- United States

- /

- Healthtech

- /

- NYSE:DOCS

Doximity (DOCS): Assessing Valuation After Upbeat Q2 2026 Earnings and Upgraded Guidance

Reviewed by Simply Wall St

Doximity (DOCS) delivered fiscal Q2 2026 results that turned heads, with revenue jumping 23% year-over-year and notable EBITDA growth. The company also increased its annual revenue forecast, which exceeded Wall Street’s estimates.

See our latest analysis for Doximity.

After this upbeat earnings report, Doximity’s 1-day share price return jumped 2.24%, and the 7-day return is up 7.7% following a surge in investor confidence. However, challenging market conditions have weighed on the stock’s 30- and 90-day performance, reflecting a loss of momentum in the short term. Looking further out, total shareholder return over three years remains an impressive 58.9%, which underscores the company’s strong long-term growth story.

If Doximity’s recent momentum has you curious, now is a great opportunity to discover other healthcare innovators with our See the full list for free..

With Doximity’s new guidance and analyst optimism fueling renewed interest, the question now becomes clear: is there untapped value in the stock at current prices, or has the market already accounted for its future growth potential?

Most Popular Narrative: 28.2% Undervalued

Doximity’s most closely followed valuation narrative pegs its fair value well above the latest closing price of $51.07, even as the market remains hesitant. The narrative draws on forward-looking projections, suggesting recent momentum is just one piece of a larger story unfolding behind the scenes.

The expanded adoption of AI-powered workflow tools (Scribe, Doximity GPT, and Pathway AI) is expected to further entrench Doximity as a core clinician productivity suite. This could drive higher frequency of platform use, deeper customer retention, and ultimately higher average revenue per user (ARPU) over time, supporting long-term revenue and margin expansion.

Want to know what’s fueling this sharp disconnect between price and value? The narrative hinges on bullish projections of user engagement, premium revenue per user, and bold margin targets. Which forecasts are moving the needle? Find out which figures could flip the script on valuation expectations.

Result: Fair Value of $71.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Doximity’s growth story could face hurdles if provider adoption plateaus or if regulatory changes disrupt pharmaceutical marketing spend in key channels.

Find out about the key risks to this Doximity narrative.

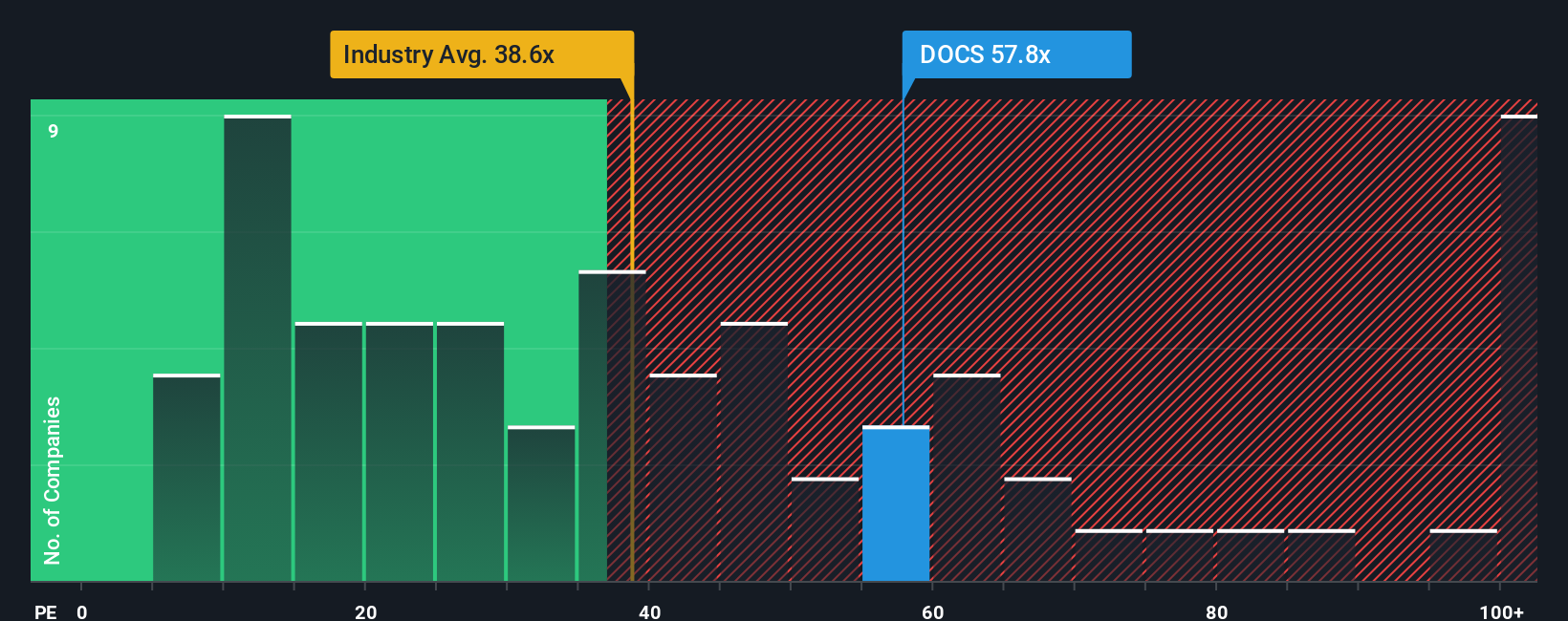

Another View: Price-to-Earnings Perspective

Looking through the lens of price-to-earnings, Doximity trades at 38x earnings, a premium above the global healthcare services average of 35.2x, and well above its fair ratio of 25.1x. While the stock looks reasonable compared to its direct peers (68.2x), this premium signals that the market might be pricing in strong future growth. Is this optimism justified, or a sign to tread carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Doximity Narrative

If you see things differently or want to dig into the numbers on your own, building your own Doximity case is quick and straightforward. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Doximity.

Looking for More Investment Ideas?

Why limit yourself to one stock when there are countless other opportunities just waiting to be uncovered? Don’t miss your shot to strengthen your portfolio with ideas tailored to powerful market trends.

- Capture high yields and protect your income by checking out these 14 dividend stocks with yields > 3%, which includes stocks with standout dividend potential and sustainable payouts.

- Tap into the next wave of healthcare innovation with these 30 healthcare AI stocks, featuring pioneers using artificial intelligence to transform patient outcomes and drive growth.

- Fuel your strategy with growth stories by targeting these 3584 penny stocks with strong financials, combining strong financials with significant potential and a track record of resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCS

Doximity

Operates as a digital platform for medical professionals in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success