- United States

- /

- Healthcare Services

- /

- NYSE:DGX

The Bull Case For Quest Diagnostics (DGX) Could Change Following New Alzheimer's Blood Test Validation Study

Reviewed by Sasha Jovanovic

- Quest Diagnostics recently announced that two of its blood tests, each using multiple biomarkers, showed high accuracy in identifying Alzheimer's disease pathology in symptomatic patients, according to a study in Neurology® Clinical Practice.

- This advancement could enable diagnosis of Alzheimer's without invasive follow-up procedures, potentially aligning with key industry guidelines for confirmatory testing.

- We'll explore how the Alzheimer's test validation may influence Quest Diagnostics' outlook and its potential to shape the investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Quest Diagnostics Investment Narrative Recap

To own shares of Quest Diagnostics, an investor would need confidence in the continued expansion of advanced diagnostic testing and the company's ability to drive volume and margin growth through innovation and operational scale. The recent Alzheimer's blood test announcement could fuel optimism around Quest’s product pipeline and support near-term sentiment, but its effect on the most pressing catalyst, volume growth from new and recurring tests, is likely to be gradual. The principal risk remains reimbursement pressure from government-driven payment changes, which poses a direct challenge to margins.

Of the recent announcements, the company’s updated earnings results stand out: strong year-over-year sales and net income growth may offer reassurance as investors weigh emerging products like the Alzheimer’s blood test. While progress in product innovation could support long-term growth, quarterly results are still the most direct barometer for assessing whether anticipated demand shifts are materializing. Yet, it is important for investors to remember that where strong quarters can boost confidence, exposure to reimbursement changes could quickly alter the outlook if...

Read the full narrative on Quest Diagnostics (it's free!)

Quest Diagnostics' outlook forecasts $11.9 billion in revenue and $1.3 billion in earnings by 2028. This assumes a 4.1% annual revenue growth rate and a $355 million increase in earnings from the current $945 million.

Uncover how Quest Diagnostics' forecasts yield a $191.56 fair value, a 9% upside to its current price.

Exploring Other Perspectives

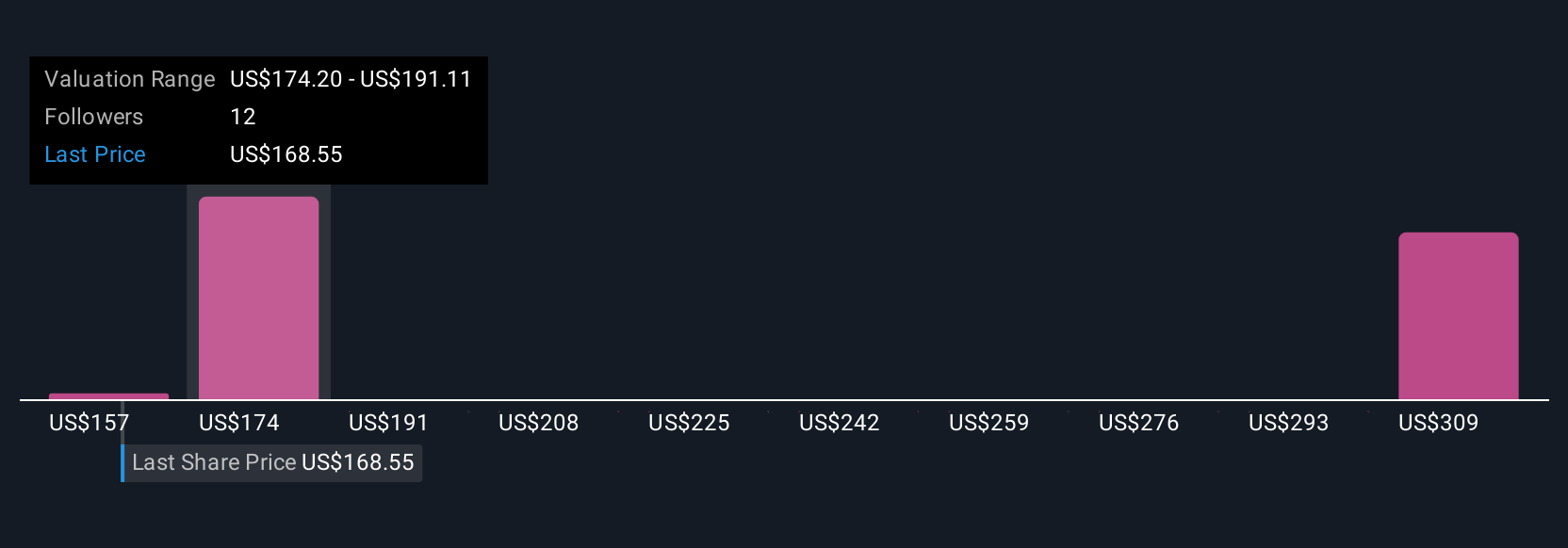

Simply Wall St Community members have shared three fair value estimates for Quest Diagnostics ranging from US$157.30 to US$327.64 per share. While opinions differ, the ongoing shift toward advanced preventive testing remains a significant factor for the company’s future opportunities, your own perspective is essential in weighing these diverse views.

Explore 3 other fair value estimates on Quest Diagnostics - why the stock might be worth as much as 86% more than the current price!

Build Your Own Quest Diagnostics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quest Diagnostics research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Quest Diagnostics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quest Diagnostics' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quest Diagnostics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DGX

Quest Diagnostics

Provides diagnostic testing and services in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives