- United States

- /

- Medical Equipment

- /

- NYSE:ENOV

Leadership Restructuring at Enovis (ENOV) Might Change the Case for Investing in the Company

Reviewed by Sasha Jovanovic

- On November 7, 2025, Daniel A. Pryor stepped down as Executive Vice President, Strategy and Business Development at Enovis, with his position eliminated as part of a broader management restructuring; he will remain as an advisor through March 31, 2026.

- This change signals a significant shift in senior leadership responsibilities and could affect the company's approach to strategy and business development in the foreseeable future.

- We'll explore how the realignment of executive leadership roles may influence Enovis's trajectory and forward-looking investment considerations.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Enovis Investment Narrative Recap

To own shares in Enovis, you need confidence in its ability to rejuvenate growth through innovation, market expansion, and operational discipline, all while overcoming persistent losses and integration hurdles. The recent elimination of a senior strategy role and executive transition appears immaterial to the most critical short-term catalyst: the successful integration and synergy realization from the Lima acquisition. The main risk, ongoing operational inefficiencies tied to rapid M&A, remains firmly in focus as management continues realignment.

One of the most relevant recent developments is the downward revision of corporate revenue guidance for 2025, announced on November 6th. This update, coming just before the executive restructure, underscores the near-term pressure on growth catalysts and highlights the urgency of effective transition and synergy capture as Enovis seeks to offset earnings headwinds and restore profitability.

But while investors may see stability in one area, the challenge of integrating more than ten acquisitions in three years is an issue you should be aware of...

Read the full narrative on Enovis (it's free!)

Enovis is projected to reach $2.6 billion in revenue and $329.3 million in earnings by 2028. This outlook assumes annual revenue growth of 6.4% and a $1.16 billion increase in earnings from the current loss of $-830.0 million.

Uncover how Enovis' forecasts yield a $49.67 fair value, a 73% upside to its current price.

Exploring Other Perspectives

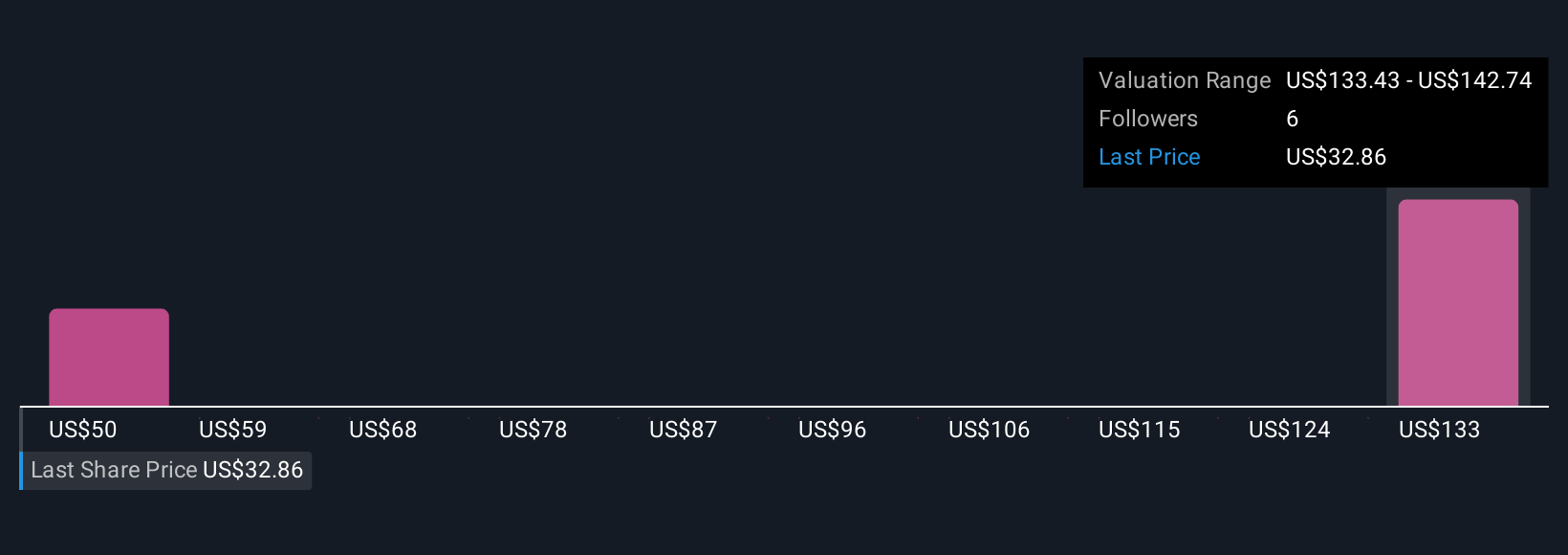

Simply Wall St Community users provided two fair value estimates for Enovis ranging from US$49.67 to US$130.37 per share. Opinions vary widely, especially as ongoing integration challenges in recent acquisitions may add to the company’s operational risk profile and earnings volatility.

Explore 2 other fair value estimates on Enovis - why the stock might be worth just $49.67!

Build Your Own Enovis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enovis research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Enovis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enovis' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enovis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENOV

Enovis

Operates as a medical technology company focus on developing clinically differentiated solutions in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives