- United States

- /

- Healthcare Services

- /

- NYSE:COR

Cencora (COR): Assessing Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

Cencora (COR) shares have steadily climbed over the past month, advancing roughly 15%. Investors are taking note of the company’s sustained performance in the healthcare sector as they reassess its longer-term outlook and value.

See our latest analysis for Cencora.

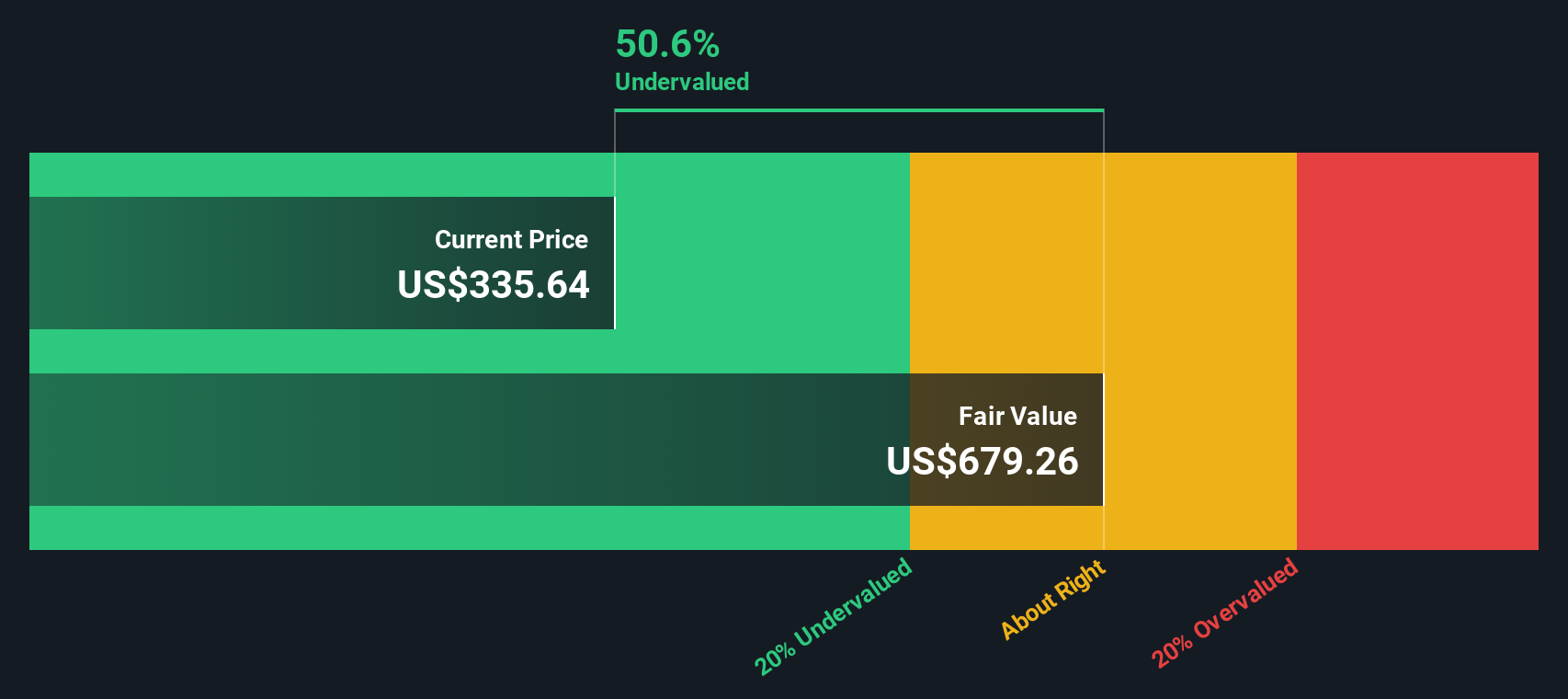

The recent surge in Cencora's share price, now sitting at $365.08, caps off an impressive run that has built considerable momentum. With a 14.8% share price return over the past month and nearly 62.5% gain year-to-date, investors seem increasingly optimistic about the company’s longer-term potential. Cencora’s total shareholder return has also been exceptional, with a 47.97% gain over the past year and a triple-digit increase over both three-year and five-year periods. This kind of sustained outperformance suggests that confidence is growing, likely reflecting sound operational execution alongside shifting perceptions of risk and value.

If the recent rally in Cencora has you rethinking your strategy, you might want to explore what else is happening in the healthcare sector by checking out See the full list for free..

With shares up sharply, investors may wonder if Cencora’s fundamentals still justify a higher price, or if the current rally means all future growth is now fully reflected. Is there still value left on the table?

Most Popular Narrative: 7.9% Overvalued

Based on the most widely followed narrative, Cencora’s recent share price surge now places it above the price considered justified by underlying growth assumptions and future profitability. This valuation gap hints at significant optimism from the market, yet the drivers behind this narrative demand a closer look.

Cencora’s ongoing investment in digital infrastructure and advanced analytics positions the company to capitalize on the accelerating digitization of healthcare and regulatory requirements like the Drug Supply Chain Security Act. These efforts are improving supply chain efficiency and transparency, which should drive higher net margins and operating income over time.

Curious about why Cencora’s fair value calculation counts on a leap in profitability and industry-shaping tech moves? Major upgrades, margin expansion, and bold numbers are just the start. The full story is only revealed deep in the details, so see how future projections really stack up against today’s market fever.

Result: Fair Value of $338.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, margin pressure from biosimilars and regulatory scrutiny could quickly challenge Cencora’s upbeat outlook if earnings or revenue growth begin to stall.

Find out about the key risks to this Cencora narrative.

Another View: Discounted Cash Flow Perspective

Looking at Cencora from the perspective of the SWS DCF model, the story changes. This model estimates Cencora’s fair value at $864.80 per share, which is far above the current price and suggests the stock could be significantly undervalued. However, can a forward-looking cash flow model outweigh market caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cencora for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 869 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cencora Narrative

If you see things differently or want to dig into the numbers at your own pace, forming your perspective takes just a couple of minutes. Do it your way.

A great starting point for your Cencora research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next smart opportunity pass you by. Use the Simply Wall Street Screener to find unique investment themes you might have overlooked.

- Supercharge your portfolio with income potential by checking out these 15 dividend stocks with yields > 3% for standout stocks offering yields above 3%.

- Capture the momentum of digital transformation by exploring these 26 AI penny stocks, where innovative AI companies are working to define the next decade.

- Access the next wave of technology by evaluating these 27 quantum computing stocks, where ambitious firms are racing to unlock the promise of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COR

Cencora

Cencora, Inc. sources and distributes pharmaceutical products in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives