- United States

- /

- Healthcare Services

- /

- NYSE:CON

Raised Guidance and Buyback Could Be a Game Changer for Concentra Group Holdings Parent (CON)

Reviewed by Sasha Jovanovic

- Concentra Group Holdings Parent, Inc. reported strong third-quarter 2025 results, raised its full-year financial guidance, and announced a cash dividend of US$0.0625 per share payable in December, along with a new US$100 million share repurchase authorization.

- Expansion through acquisitions and ongoing clinic growth, coupled with shareholder returns, signal management’s confidence in the company’s operational momentum and long-term market opportunity.

- We’ll explore how Concentra’s raised annual outlook and buyback program reshape its investment narrative and growth prospects.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Concentra Group Holdings Parent Investment Narrative Recap

Owning Concentra Group Holdings Parent means believing in the long-term demand for occupational health services and the company’s ability to expand its national clinic network while managing integration costs. The latest earnings beat and increased annual guidance support optimism about future growth, yet ongoing high leverage remains a key risk, as persistent interest expenses may limit near-term earnings momentum. While this quarter’s guidance boost is positive, it does not materially reduce the risk tied to the company’s debt load and margin pressures.

Among the recent news, the new US$100 million share repurchase authorization stands out. This move highlights management’s intent to provide ongoing shareholder returns even as Concentra continues with acquisitions and clinic openings, reinforcing the short-term catalyst of confidence in the company’s operational performance.

However, in contrast to revenue growth and new initiatives, investors should be aware of lingering concerns about high debt levels and the pressure that elevated interest expenses place on future...

Read the full narrative on Concentra Group Holdings Parent (it's free!)

Concentra Group Holdings Parent's narrative projects $2.6 billion in revenue and $249.0 million in earnings by 2028. This requires 8.4% yearly revenue growth and a $100.9 million increase in earnings from the current $148.1 million.

Uncover how Concentra Group Holdings Parent's forecasts yield a $28.12 fair value, a 45% upside to its current price.

Exploring Other Perspectives

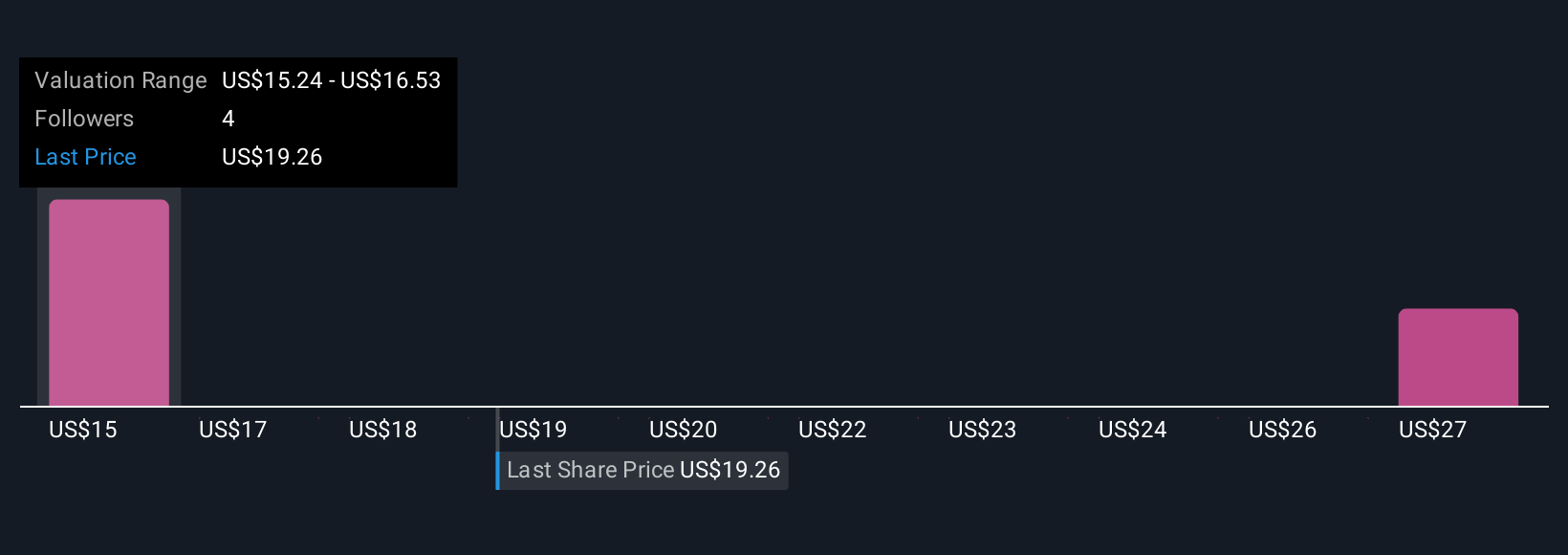

Simply Wall St Community members estimate fair values for Concentra between US$15.13 and US$28.13, with just two unique perspectives. Despite upbeat financial guidance, high debt and interest costs could challenge earnings growth, so consider the full spectrum of outlooks shared by fellow investors.

Explore 2 other fair value estimates on Concentra Group Holdings Parent - why the stock might be worth as much as 45% more than the current price!

Build Your Own Concentra Group Holdings Parent Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Concentra Group Holdings Parent research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Concentra Group Holdings Parent research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Concentra Group Holdings Parent's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CON

Concentra Group Holdings Parent

Provides occupational health services in the United States.

Good value with limited growth.

Market Insights

Community Narratives