- United States

- /

- Healthcare Services

- /

- NYSE:COR

Does Cencora’s Latest Acquisition Signal More Upside After a 51.7% 2025 Rally?

Reviewed by Bailey Pemberton

- Ever wondered if Cencora is offering fair value or if there's hidden upside waiting to be discovered? You're in the right place for a deep dive into what the numbers and the market are really telling us.

- The stock has been on a tear lately, leaping 12.6% over the past month and racking up an impressive 51.7% gain year to date, with a standout 47.0% return over the last year.

- Investors have been buzzing after Cencora announced its acquisition of a specialty distribution business, fueling optimism about future revenue streams and hinting at fresh strategic momentum. This move aligns with their recent expansion initiatives and helps explain some of the positive shift in market sentiment.

- All this excitement aside, Cencora scores just 2 out of 6 on our undervaluation checks, so let's break down the numbers with both classic and alternative valuation tools, then reveal a smarter way to gauge value at the close of this article.

Cencora scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cencora Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future cash flows, then discounts those expected amounts back to the present to estimate what the business is truly worth today. This approach helps investors look past current sentiment and instead focus on fundamental cash generation potential.

For Cencora, the latest trailing twelve months Free Cash Flow stands at $1.17 Billion. According to analyst forecasts, this figure is expected to rise steadily. Five-year projections show growth to $4.59 Billion by 2029. While analyst coverage drops off beyond this point, Simply Wall St extrapolates further and estimates continued expansion in free cash generation through 2035.

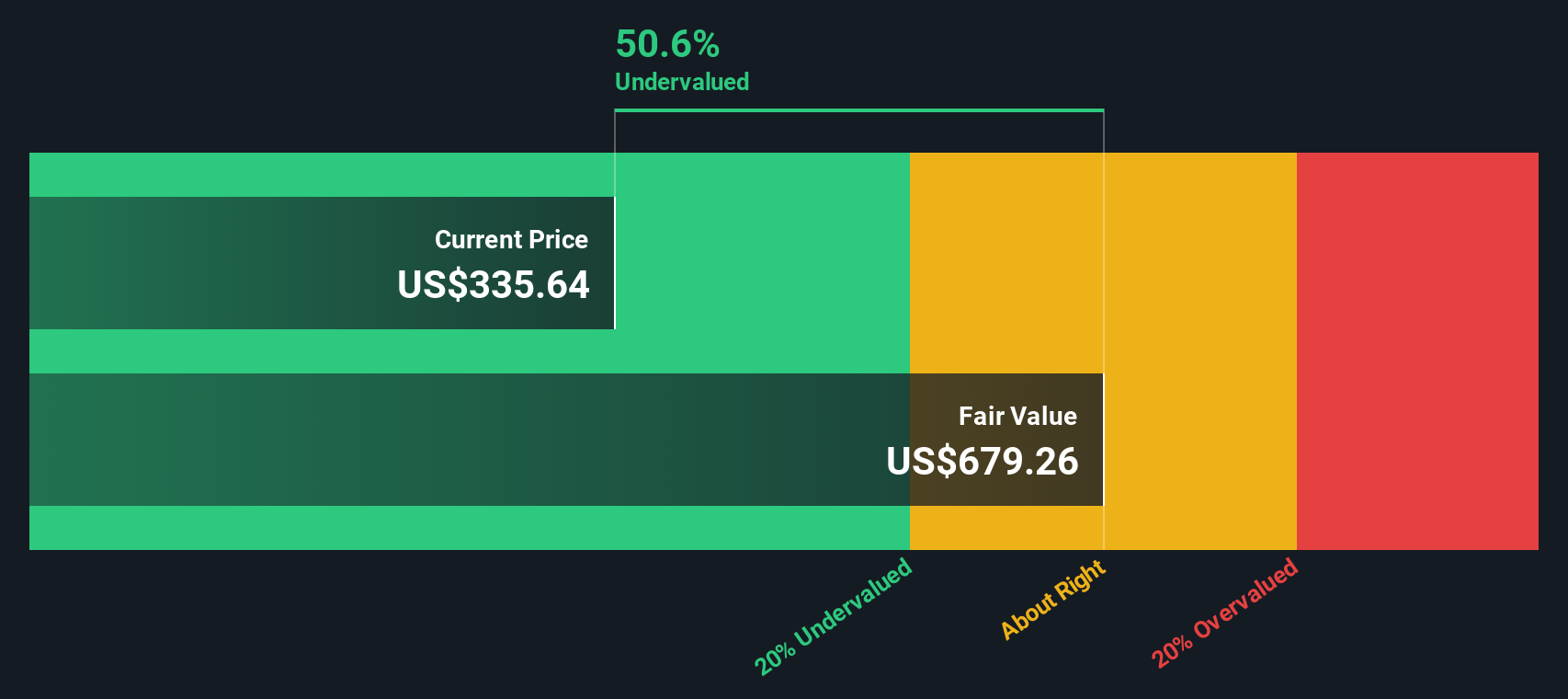

Using these cash flow projections and applying the 2 Stage Free Cash Flow to Equity DCF method, Cencora’s intrinsic value is calculated at $679.26 per share. That number represents a sizable 49.8% discount to the current market price, meaning the stock is deeply undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cencora is undervalued by 49.8%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

Approach 2: Cencora Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a go-to tool for valuing profitable companies like Cencora because it connects a company's stock price to its actual earnings power. It allows investors to quickly compare how much they are paying for each dollar of profit, making it especially relevant for businesses with established and growing earnings.

What counts as a "normal" or "fair" PE ratio? That depends on the company’s growth outlook and risk profile. Higher growth and lower risk often justify paying a higher PE, as investors expect rising profits to eventually reward shareholders. Conversely, if growth is slow or risks are high, the fair PE drops.

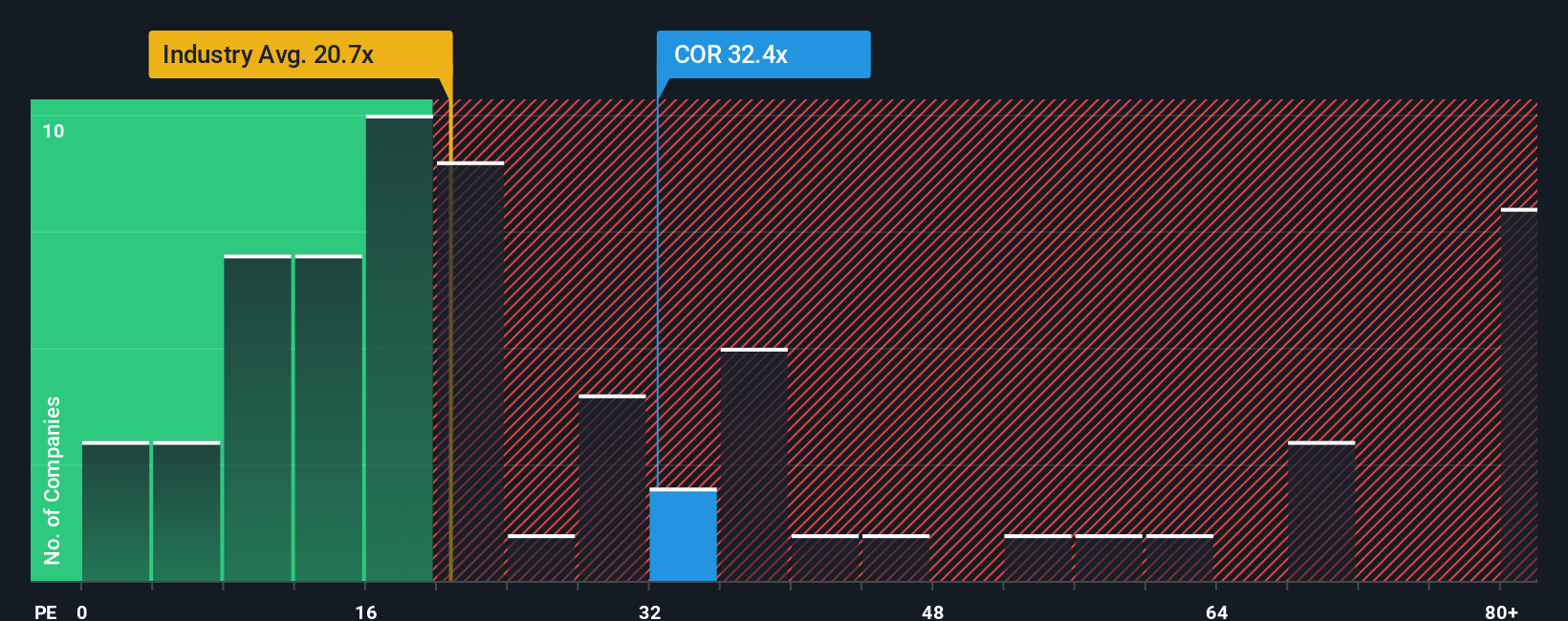

Cencora currently trades at a PE ratio of 34.8x. For context, the average PE in the healthcare industry sits at 20.3x, while Cencora’s peer group averages 23.0x. At first glance, Cencora appears much more expensive than both its industry and its peers.

Simply Wall St’s “Fair Ratio” is a proprietary metric that estimates a custom “fair” PE for Cencora, considering earnings growth, profit margin, scale, industry dynamics, and risk. Unlike raw peer or industry comparisons, the Fair Ratio offers a more nuanced benchmark that fits the company’s actual situation. For Cencora, that Fair Ratio is 30.9x.

With Cencora’s actual PE of 34.8x sitting just above its Fair Ratio of 30.9x, the stock looks a little expensive through this lens. Ultimately, the valuation is not wildly off the mark but stretches somewhat beyond what would be considered truly fair value.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cencora Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful tool that allows you to put your story behind the numbers, linking your perspective on Cencora’s strategy, industry changes, and market outlook directly to forecasts for future revenue, earnings, margins, and ultimately fair value.

By combining these stories with financial assumptions, Narratives connect what’s happening with the business, such as Cencora’s digital investments or competitive pressures, to a tangible fair value that’s easy to compare against today’s share price. Narratives are accessible on Simply Wall St’s Community page, used by millions of investors to capture and update their thinking in real time as news and earnings emerge.

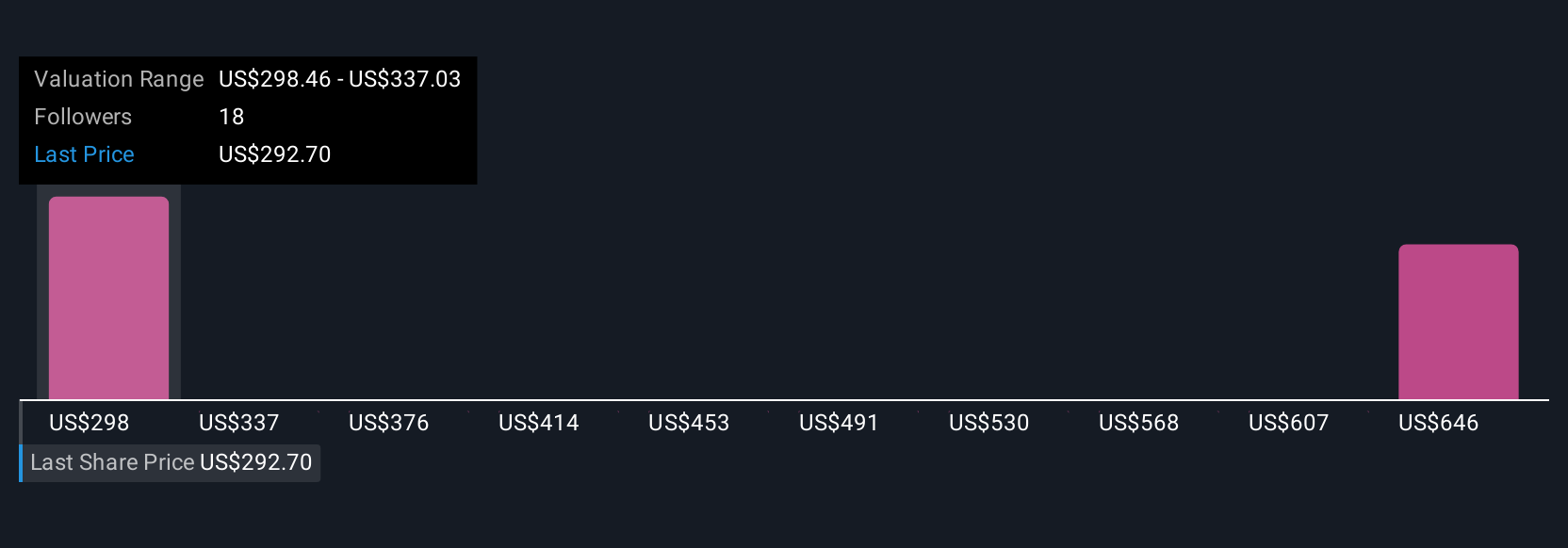

They make buy or sell decisions simpler. You just compare the fair value from your Narrative to the current market price to see if there is still upside or downside. For example, some investors currently have fair values as high as $355, reflecting belief in Cencora’s margin expansion and growth, while others are more cautious, seeing fair value as low as $274 and reflecting concerns about regulatory pressure and competitive risks. Narratives let you decide which view fits you and update your stance anytime new information arrives.

Do you think there's more to the story for Cencora? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COR

Cencora

Cencora, Inc. sources and distributes pharmaceutical products in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives