- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Evaluating Hims & Hers Shares After 28.8% Drop and New Telehealth Partnerships

Reviewed by Bailey Pemberton

- Ever wondered if Hims & Hers Health could be a hidden gem, or if the hype is already priced in? Let's dig into what the numbers and latest trends are telling us about its value.

- The stock has been on a wild ride: up 37.7% year-to-date and 468.1% over three years, yet it dipped 28.8% in the last month.

- Recent headlines have buzzed about Hims & Hers Health's innovative telehealth partnerships and an expanded product lineup. This combination has fueled both optimism and volatility. The excitement, together with the competitive digital health landscape, has made price swings bigger than usual.

- The current valuation score is 2 out of 6, so clearly there is more to discuss. We'll break down how this score is calculated, compare different valuation methods, and explore one approach that might change your perspective by the end of this piece.

Hims & Hers Health scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hims & Hers Health Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and discounting them back to today's dollars. This helps investors judge what the business is truly worth beyond just its current market price.

Hims & Hers Health currently generates $189.38 Million in Free Cash Flow. Using analyst projections, this figure is expected to grow steadily over the next few years, reaching $406.71 Million by 2029. Since analyst estimates extend only five years out, further projections are extrapolated based on recent growth trends, providing an outlook through 2035.

All future cash flows are added together and discounted to reflect their present value. According to this two-stage DCF analysis, the intrinsic value of Hims & Hers Health shares is estimated at $58.00. With the stock currently trading around 40.2% below this projection, the numbers suggest the market is undervaluing the company’s anticipated cash flow potential.

This may indicate a potential opportunity for investors who believe in the company’s growth story and ability to continue delivering strong results.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hims & Hers Health is undervalued by 40.2%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: Hims & Hers Health Price vs Earnings

The Price-to-Earnings (PE) ratio is particularly useful for valuing profitable companies such as Hims & Hers Health, as it relates the company's share price to its earnings per share. This metric helps investors assess how much they are paying for each dollar of the company's profits.

A "normal" or "fair" PE ratio is influenced by expectations for future growth and the level of risk in the company and its industry. In general, higher growth prospects and lower risks tend to justify higher PE ratios. Conversely, lower growth or higher risk calls for lower ratios.

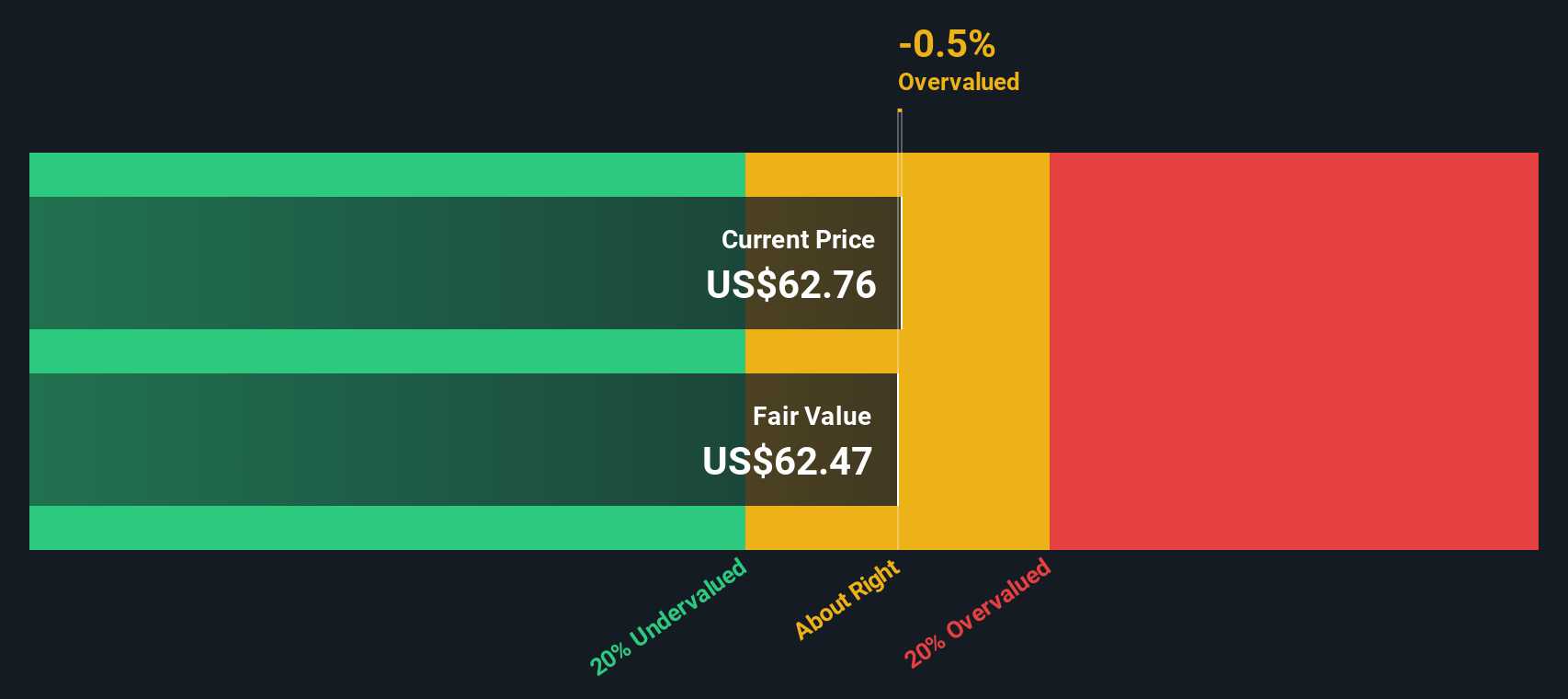

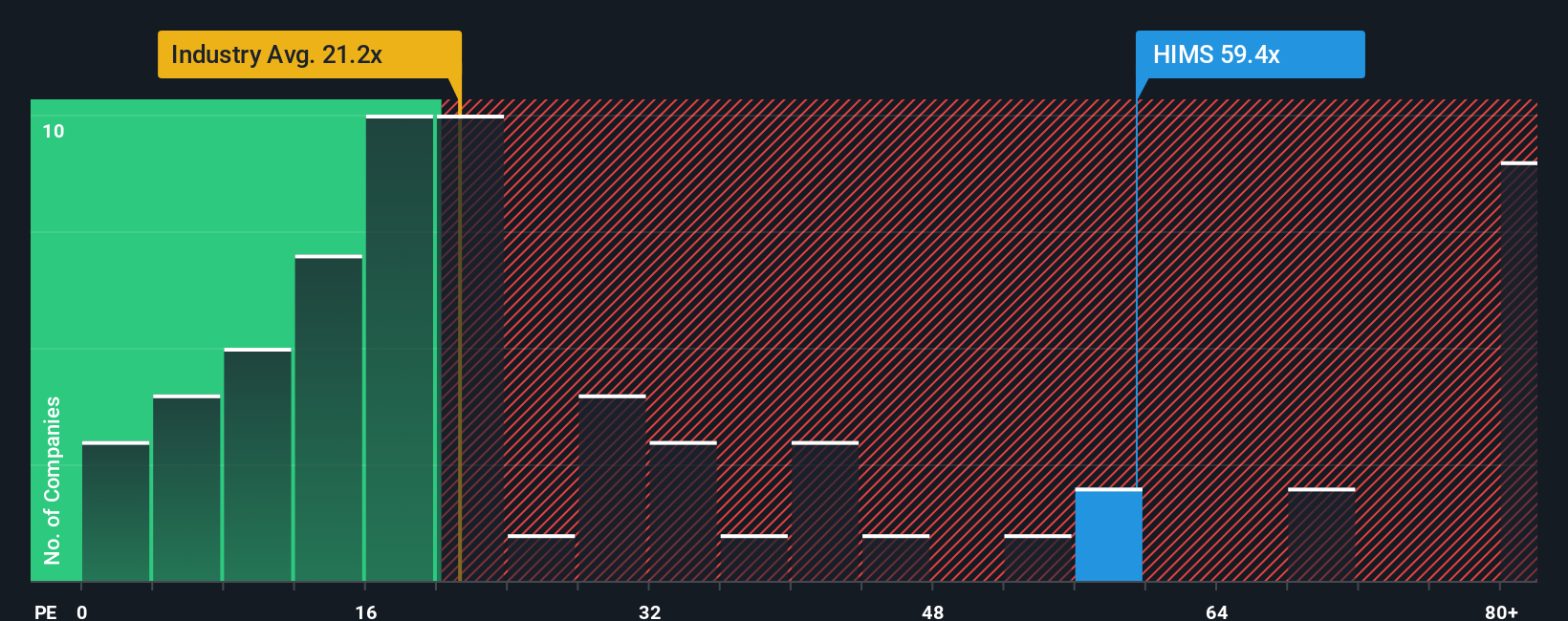

Currently, Hims & Hers Health trades at a PE ratio of 59.1x. For context, the average PE ratio for the healthcare industry is 22.4x, and the average for the company’s peers is 30.1x. On the surface, this suggests Hims & Hers is being valued at a premium compared to its sector and peers.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Hims & Hers Health is currently 45.2x. This figure factors in anticipated earnings growth, profit margins, market cap, risks specific to the business, and how these compare within its industry. Unlike simple peer or industry comparisons, the Fair Ratio provides a tailored benchmark based on a fuller picture of the company’s outlook and profile.

Compared with the Fair Ratio of 45.2x, Hims & Hers Health’s current PE of 59.1x is noticeably higher. This suggests shares are trading at a premium relative to what is justified by their fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1430 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hims & Hers Health Narrative

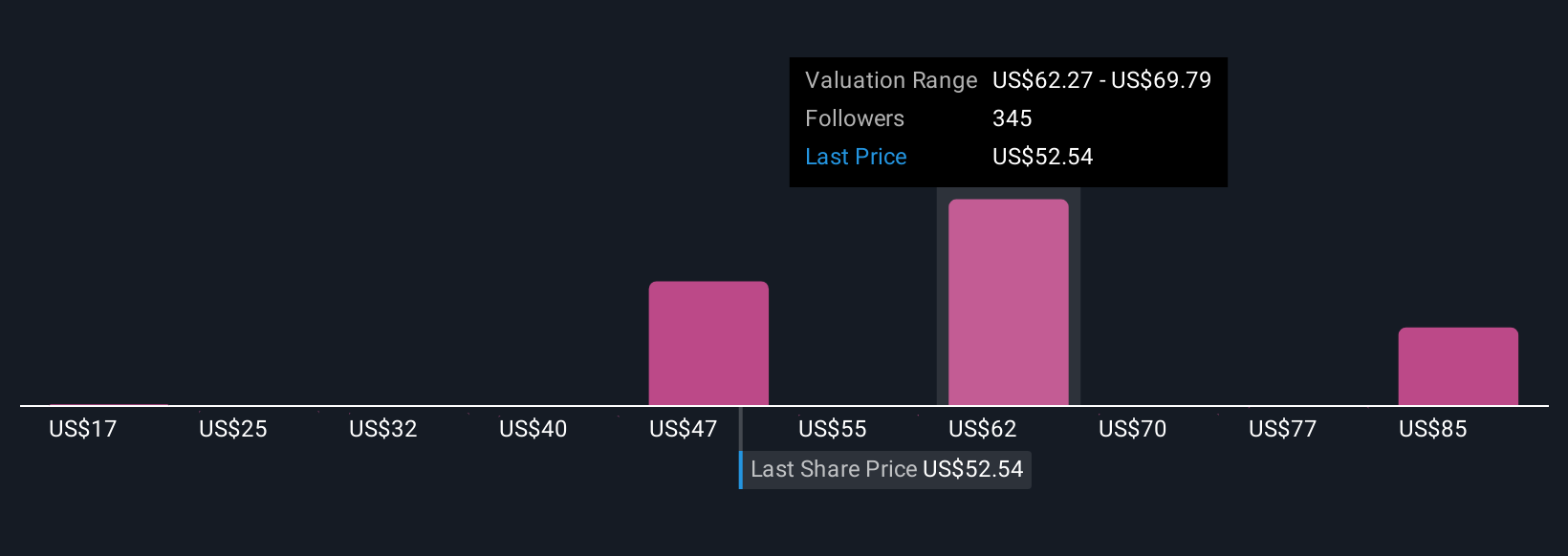

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a smart, approachable tool that let you define your own story about a company by connecting the numbers, such as fair value, revenue and margin forecasts, to your personal perspective on its future.

On Simply Wall St’s Community page, you can create or follow Narratives used by millions of investors. Each Narrative links a company’s unique story with a tailored financial forecast, which then calculates a fair value and shows how that stacks up against the current share price.

Narratives help you spot buy or sell opportunities by making it easy to compare your conviction-driven fair value to what the market is offering right now. When new information comes in, such as earnings updates or news, Narratives quickly update to ensure your story always reflects the latest data.

For example, one Hims & Hers Health Narrative sees the company as a long-term platform leader worth $114 per share, while another sets fair value at just $28, depending on each investor’s assumptions about growth and risk.

Do you think there's more to the story for Hims & Hers Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives