- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Will a $250 Million Buyback Amid Margin Pressures Shift the Hims & Hers (HIMS) Story?

Reviewed by Sasha Jovanovic

- In recent days, Hims & Hers Health reported strong third-quarter revenue growth, introduced a US$250 million share buyback program, and faced heightened volatility following its exclusion from a key partner's list.

- This series of events has highlighted persistent investor concerns over shrinking profit margins, institutional trading activity, and competitive pressures in highly contested telehealth and weight-loss markets.

- We'll now explore how the recent share buyback announcement may influence the company's investment narrative and future outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Hims & Hers Health Investment Narrative Recap

To be a shareholder in Hims & Hers Health today, you need to believe in the company’s ability to drive long-term growth through category expansion and ongoing innovation despite mounting margin pressures in telehealth and weight-loss segments. The recent share buyback program and resulting market volatility do not materially change the immediate importance of the company’s ability to sustain user retention and recurring revenue, nor do they override the key risk of profit margin compression due to heavy investment needs and strong competition.

The most relevant recent announcement is the launch of the “Labs” service for at-home health monitoring, which directly supports ongoing diversification efforts and underpins a critical growth catalyst, the expansion into new high-need health categories aimed at boosting customer retention and multi-condition engagement.

However, for investors, it’s important to keep in mind that, despite new initiatives and capital returns, growing regulatory scrutiny around drug promotion practices may impact essential...

Read the full narrative on Hims & Hers Health (it's free!)

Hims & Hers Health's narrative projects $3.3 billion in revenue and $261.3 million in earnings by 2028. This requires 18.3% yearly revenue growth and a $67.7 million increase in earnings from the current $193.6 million.

Uncover how Hims & Hers Health's forecasts yield a $46.00 fair value, a 23% upside to its current price.

Exploring Other Perspectives

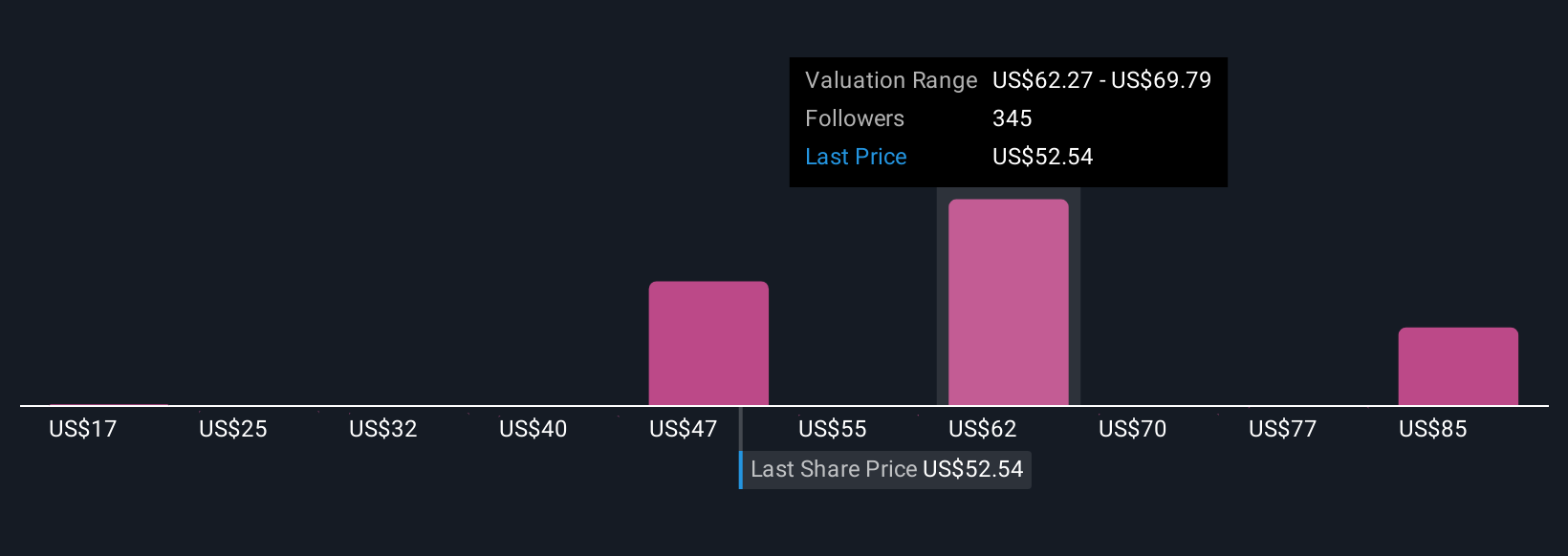

Simply Wall St Community members provided 41 fair value estimates for Hims & Hers Health ranging from US$32.67 to US$97.04 per share. While opinions differ widely, growing regulatory scrutiny remains a pressing issue that could shape both near and longer-term performance, highlighting the value of considering diverse perspectives.

Explore 41 other fair value estimates on Hims & Hers Health - why the stock might be worth 13% less than the current price!

Build Your Own Hims & Hers Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hims & Hers Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hims & Hers Health's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026