- United States

- /

- Medical Equipment

- /

- NYSE:EW

How Strong Clinical Data and Upbeat Guidance at Edwards Lifesciences (EW) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In the past week, Edwards Lifesciences reported third quarter results with US$1.55 billion in sales, raised its full-year sales growth guidance, announced a transition plan for its CFO, and shared new robust clinical data supporting its mitral and tricuspid valve therapies.

- These clinical milestones, including long-term valve performance and real-world patient outcomes, underpin Edwards' ongoing expansion in transcatheter heart therapies and reinforce its leadership in next-generation cardiovascular treatments.

- We'll examine how these improved clinical results and guidance updates impact Edwards Lifesciences' growth outlook and investment narrative.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Edwards Lifesciences Investment Narrative Recap

Shareholders in Edwards Lifesciences need to believe in the sustained, long-term adoption of transcatheter heart therapies and the company's ability to execute amid evolving clinical standards and competitive market forces. The company's upgraded sales growth guidance and positive clinical data provide support for its case in the near term, but the most important short-term catalyst remains regulatory expansion of TAVR indications, while the primary risk continues to be earnings pressure from tariff impacts, neither of which is materially altered by last week’s news.

Among recent announcements, the presentation of seven-year outcomes from the PARTNER 3 trial stands out, reinforcing the durability and long-term performance of Edwards’ TAVR platform. This matters for investors tracking the crucial TAVR opportunity, as robust clinical validation is key to both physician adoption and regulatory progress, two factors integral to both potential upside and near-term revenue momentum.

In contrast, understanding how the company's exposure to tariffs could affect profit margins in 2026 is something investors should keep in mind if...

Read the full narrative on Edwards Lifesciences (it's free!)

Edwards Lifesciences is projected to reach $7.6 billion in revenue and $1.8 billion in earnings by 2028. This outlook assumes annual revenue growth of 10.0% and an increase in earnings of about $0.4 billion from the current $1.4 billion.

Uncover how Edwards Lifesciences' forecasts yield a $88.83 fair value, a 7% upside to its current price.

Exploring Other Perspectives

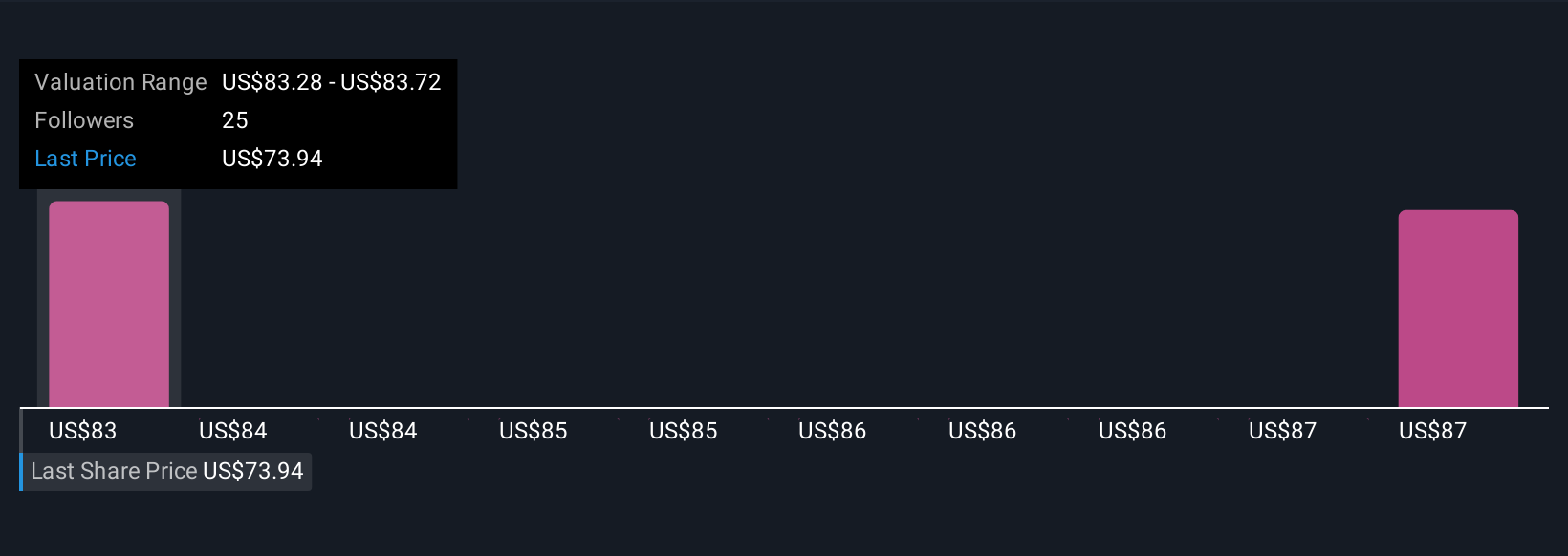

Simply Wall St Community members submitted two fair value estimates for Edwards Lifesciences, ranging from US$81.78 to US$88.83 per share. While opinions vary, recent clinical trial milestones may encourage some to revisit the outlook for TAVR approvals and long-term growth potential.

Explore 2 other fair value estimates on Edwards Lifesciences - why the stock might be worth just $81.78!

Build Your Own Edwards Lifesciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Edwards Lifesciences research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Edwards Lifesciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Edwards Lifesciences' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edwards Lifesciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EW

Edwards Lifesciences

Provides products and technologies to treat advanced cardiovascular diseases in the United States, Europe, Japan, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives