- United States

- /

- Healthcare Services

- /

- NYSE:CAH

What Cardinal Health (CAH)'s Strong Q1 Earnings and Dividend Hike Mean for Shareholders

Reviewed by Sasha Jovanovic

- Cardinal Health recently reported strong first-quarter earnings for 2025, with revenue reaching US$64.01 billion and net income rising to US$450 million, along with the board's approval of a quarterly dividend of US$0.5107 per share payable in January 2026.

- This combination of profit growth, continued dividend payments, and share repurchases highlights Cardinal Health's focus on consistent shareholder returns and financial stability.

- We’ll now explore how the reaffirmed dividend, alongside solid earnings, shapes Cardinal Health’s updated investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Cardinal Health Investment Narrative Recap

To be a shareholder in Cardinal Health right now, you need to believe the company can continue to harness strong pharmaceutical demand, supply chain improvements, and operational scale to offset industry risks like regulatory scrutiny and contract expirations. The recent combination of solid earnings growth, dividend affirmation, and buybacks, while notable, does not materially impact the biggest short-term catalyst, gains from increasing global healthcare product demand, or the major risk, which remains potential margin pressure from new regulations and major contract losses.

Among recent announcements, the consistent approval and payout of quarterly dividends stands out as most relevant. A steady dividend, especially following robust first-quarter earnings, reinforces Cardinal Health's willingness to return value to shareholders even amidst industry headwinds, supporting investor confidence in the company's operational cash flows and capital allocation strategy.

But investors should also watch for how Cardinal Health manages through heightened regulatory uncertainty and pricing pressure, since ...

Read the full narrative on Cardinal Health (it's free!)

Cardinal Health's narrative projects $288.0 billion revenue and $2.2 billion earnings by 2028. This requires 9.0% yearly revenue growth and a $0.6 billion earnings increase from $1.6 billion currently.

Uncover how Cardinal Health's forecasts yield a $189.36 fair value, a 4% downside to its current price.

Exploring Other Perspectives

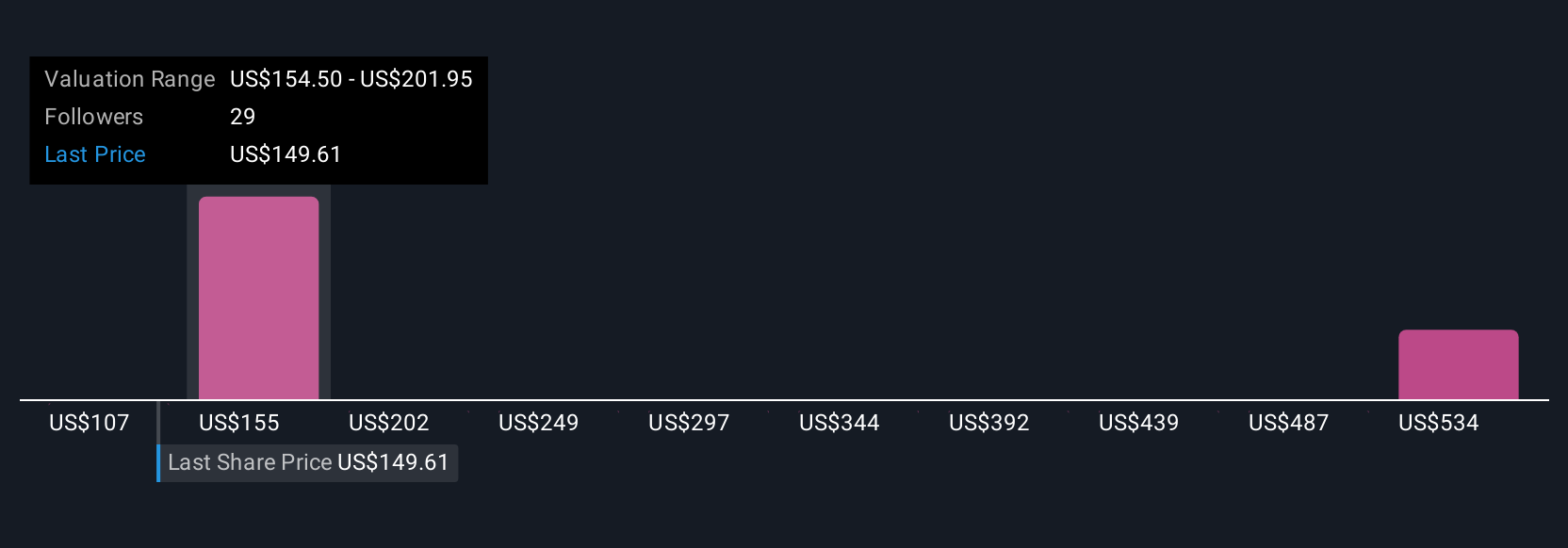

Private members of the Simply Wall St Community placed Cardinal Health’s fair value between US$168 and US$462, with three distinct estimates recorded. Opinions differ, particularly as ongoing regulatory changes could affect the company’s future profitability and earnings resilience, consider how these views might influence your own research.

Explore 3 other fair value estimates on Cardinal Health - why the stock might be worth over 2x more than the current price!

Build Your Own Cardinal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cardinal Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cardinal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cardinal Health's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAH

Cardinal Health

Operates as a healthcare services and products company in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives