- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Hims & Hers (HIMS) Is Up 6.2% After $250M Buyback and Labs Launch Is Growth Story Evolving?

Reviewed by Sasha Jovanovic

- In recent developments, Hims & Hers Health announced a new US$250 million share repurchase program, introduced its Labs health-testing service, and appointed Deb Autor as its first Chief Policy Officer to lead regulatory and policy initiatives. These steps highlight the company’s efforts to expand personalized care offerings, strengthen compliance, and signal management’s confidence in its long-term growth trajectory.

- The company’s expansion into at-home lab testing and women’s health, combined with rising user adoption and international growth, is expected by analysts to broaden its revenue streams despite exposure to regulatory and margin risks as it enters new markets and invests in technology.

- We’ll examine how the launch of Labs and a significant buyback initiative may reshape Hims & Hers Health’s investment outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Hims & Hers Health Investment Narrative Recap

To be a shareholder in Hims & Hers Health, you need to believe in the company's ability to expand successfully into new health categories and international markets while maintaining profitability and compliance. Recent announcements, including the share repurchase program, Labs launch, and new executive appointment, reinforce confidence in diversification and regulatory readiness, yet do not materially change the immediate catalyst of subscription user growth or the principal risk tied to regulatory headwinds as the company scales new offerings.

The launch of Labs is particularly relevant, as it marks a major step in expanding Hims & Hers' personalized telehealth services and could improve customer retention and revenue stability if adoption is strong. This product expansion directly relates to the key catalyst of diversifying revenue streams and deepening user engagement, which are central to the company's long-term growth narrative.

Yet, with all these shifts, it’s important not to overlook the fact that regulatory uncertainty in new healthcare markets remains a risk that investors should be aware of...

Read the full narrative on Hims & Hers Health (it's free!)

Hims & Hers Health is projected to reach $3.3 billion in revenue and $261.3 million in earnings by 2028. This outlook assumes an 18.3% annual revenue growth rate and a $67.7 million increase in earnings from the current $193.6 million.

Uncover how Hims & Hers Health's forecasts yield a $46.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

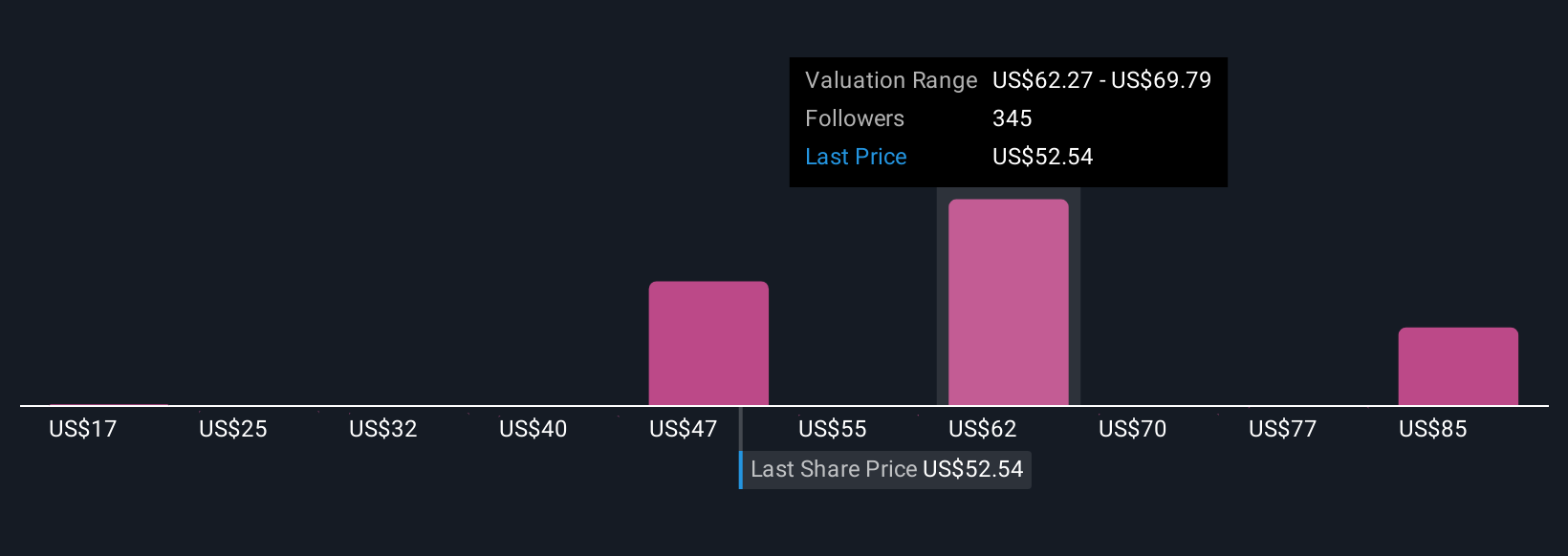

Forty members of the Simply Wall St Community provided fair value estimates ranging from US$33.15 to US$97.04, showing a wide spectrum of opinions on Hims & Hers Health. While growth in new segments like at-home labs piques optimism, regulatory challenges remain a significant influence on the company's performance outlook.

Explore 40 other fair value estimates on Hims & Hers Health - why the stock might be worth over 2x more than the current price!

Build Your Own Hims & Hers Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hims & Hers Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hims & Hers Health's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success