- United States

- /

- Healthcare Services

- /

- NYSE:EHAB

Enhabit (EHAB): Widening Losses Challenge Bullish Profitability Narrative Despite Deep Share Discount

Reviewed by Simply Wall St

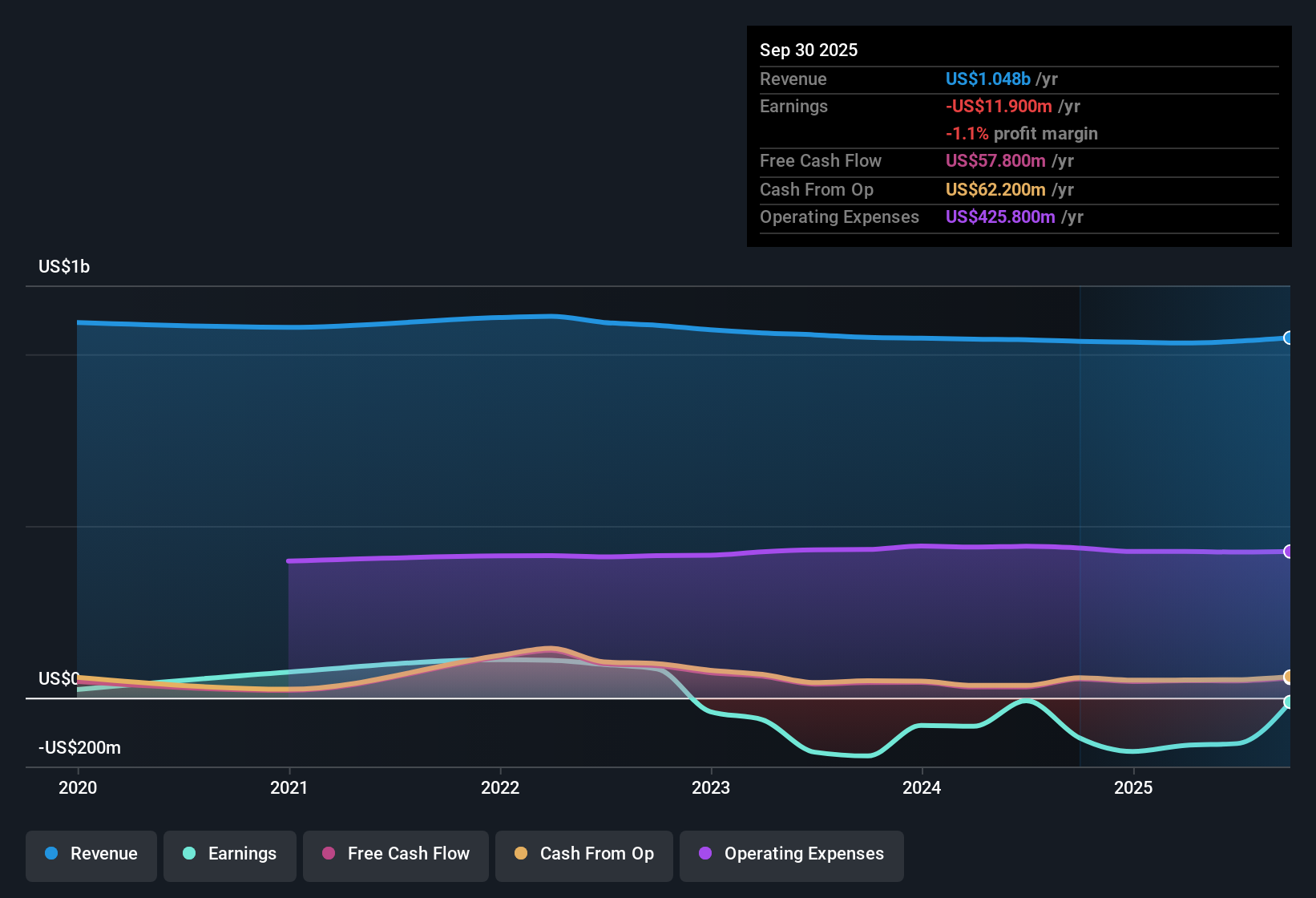

Enhabit (EHAB) has posted increasing losses over the last five years, with annual losses expanding at a rate of 55.2%. Revenue is expected to grow at 5.5% per year, which trails the 10.4% annual growth forecast for the broader US market. Despite these ongoing losses, EHAB is projected to turn profitable within the next three years. Earnings are forecast to grow at 15.3% annually.

See our full analysis for Enhabit.Next, let’s see how these latest figures compare to the narratives commonly discussed among investors, and whether the results are shifting the story on EHAB.

See what the community is saying about Enhabit

Profit Margins Set to Recover

- Analysts expect Enhabit's profit margins to move up from -12.8% today to 1.8% in three years, marking a shift toward profitability after several years of expanding losses.

- Analysts' consensus view spotlights how margin expansion could hinge on factors such as successful payer contract renegotiations and new technology investments.

- The consensus narrative notes that margin improvement is fueled by a recent large national payer contract resulting in a low-double-digit per-visit rate increase. Further upgrades to value-based models are expected to boost stability.

- Offsetting these gains, reimbursement cuts and higher labor costs remain persistent threats that could undermine the path to stable margins, indicating that execution on both rates and productivity will be critical.

See how demographic tailwinds and strategic moves could affect Enhabit’s earnings story in the full Consensus Narrative. 📊 Read the full Enhabit Consensus Narrative.

Hospice Segment Drives Expansion

- Enhabit's continued focus on its hospice business, including disciplined openings in high-potential markets, provides operating leverage and an ongoing catalyst for margin and earnings growth.

- According to the analysts' consensus view, the robust growth in hospice is expected to provide a counterbalance to the reimbursement pressures in home health.

- The consensus narrative credits the hospice segment’s organic expansion and increased utilization as helping to anchor overall revenue and margin stability, even as broader costs rise.

- However, sustained inflation and competitive labor markets could still create headwinds, making successful expansion vital to maintaining the company’s financial footing.

Shares Trade Well Below DCF Fair Value

- Enhabit’s current share price of $7.71 is markedly lower than its DCF fair value of $37.94, and its price-to-sales ratio of 0.4x remains far below both the industry average of 1.3x and peer average of 2x.

- The analysts' consensus narrative frames this valuation gap as a key point for investors who believe the company will reach forecast targets.

- The consensus narrative highlights that achieving analyst price targets depends on Enhabit growing revenue to $1.2 billion and earnings to $22.3 million by 2028. Future profitability is implicitly reflected in today’s discount.

- This creates tension: the upside is significant if profitability materializes, but the steep discount signals lingering skepticism about Enhabit’s ability to deliver sustained growth amid industry pressures.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Enhabit on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different angle on the data? In just a few minutes, you can shape your own unique view of the numbers. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Enhabit.

See What Else Is Out There

Despite the potential for profitability, Enhabit faces ongoing margin pressures, below-average revenue growth, and persistent skepticism about its ability to deliver consistent expansion.

If steady, reliable progress matters to you, discover stronger performers backed by consistent results by starting with stable growth stocks screener (2078 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enhabit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EHAB

Very undervalued with moderate growth potential.

Market Insights

Community Narratives