- United States

- /

- Healthcare Services

- /

- NYSE:EHC

How Will the New Amarillo Rehabilitation Hospital Shape Encompass Health’s Expansion Plans (EHC)?

Reviewed by Sasha Jovanovic

- BSA Health System and Encompass Health recently opened the 50-bed Rehabilitation Hospital of Amarillo, providing comprehensive inpatient rehabilitation services for patients recovering from strokes, brain injuries, spinal cord injuries, amputations, and complex orthopedic conditions.

- This hospital features advanced rehabilitation technologies, a therapy courtyard, and individualized care plans, addressing significant needs in the Amarillo region's post-acute care landscape.

- We'll explore how this new hospital opening through a partnership could support Encompass Health's expansion strategy and market positioning.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Encompass Health Investment Narrative Recap

To own a piece of Encompass Health, investors need to believe in sustained demand for inpatient rehabilitation, driven by an aging population and a persistent shortage of beds. The recent Amarillo opening strengthens Encompass Health’s expansion strategy and supports its largest short-term growth catalyst, a robust pipeline of hospital launches, though its impact on risks such as labor shortages is not material at this stage.

Among recent company announcements, the hospital opening in St. Petersburg, Florida, closely parallels the Amarillo launch in scale and patient focus, underscoring Encompass Health’s commitment to expanding access in underserved markets. Both announcements directly reflect ongoing investments in facility growth, which analysts identify as a key driver of future revenue and market share for the company.

By contrast, investors should also be mindful that persistent labor market pressures could still challenge Encompass Health’s ability to...

Read the full narrative on Encompass Health (it's free!)

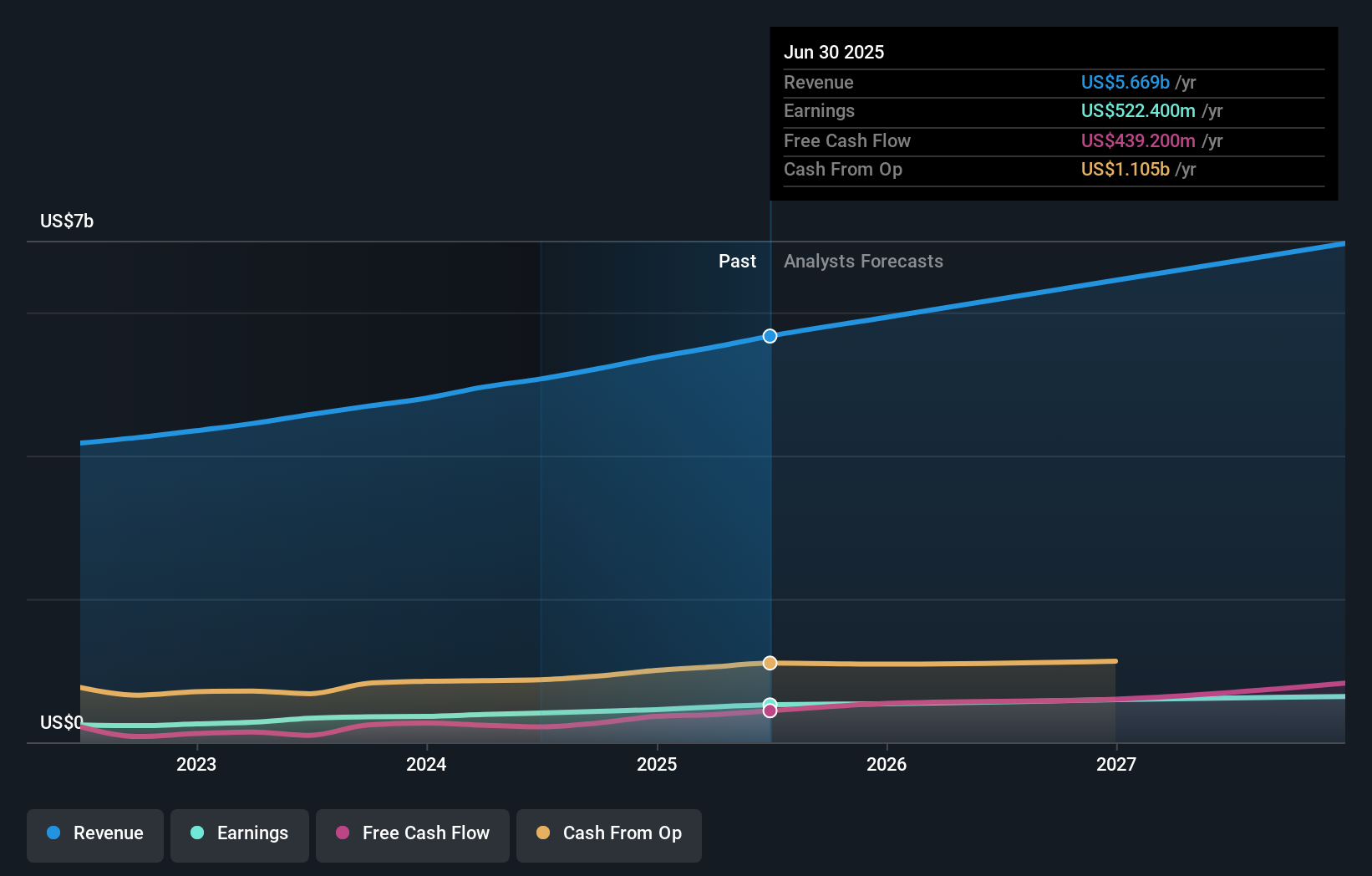

Encompass Health is projected to reach $7.2 billion in revenue and $711.6 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 8.1% and an earnings increase of approximately $189 million from current earnings of $522.4 million.

Uncover how Encompass Health's forecasts yield a $140.33 fair value, a 25% upside to its current price.

Exploring Other Perspectives

All two fair value estimates from the Simply Wall St Community cluster at US$140.33 per share, pointing to agreement but limited range of opinion. With management executing on new hospital builds, future investor outlooks may shift as these expansion efforts interact with broader industry risks and potential rewards.

Explore 2 other fair value estimates on Encompass Health - why the stock might be worth as much as 25% more than the current price!

Build Your Own Encompass Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Encompass Health research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Encompass Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Encompass Health's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Encompass Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EHC

Encompass Health

Provides post-acute healthcare services in the United States and Puerto Rico.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives