whether Inspire Medical Systems stock remains undervalued or if the market has already adjusted for future growth prospects.

Most Popular Narrative: 28.6% Undervalued

Based on the most widely followed narrative, Inspire Medical Systems is seen as significantly cheaper than its estimated fair value, with the latest close ($83.81) well below where the narrative sets its valuation. The difference highlights bullish conviction in long-term business potential amid recent price weakness, setting the stage for key growth drivers to play a pivotal role in valuation.

The second half of 2025 will see a ramp in marketing and new center expansion following a purposeful pause in H1 as the Inspire V launch occurs. This resurgence in patient education, awareness campaigns, and provider capacity building should drive higher procedure volumes and top-line acceleration into 2026 and beyond.

Curious how a medical device company gets valued this high in a tough sector? The secret is growth—faster, broader, and unlocked by a future-looking shift in its strategy. Want to find out what bold financial forecasts make this narrative tick? Unlock the breakdown to see exactly how analysts justify that aggressive price target.

Result: Fair Value of $129.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower-than-expected rollouts and growing competition could dampen Inspire Medical Systems' growth outlook and challenge the bullish undervaluation narrative.

Find out about the key risks to this Inspire Medical Systems narrative.

Another View: What Do Market Multiples Suggest?

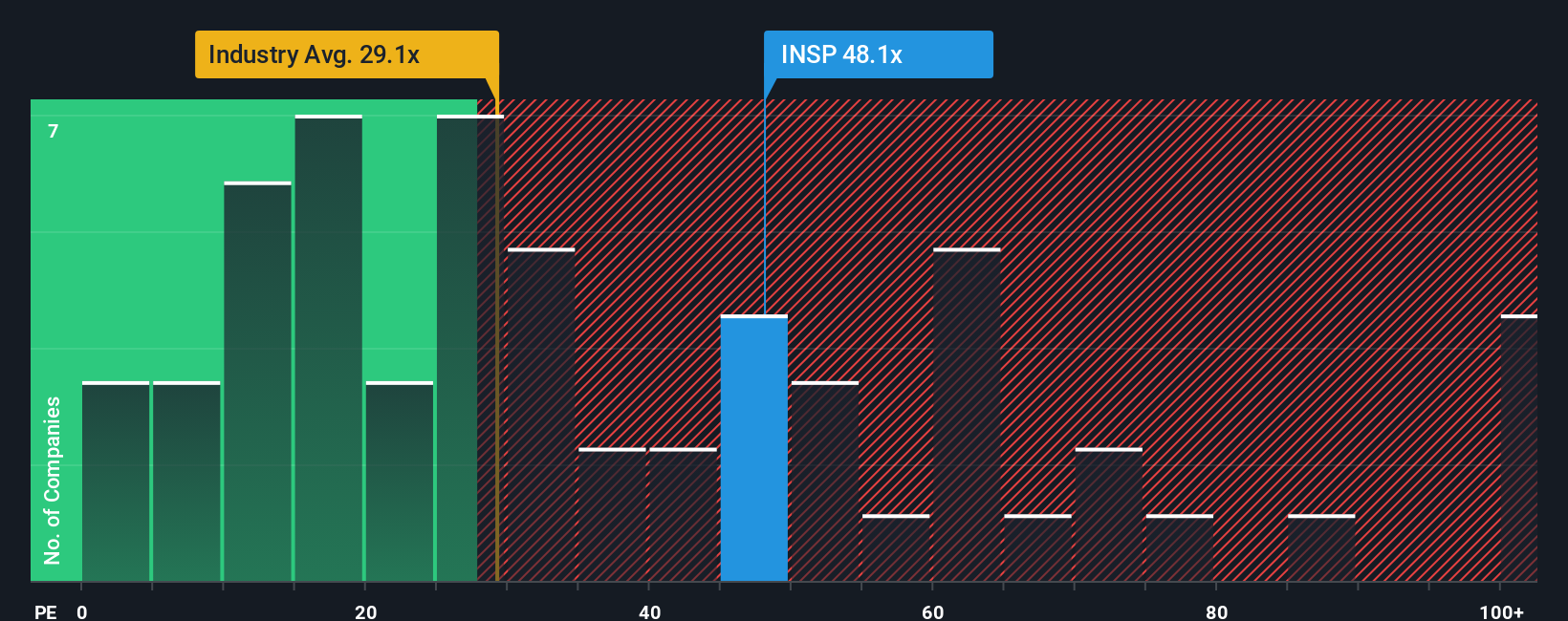

Taking a different approach, let's look at Inspire Medical Systems' current price-to-earnings ratio of 54.7 times. This figure stands well above the fair ratio of 28.7 times and the US Medical Equipment industry average of 29 times. The premium indicates the stock is priced far higher than both its peers and what the broader market might consider fair based on historical relationships.

Does this steep valuation reflect future upside, or is it a sign of increased risk if growth disappoints? See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Inspire Medical Systems Narrative

If these viewpoints don't match your own, or if you like to dig into the numbers firsthand, you can generate your own perspective in just a few minutes. Do it your way

A great starting point for your Inspire Medical Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to strengthen your portfolio? Take action now and unlock fresh opportunities you won't want to miss. Be the first among your friends to spot potential winners.

- Secure steady income streams when you check out these 17 dividend stocks with yields > 3% yielding over 3% while balancing risk and reward for your investments.

- Set your sights on rapid breakthroughs in artificial intelligence by using these 25 AI penny stocks and target innovators primed for explosive future growth.

- Position yourself ahead of the curve with these 861 undervalued stocks based on cash flows that are priced well below their intrinsic value but packed with upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives