- United States

- /

- Medical Equipment

- /

- NYSE:GKOS

Why Glaukos (GKOS) Is Up 13.9% After iDose Tops Forecasts and 2025 Outlook Rises

Reviewed by Sasha Jovanovic

- Earlier this month, Glaukos Corporation reported strong third-quarter earnings, with revenue from its iDose medication surpassing Truist Securities' estimates and leading management to raise guidance for 2025; President & COO Joseph E. Gilliam also sold 19,340 shares for US$1.74 million.

- The robust iDose performance and favorable feedback from key opinion leaders prompted several analysts to maintain or lift their Buy ratings, reflecting heightened optimism on the product’s market adoption.

- We’ll explore how Glaukos’ improved 2025 revenue outlook, driven by iDose momentum, could shape its investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Glaukos Investment Narrative Recap

To be a Glaukos shareholder, you need confidence in the continued adoption of iDose and the potential for minimally invasive glaucoma therapies to secure commercial and reimbursement traction. The recent earnings beat and 2025 guidance raise reinforce iDose as the near-term growth driver, the top catalyst for the stock, while competition and future reimbursement decisions remain the most immediate risks; the insider sale by the President & COO does not appear to alter these dynamics in any material way.

Among recent announcements, the FDA approval of Epioxa™ for keratoconus expands Glaukos’ reach beyond glaucoma and signals progress in pipeline diversification. However, the most meaningful short-term factor remains the pace of iDose uptake, which is reflected in recent management guidance upgrades and positive analyst sentiment.

Yet, with enthusiasm rising around iDose, it remains equally important for investors to consider how competitive pressures from other device makers and new entrants could threaten Glaukos’ growth if...

Read the full narrative on Glaukos (it's free!)

Glaukos' outlook anticipates $856.9 million in revenue and $72.3 million in earnings by 2028. This implies a 25.6% annual revenue growth rate and a $165.1 million increase in earnings from the current -$92.8 million.

Uncover how Glaukos' forecasts yield a $120.50 fair value, a 15% upside to its current price.

Exploring Other Perspectives

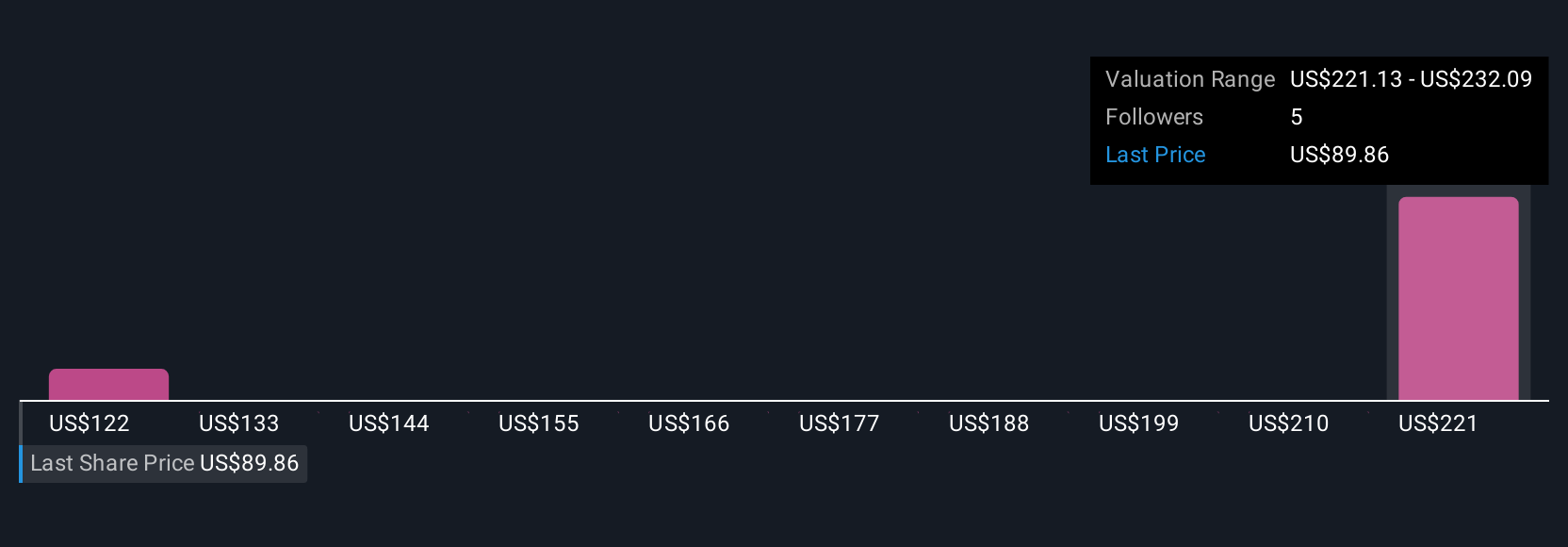

Four private investors in the Simply Wall St Community offered fair value estimates ranging from US$74 to US$310 per share. Against this wide diversity of views, competition from established device makers and new entrants stands out as a critical variable for the company’s performance, so it’s worth weighing these different outlooks side by side.

Explore 4 other fair value estimates on Glaukos - why the stock might be worth 29% less than the current price!

Build Your Own Glaukos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Glaukos research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Glaukos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Glaukos' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GKOS

Glaukos

An ophthalmic pharmaceutical and medical technology company, develops therapies for the treatment of glaucoma, corneal disorders, and retinal diseases in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success