- United States

- /

- Healthtech

- /

- NYSE:DOCS

Can Doximity’s (DOCS) Share Buybacks and Earnings Strength Tell Us More About Its Growth Vision?

Reviewed by Sasha Jovanovic

- Doximity, Inc. recently reported its second quarter and six-month earnings for the period ended September 30, 2025, highlighting sales of US$168.53 million and net income of US$62.06 million for the quarter, both up from the same period last year, along with updated revenue guidance for the upcoming quarter and fiscal year.

- The company also completed a tranche of its share repurchase program, which may indicate management's confidence in Doximity's long-term prospects.

- We'll examine how Doximity's improved quarterly profits and updated revenue guidance influence its future growth outlook and investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Doximity Investment Narrative Recap

To be a Doximity shareholder, you likely believe that the company's platform is essential for clinicians and will become even more entrenched as it expands its AI-powered productivity tools. The recent strong quarterly results and raised revenue guidance are meaningful for the short-term growth narrative but do not materially reduce the key risk of Doximity's dependence on pharmaceutical marketing budgets, which remain vulnerable to regulatory changes.

Among the recent company updates, the share repurchase program stands out in this context. While it reflects active capital management, it does not directly address either the upside associated with AI adoption or the primary risk of regulatory disruption to pharma marketing spend, which still looms over near-term catalysts and longer-term sustainability.

However, investors should be aware that despite solid quarterly growth, the ongoing concentration risk tied to pharma budgets could...

Read the full narrative on Doximity (it's free!)

Doximity's outlook anticipates $805.8 million in revenue and $280.5 million in earnings by 2028. This is based on analysts' forecasts of 11.0% annual revenue growth and a $45.4 million increase in earnings from the current $235.1 million.

Uncover how Doximity's forecasts yield a $71.11 fair value, a 48% upside to its current price.

Exploring Other Perspectives

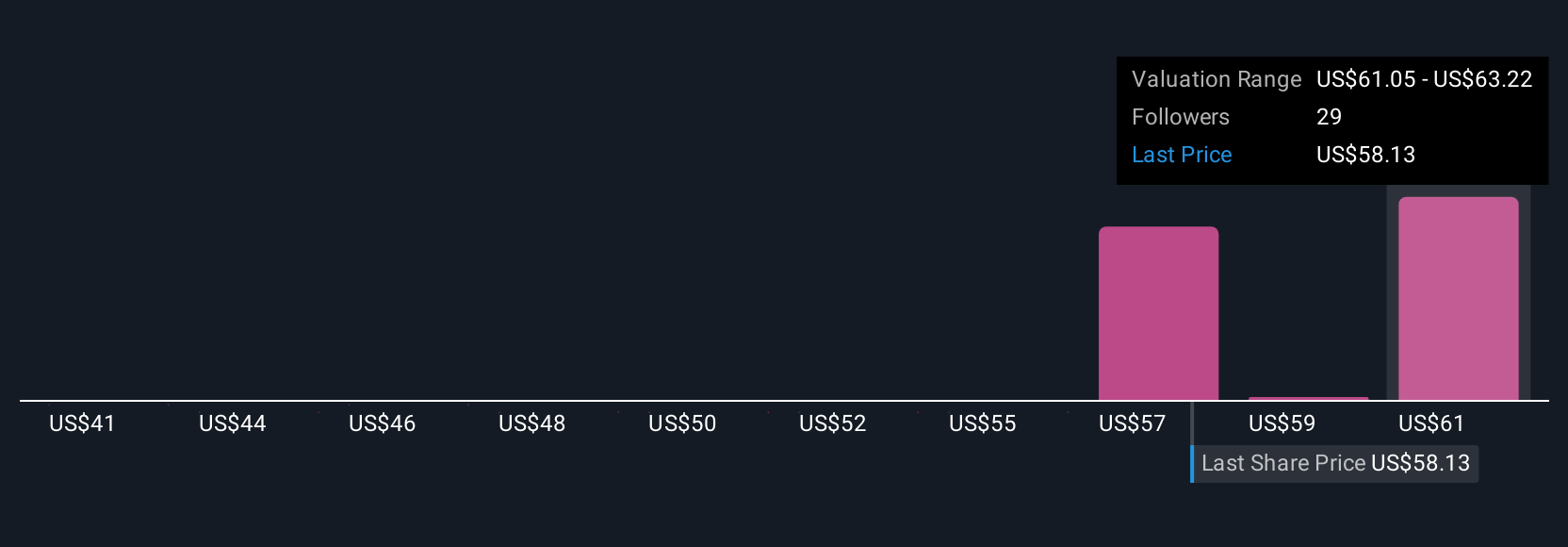

Simply Wall St Community members provided seven different fair value estimates for Doximity, spanning from US$41.46 to US$78.58. As these opinions differ widely, remember that the company's reliance on pharma marketing spend is still a key risk impacting future performance and is worth weighing alongside other viewpoints.

Explore 7 other fair value estimates on Doximity - why the stock might be worth 14% less than the current price!

Build Your Own Doximity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Doximity research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Doximity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Doximity's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCS

Doximity

Operates as a digital platform for medical professionals in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives