- United States

- /

- Medical Equipment

- /

- NYSE:EW

Edwards Lifesciences (EW): Examining Valuation After Recent Gains and Analyst Target Updates

Reviewed by Simply Wall St

See our latest analysis for Edwards Lifesciences.

Looking at the broader picture, Edwards Lifesciences has built some momentum this year. The company has achieved a 13.6% year-to-date share price return and a solid 22% total shareholder return over the past 12 months, signaling growing investor confidence around its recovery and longer-term outlook.

Curious about which other healthcare stocks are showing fresh momentum? This could be an ideal time to discover See the full list for free.

With Edwards Lifesciences trading just below analyst targets after delivering double-digit gains, investors are left wondering if there is still untapped value in the stock, or if its future growth is already fully reflected in the share price.

Most Popular Narrative: 7% Undervalued

With the fair value set at $88.83 and the last closing price at $82.45, the narrative crowd sees room for further upside. As attention grows, market watchers are dissecting how analyst models justify this valuation gap.

Strategic product launches, like the TAVR approval and EVOQUE, position Edwards for significant revenue growth and expanded market share. Investments in surgical innovation and operational efficiency mitigate financial threats, enhance global therapy adoption, and stabilize earnings.

Curious what ambitious growth assumptions are packed into this narrative? Behind the bullish target lies aggressive forecasts for new therapies, robust global expansion, and profitability improvements. Discover how one underlying margin forecast could make all the difference. Read the full narrative to see what is driving the optimism.

Result: Fair Value of $88.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff impacts and increased competition in key markets remain risks that could challenge Edwards Lifesciences' current growth and valuation expectations.

Find out about the key risks to this Edwards Lifesciences narrative.

Another View: Multiples Paint a Different Picture

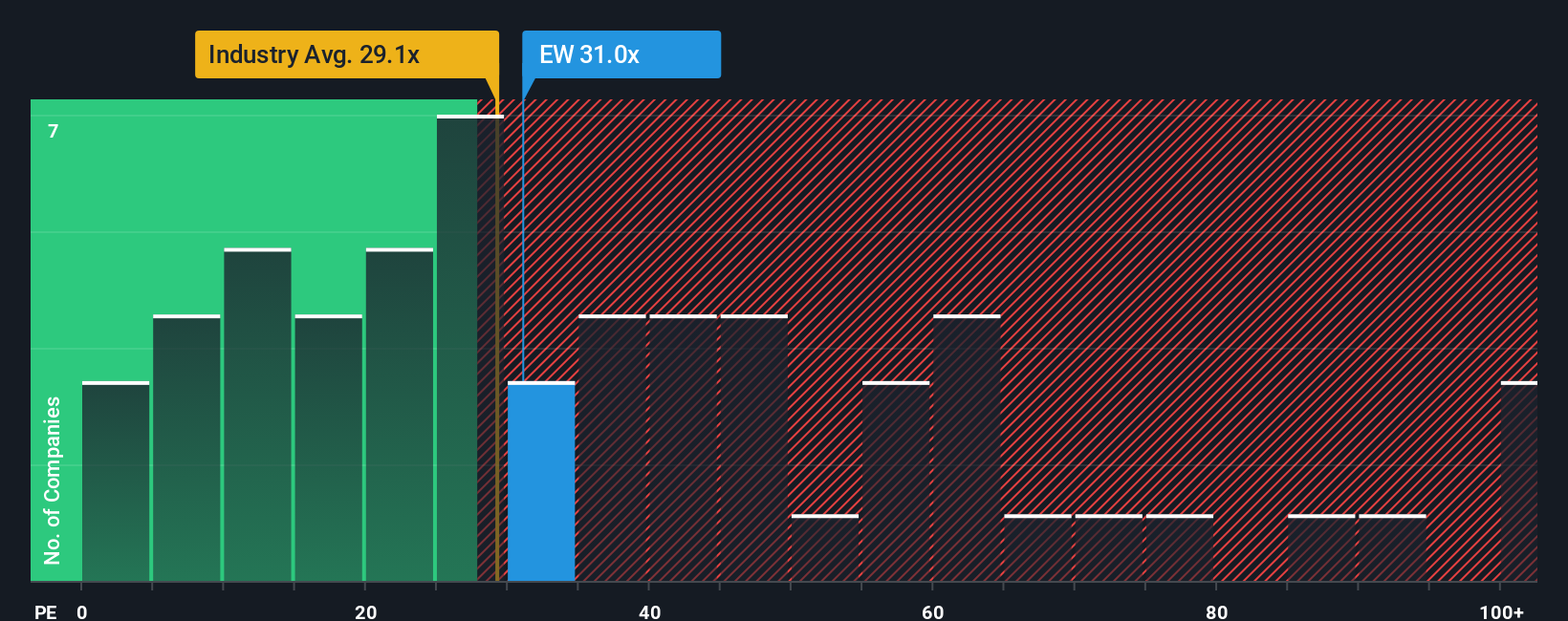

While our fair value estimate suggests Edwards Lifesciences is undervalued, a look at its price-to-earnings ratio offers a different story. The company trades at 36.1 times earnings, which is above its peers (31x) and the US Medical Equipment industry average (27.7x). It is also well above the fair ratio of 28.9x, implying the stock is priced for robust growth. Does this premium signal conviction or leave investors exposed if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Edwards Lifesciences Narrative

Want to take a different angle or dig deeper yourself? It only takes a few minutes to explore the numbers and shape your own market story. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Edwards Lifesciences.

Looking for More Smart Investment Ideas?

Give yourself the edge by targeting stocks that align with today’s megatrends and market opportunities. Missing these could mean passing up tomorrow’s big winners.

- Tap into powerful growth by uncovering these 26 AI penny stocks fueling breakthroughs in AI-driven industries and technology sectors that are transforming how businesses compete.

- Capture reliable income streams when you browse these 22 dividend stocks with yields > 3%, featuring solid companies delivering attractive yields above 3% for your portfolio.

- Ride the innovation wave and gain early exposure to tomorrow’s leaders with these 81 cryptocurrency and blockchain stocks revolutionizing finance through blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edwards Lifesciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EW

Edwards Lifesciences

Provides products and technologies to treat advanced cardiovascular diseases in the United States, Europe, Japan, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives