- United States

- /

- Healthcare Services

- /

- NYSE:DGX

The Bull Case For Quest Diagnostics (DGX) Could Change Following Upbeat Guidance and Corewell Joint Venture — Learn Why

Reviewed by Sasha Jovanovic

- Quest Diagnostics reported strong third-quarter results, raising its full-year 2025 guidance to net revenues of US$10.96–11.00 billion and announcing a joint venture with Corewell Health expected to generate roughly US$1 billion annually next year.

- These developments highlight a combination of robust organic growth, increased test volumes, and a focus on expanding clinical partnerships to support future performance.

- We will explore how management’s upward revenue guidance revision and new Corewell Health partnership could impact Quest Diagnostics’ investment narrative going forward.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Quest Diagnostics Investment Narrative Recap

To be a Quest Diagnostics shareholder, you need to believe in the company’s ability to drive sustained growth through rising test volumes, recurring preventive testing, and innovation despite ever-present healthcare pricing pressures. The latest quarterly results reinforce organic growth and expanding clinical partnerships, but attention remains on evolving U.S. healthcare reimbursement policies, which still represent the biggest short-term catalyst and risk. The impact of the recent news on these factors is notable but does not materially change the underlying equation.

Among recent corporate actions, Quest’s new joint venture with Corewell Health stands out for its potential to accelerate patient volume growth and strengthen health system partnerships. This aligns closely with the near-term catalysts underpinning Quest’s updated revenue outlook and underscores management’s focus on long-term collaboration across the clinical testing sector.

However, in contrast to the growth story, investors should be aware of ongoing risks from policy changes and pricing headwinds, particularly those stemming from...

Read the full narrative on Quest Diagnostics (it's free!)

Quest Diagnostics is projected to reach $11.9 billion in revenue and $1.3 billion in earnings by 2028. This outlook relies on annual revenue growth of 4.1% and an earnings increase of $355 million from the current $945 million.

Uncover how Quest Diagnostics' forecasts yield a $191.56 fair value, a 5% upside to its current price.

Exploring Other Perspectives

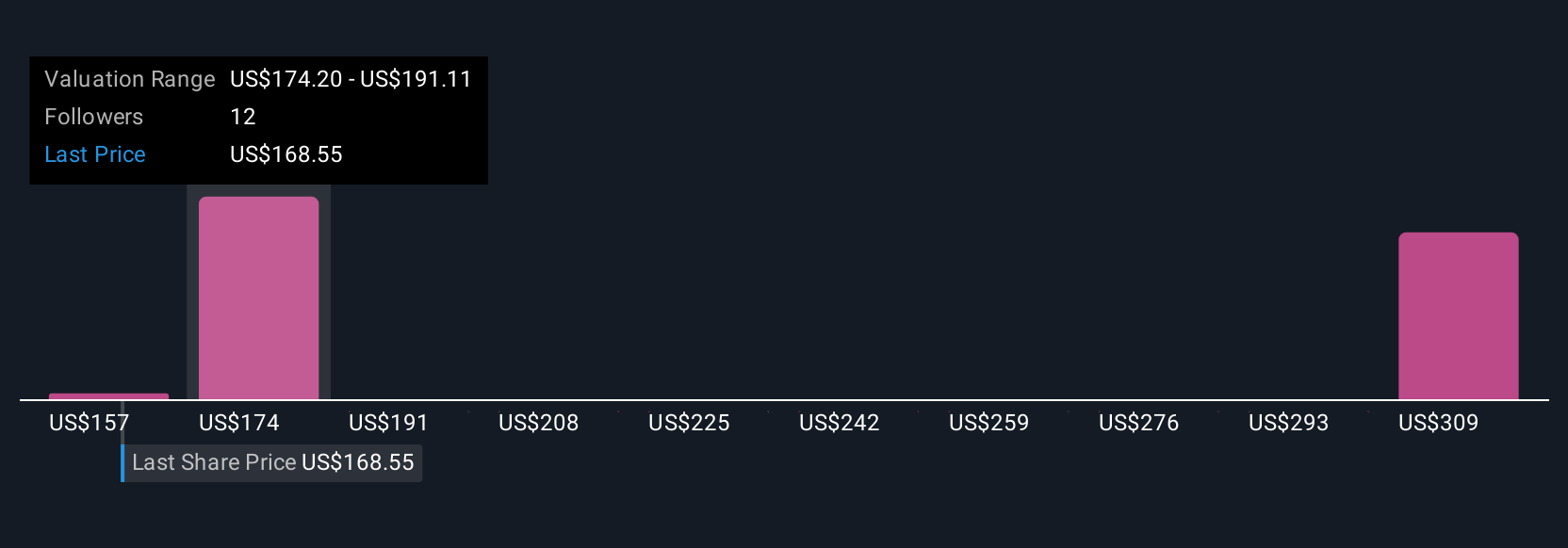

Fair value estimates from the Simply Wall St Community vary widely, from US$157.30 to US$309.54, based on three distinct viewpoints. While opinions differ, ongoing concerns about healthcare policy and reimbursement changes could shape future expectations for Quest Diagnostics’ performance, highlighting the importance of reviewing a broad range of community insights.

Explore 3 other fair value estimates on Quest Diagnostics - why the stock might be worth as much as 69% more than the current price!

Build Your Own Quest Diagnostics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quest Diagnostics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Quest Diagnostics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quest Diagnostics' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quest Diagnostics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DGX

Quest Diagnostics

Provides diagnostic testing and services in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives