- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Hims & Hers Health (HIMS) Revenue Growth Forecast Tops Market, Elevating Debate on Valuation Premium

Reviewed by Simply Wall St

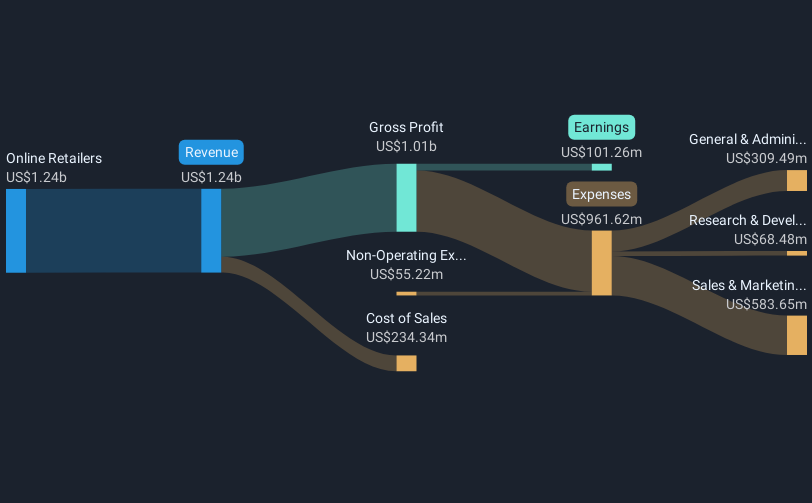

Hims & Hers Health (HIMS) posted strong revenue and earnings growth forecasts, with revenue expected to rise 14.7% per year and earnings projected to climb 27.5% annually. Both figures surpass broader US market trends. While the company’s average annual earnings growth reached 62.2% over the past five years, the most recent year saw a 32.1% expansion, and net profit margins dipped to 6.1% compared to 8.2% a year ago. Investors are weighing a solid profitability record and bright growth outlook against a notably high price-to-earnings ratio. The stock trades well below fair value but at a sizable premium to industry multiples.

See our full analysis for Hims & Hers Health.Next, we’ll see how these headline figures compare with the key narratives shaping market sentiment, highlighting where perspectives align and where new questions emerge.

See what the community is saying about Hims & Hers Health

Price-to-Earnings Premium Widens

- Hims & Hers shares trade at a price-to-earnings ratio of 72.8x, well above the US healthcare sector average of 21.5x and peer average of 28.4x. This reflects a significant valuation premium compared to both its direct competitors and the broader industry.

- Analysts' consensus view highlights that, despite this lofty premium, the valuation is underpinned by expectations of recurring revenue growth and operational efficiencies as the company expands internationally and integrates AI-powered care:

- Ongoing expansion into new health categories and international markets is expected to sustain top-line growth and support high multiples.

- The push for personalized offerings and enhanced tech integration, especially in areas like telehealth subscriptions and automated patient support, is seen as delivering greater customer retention and improved earnings quality.

- The current share price of $42.79 remains meaningfully below DCF fair value at $75.78. This further fuels the debate on whether high multiples are justified by forward growth potential or simply reflect investor enthusiasm.

Surging profit forecasts and global expansion plans are at the heart of the consensus narrative for this telehealth pioneer. See how bulls and bears frame the future stakes in the full Consensus Narrative. 📊 Read the full Hims & Hers Health Consensus Narrative.

Margins Face Pressure as Growth Outpaces Profits

- Net profit margin declined this year to 6.1% from 8.2% a year ago, even as annual earnings growth remained robust at 32.1%. This suggests that rapid revenue expansion is coming at the cost of some profitability.

- Analysts' consensus view notes that future earnings stability depends on balancing investments in new technologies and international launches with careful management of costs:

- Integration of AI and automation is expected to drive clinical and operational efficiency, but failure to achieve these gains could lead to continued margin compression or higher operating expenses.

- Marketing spend has increased to support new verticals and geographic launches, heightening the risk that rising customer acquisition costs erode profitability if subscriber growth and retention stall.

Analyst Price Targets Hover Near Current Price

- The analyst consensus price target is $47.08, just 10% above the current share price of $42.79. This indicates that most analysts view Hims & Hers as fairly valued on current fundamentals and near-term growth assumptions.

- According to the consensus narrative, this close gap suggests ongoing debate about whether long-term expansion and technology bets can deliver outsized returns:

- Most projections call for annual revenue growth of 18.3% and earnings reaching $261.3 million by 2028, but there is significant disagreement, with the most optimistic analysts targeting up to $304.1 million and skeptics forecasting as low as $28 million.

- For the current price to be attractive relative to consensus targets, investors must believe the company deserves to trade at a PE of 57.6x on 2028 earnings, far above sector norms.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hims & Hers Health on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Share your perspective and craft a fresh narrative in just a few minutes. Do it your way

A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Hims & Hers Health’s rapid revenue growth has come at the cost of shrinking profit margins and mounting questions around whether its premium valuation is justified by future performance.

If volatile margins and sky-high multiples give you pause, discover companies showing greater value for money with these 840 undervalued stocks based on cash flows, which could offer stronger upside potential with less valuation risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives