- United States

- /

- Healthcare Services

- /

- NYSE:CNC

Centene (CNC) Is Up 6.2% After Q3 Revenue Beats and New Product Launches - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Centene Corporation recently reported third-quarter results, with revenue reaching US$49.69 billion and adjusted earnings per share surpassing expectations despite a significant non-cash goodwill impairment charge of US$6.7 billion.

- This quarter also saw Centene launch new Ambetter health insurance plan offerings in Arizona, Georgia, and Mississippi for 2026, as well as expanded member wellness programs and digital enrollment tools.

- We'll explore how Centene's robust revenue growth and recent product expansions could influence its overall investment outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Centene Investment Narrative Recap

To be a Centene shareholder today, you would need to believe in the company's ability to recover margins through growth in Medicaid and Marketplace products, while managing cost pressures and policy headwinds. The recent surge in revenue and new product launches may support short-term sentiment, but large impairment charges and ongoing margin risks remain front and center. For now, none of the latest product rollouts have materially changed the biggest catalyst, Medicaid margin recovery, or meaningfully reduced the main risk, which remains policy and cost volatility.

One relevant announcement is Centene’s expanded Ambetter health insurance offerings in Arizona, Georgia, and Mississippi for 2026. The introduction of enhanced digital tools, additional wellness programs, and broader telehealth services supports continued membership growth, but uncertainty remains around how these expansion efforts will translate into improved margins, particularly as the company continues to address cost pressures in its Medicaid business.

By contrast, investors should be aware that continued volatility in Medicaid-related rates and medical costs...

Read the full narrative on Centene (it's free!)

Centene's narrative projects $195.6 billion in revenue and $2.1 billion in earnings by 2028. This requires 7.0% yearly revenue growth, with earnings remaining flat compared to the current earnings of $2.1 billion.

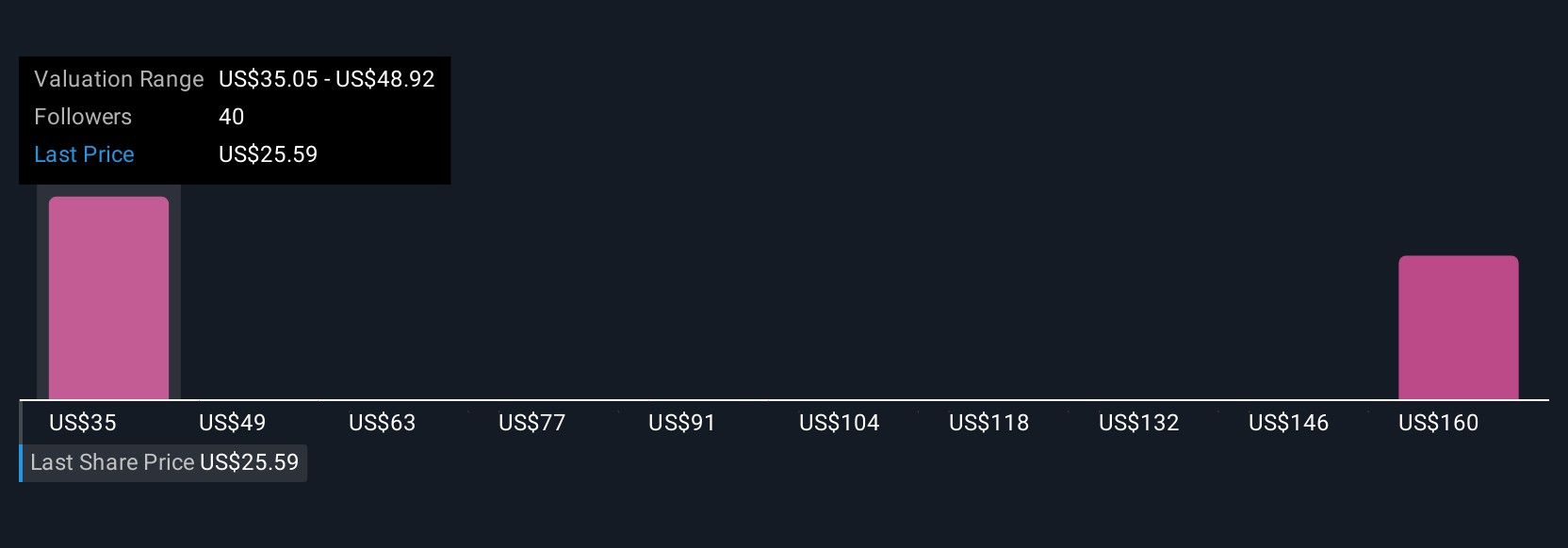

Uncover how Centene's forecasts yield a $39.76 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Sixteen views from the Simply Wall St Community place Centene’s fair value estimates anywhere from US$31.58 to US$173.89 per share. While many see potential for margin recovery in Medicaid and Marketplace segments, opinions vary widely, demonstrating how much hinges on future cost controls and policy stability.

Explore 16 other fair value estimates on Centene - why the stock might be worth over 4x more than the current price!

Build Your Own Centene Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centene research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Centene research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centene's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives