- United States

- /

- Medical Equipment

- /

- NYSE:GKOS

Glaukos (GKOS): Losses Deepen at 14.6% Annual Rate as Bulls Bank on Turnaround Narrative

Reviewed by Simply Wall St

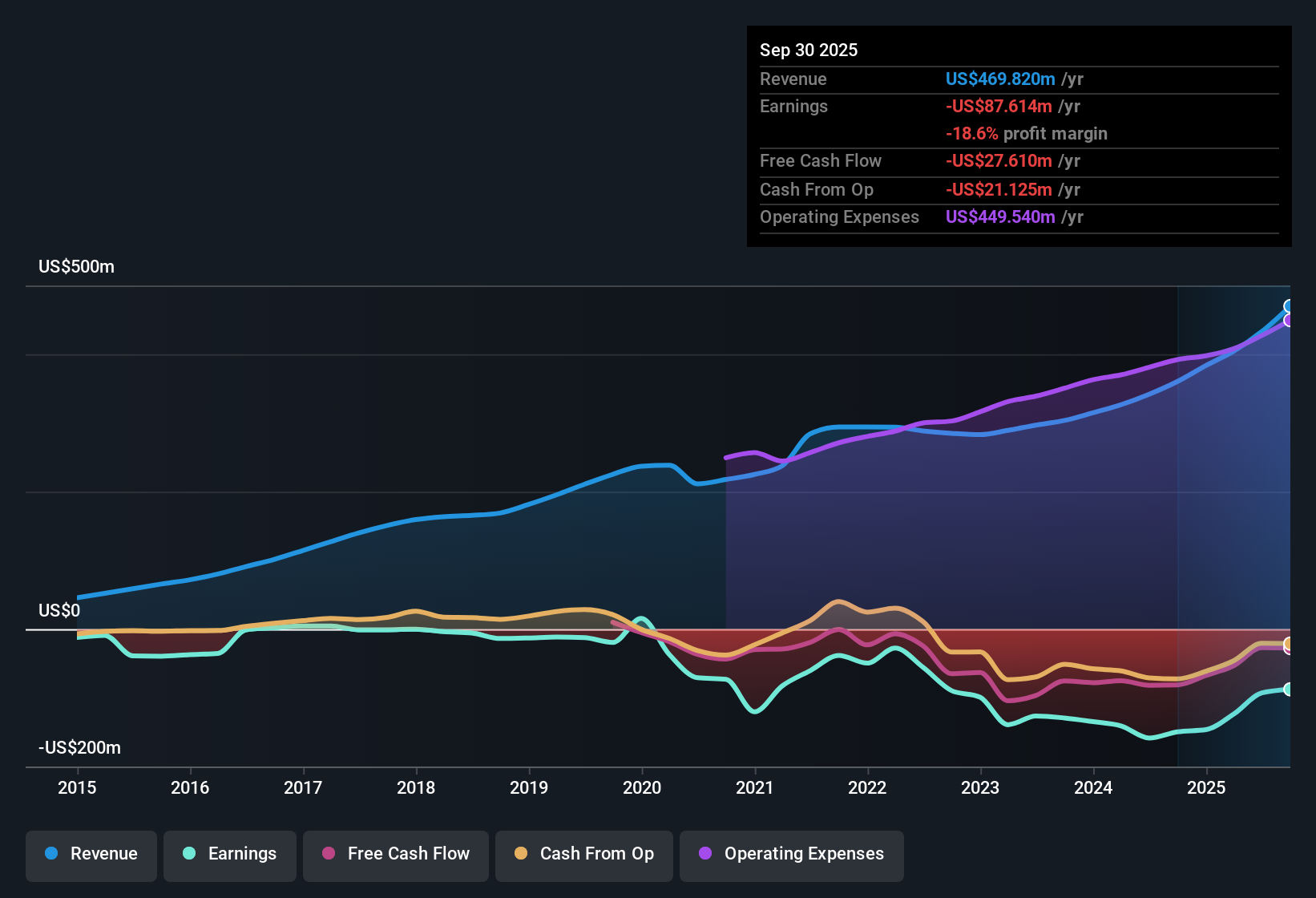

Glaukos (GKOS) remains unprofitable as losses have increased at a rate of 14.6% per year for the past five years, and the company’s net profit margin has shown no sign of improvement. Despite this trend, earnings are forecast to grow 103.58% per year and Glaukos is expected to become profitable within the next three years. Revenue is projected to climb at 20.5% per year, which is well above the US market average of 10.3% per year. The key debate for investors revolves around these strong growth projections set against a backdrop of persistent unprofitability and a premium sales multiple compared to industry peers.

See our full analysis for Glaukos.Next up, we’ll set these headline numbers against the big narratives in the market to see which views get reinforced and where expectations may need a reset.

See what the community is saying about Glaukos

Margin Expansion Forecast: Analysts See -21.4% to 8.4% Swing

- Analysts currently expect Glaukos’ profit margins to increase dramatically from -21.4% today to 8.4% within three years, suggesting a significant turnaround is being priced in.

- According to the analysts' consensus view, these projected margin improvements are underpinned by expectations for increased adoption of higher-margin therapies like iDose TR and progress in securing payer coverage.

- Consensus notes a shift toward minimally invasive, in-office glaucoma procedures that could further accelerate earnings quality and drive greater operational leverage.

- They argue that ongoing international launches, especially in underpenetrated markets, will bolster both top-line growth and operating margins as scale improves.

- The consensus perspective highlights the unusual scope of profitability improvement that analysts now model for Glaukos, emphasizing that the business case relies heavily on these operational and product mix shifts paying off over the next three years.

What could change the outcome? Bulls and bears are closely watching whether these margin forecasts can materialize as Glaukos continues investing in new technologies and global expansion.

📊 Read the full Glaukos Consensus Narrative.

Sales Multiple at 10.7x: Rich Against Industry but Below DCF Fair Value

- Glaukos is trading on a Price-to-Sales Ratio of 10.7x, above both its peer group average of 3.6x and the US medical equipment industry average of 2.8x. However, the current share price of $87.80 sits markedly below its DCF fair value estimate of $234.96.

- Analysts' consensus view underscores this valuation disparity, suggesting investors are paying a significant premium for forecasted high growth and future profitability, rather than today’s results.

- Consensus highlights that the company’s rapid revenue expansion and anticipated margin leverage are expected to justify the elevated multiple, provided Glaukos can deliver on its growth story.

- However, with the stock trading below DCF fair value, consensus also flags that investors expecting eventual catch-up in price may see long-term upside if growth forecasts hold.

Share Count to Rise 4.01% Annually: Dilution or Growth Investment?

- The number of Glaukos shares outstanding is forecast to climb by 4.01% per year over the coming three years, reflecting continued capital raises or incentive plans to fund R&D and expansion.

- Analysts' consensus view frames this as a calculated risk:

- While share dilution can cap per-share returns, consensus expects the capital raised will be channeled into new launches such as Epioxa and international infrastructure, fueling the company’s multi-year growth ambitions.

- Success here is expected to more than offset the downside from dilution, provided that new products and global expansion convert to sustained revenue and profit increases.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Glaukos on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the numbers that others might have missed? Share your unique outlook and shape your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Glaukos.

See What Else Is Out There

Despite Glaukos's forecasted rapid growth, it remains unprofitable, with sustained negative margins, heavy reliance on optimistic projections, and faces above-average dilution risk.

If you want more consistent performance and fewer surprises, focus on companies showing steady expansion and operational stability by using stable growth stocks screener (2113 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GKOS

Glaukos

An ophthalmic pharmaceutical and medical technology company, develops therapies for the treatment of glaucoma, corneal disorders, and retinal diseases in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives