- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Announcing: Inspire Medical Systems (NYSE:INSP) Stock Increased An Energizing 147% In The Last Year

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Inspire Medical Systems, Inc. (NYSE:INSP) share price had more than doubled in just one year - up 147%. It's also good to see the share price up 59% over the last quarter. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View our latest analysis for Inspire Medical Systems

Because Inspire Medical Systems made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Inspire Medical Systems saw its revenue grow by 34%. That's a fairly respectable growth rate. The revenue growth is decent but the share price had an even better year, gaining 147%. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

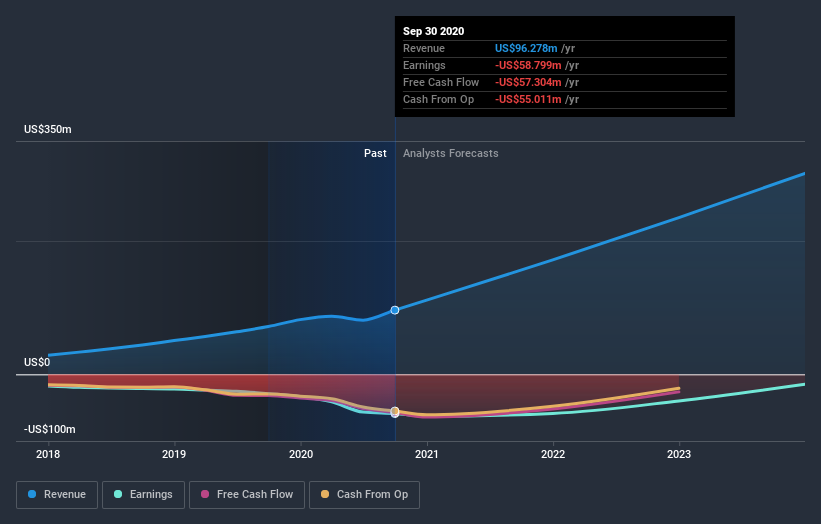

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling Inspire Medical Systems stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Inspire Medical Systems shareholders should be happy with the total gain of 147% over the last twelve months. And the share price momentum remains respectable, with a gain of 59% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. It's always interesting to track share price performance over the longer term. But to understand Inspire Medical Systems better, we need to consider many other factors. Take risks, for example - Inspire Medical Systems has 3 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Inspire Medical Systems or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet and good value.