- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

A Fresh Look at Hims & Hers Health (HIMS) Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Hims & Hers Health (HIMS) has captured some investor buzz lately as its stock price has moved over the past month. The company’s shares have seen a 30% drop during this period, raising questions about what could be influencing sentiment for the popular telehealth provider.

See our latest analysis for Hims & Hers Health.

While Hims & Hers Health’s share price just took a sharp dive over the past month, the full story is more nuanced. Momentum has cooled off recently, but the big picture remains impressive, with a one-year total shareholder return of 64% and a staggering 471% gain over three years. These figures hint at underlying growth drivers that continue to shape investor sentiment.

If the recent volatility has you scanning for other opportunities in healthcare, our screener uncovers fresh names that might be worth your attention See the full list for free.

This leaves investors at a crossroads, wondering whether Hims & Hers Health’s recent pullback signals an undervalued opportunity or if the market has already factored in the company’s ambitious growth trajectory.

Most Popular Narrative: 58% Undervalued

According to BlackGoat, the widely followed narrative sees fair value at over three times the current price. This bold outlook is built on Hims & Hers Health's strategy to reinvent healthcare infrastructure at scale, with future-facing ambitions well beyond a traditional telehealth brand.

Hims & Hers Health isn’t a telehealth gimmick or a GLP-1 hype stock; it is quietly becoming the top-of-funnel infrastructure layer for healthcare in the United States. It is executing a strategy similar to Amazon, Spotify, and Costco: deliver more value per dollar spent, reinvest scale advantages, and win via customer-centric efficiency. But unlike those companies, Hims operates in a $4T market that desperately needs reinvention.

Curious what powers such a lofty valuation? The narrative builds on bold growth projections, margin expansion, and a future profit profile rarely seen outside tech giants. Want to see the exact numbers and strategy that justify this price? Dive into the details of this game-changing forecast.

Result: Fair Value of $114 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering regulatory uncertainty and heightened competition from big pharma or tech giants could quickly reshape the future trajectory of Hims & Hers Health.

Find out about the key risks to this Hims & Hers Health narrative.

Another View: Market Ratios Raise Eyebrows

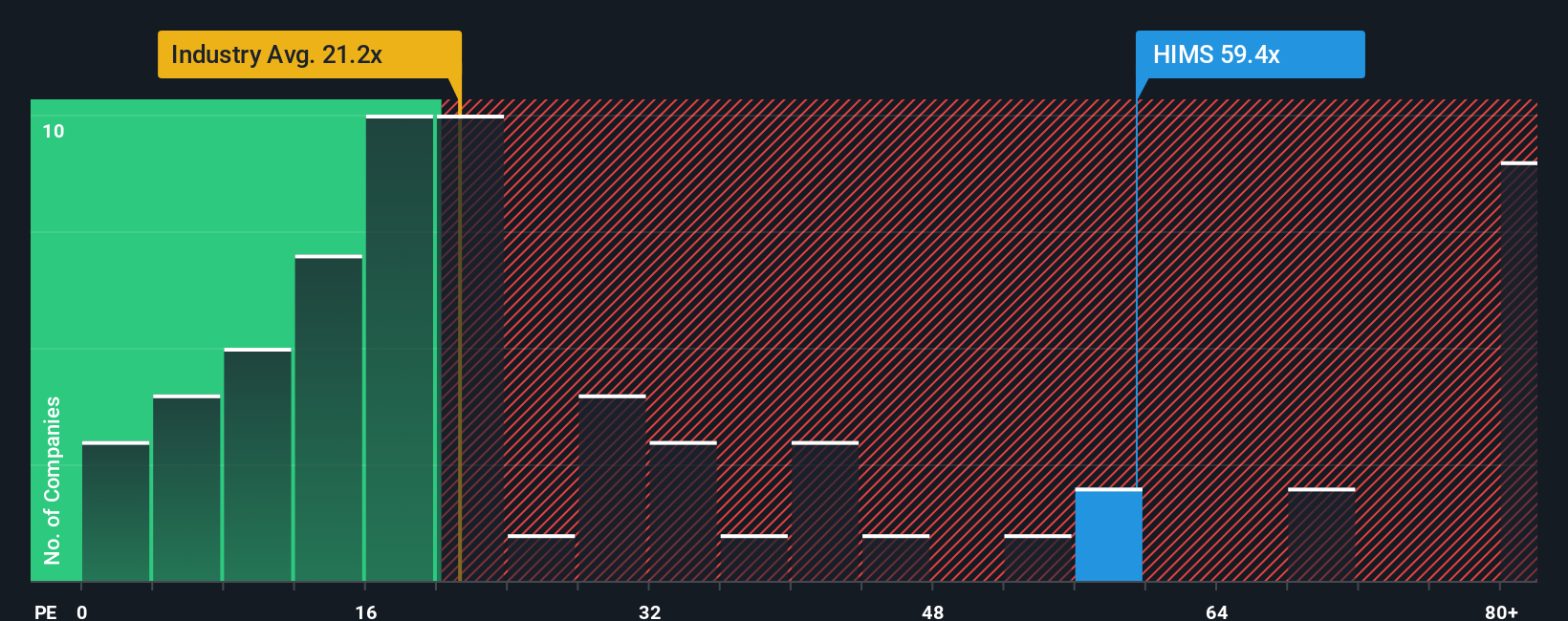

Looking at the market’s preferred earnings ratio, Hims & Hers Health trades at a lofty 61x, far above the healthcare industry average of 21.9x and the peer average of 28.4x. Even in comparison to our fair ratio of 46.2x, the company appears expensive. This suggests the market has high expectations already reflected in the price. Could this premium signal risk for new investors, or does it simply reflect outsized growth potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hims & Hers Health Narrative

If you have a different perspective or want to dig deeper into the numbers, you can create your own Hims & Hers Health narrative in just a few minutes. Your view might spotlight something new: Do it your way

A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

The markets never stand still, and neither should your search for opportunity. Make your next move count with some of the smartest screens on Simply Wall Street.

- Spot game-changing companies shaking up artificial intelligence by checking out these 27 AI penny stocks, which are poised to redefine entire industries.

- Start building income potential when you evaluate these 15 dividend stocks with yields > 3%, which consistently deliver robust yields above 3%.

- Get a head start on tomorrow’s stars by reviewing these 898 undervalued stocks based on cash flows, currently flying under the radar based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives