- United States

- /

- Healthcare Services

- /

- NYSE:CAH

Cardinal Health (CAH): Assessing Valuation Following Raised Earnings Guidance and Strong Quarterly Performance

Reviewed by Simply Wall St

Cardinal Health (CAH) drew attention after releasing quarterly results that showed meaningful revenue and earnings gains compared to last year. This prompted the company to raise its full-year earnings guidance for investors.

See our latest analysis for Cardinal Health.

Cardinal Health is on a tear this year, with the share price up 72.6% year-to-date and the company bursting past a fresh 52-week high after robust Q1 results and a healthy dividend boost. The strong 29.8% share price return in just the last month, following upbeat earnings, buybacks, and board approvals, speaks to growing investor confidence and sustained business momentum over both the short and long term.

If you’re interested in other healthcare companies making big moves, take a look at the latest leaders and innovators in our health sector lineup with See the full list for free.

With shares hitting fresh highs and analyst upgrades rolling in, the key question for investors now is whether Cardinal Health’s recent outperformance signals more room to run or if the market is already factoring in its future growth.

Most Popular Narrative: 8% Overvalued

With Cardinal Health shares recently closing at $203.67 and the narrative fair value placed at $189.36, the narrative positions the stock above its estimated fair worth. This sets up a fascinating debate over the future trajectory of this healthcare giant.

The company's investments in automation, advanced supply chain technology, and new distribution centers are expected to deliver long-term operational efficiencies and cost savings. These improvements may support better net margins and free cash flow as healthcare shifts to value-based and outpatient models.

Want a peek under the hood of this valuation? It’s all about future profits—where margins go, and how operational upgrades tip the scales. The secret? A set of aggressive targets for cash flow and profitability that power the price target. Ready to see what’s fueling this high-stakes number crunch?

Result: Fair Value of $189.36 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty and possible contract expirations could disrupt Cardinal Health’s growth story. These are important risks for investors to watch.

Find out about the key risks to this Cardinal Health narrative.

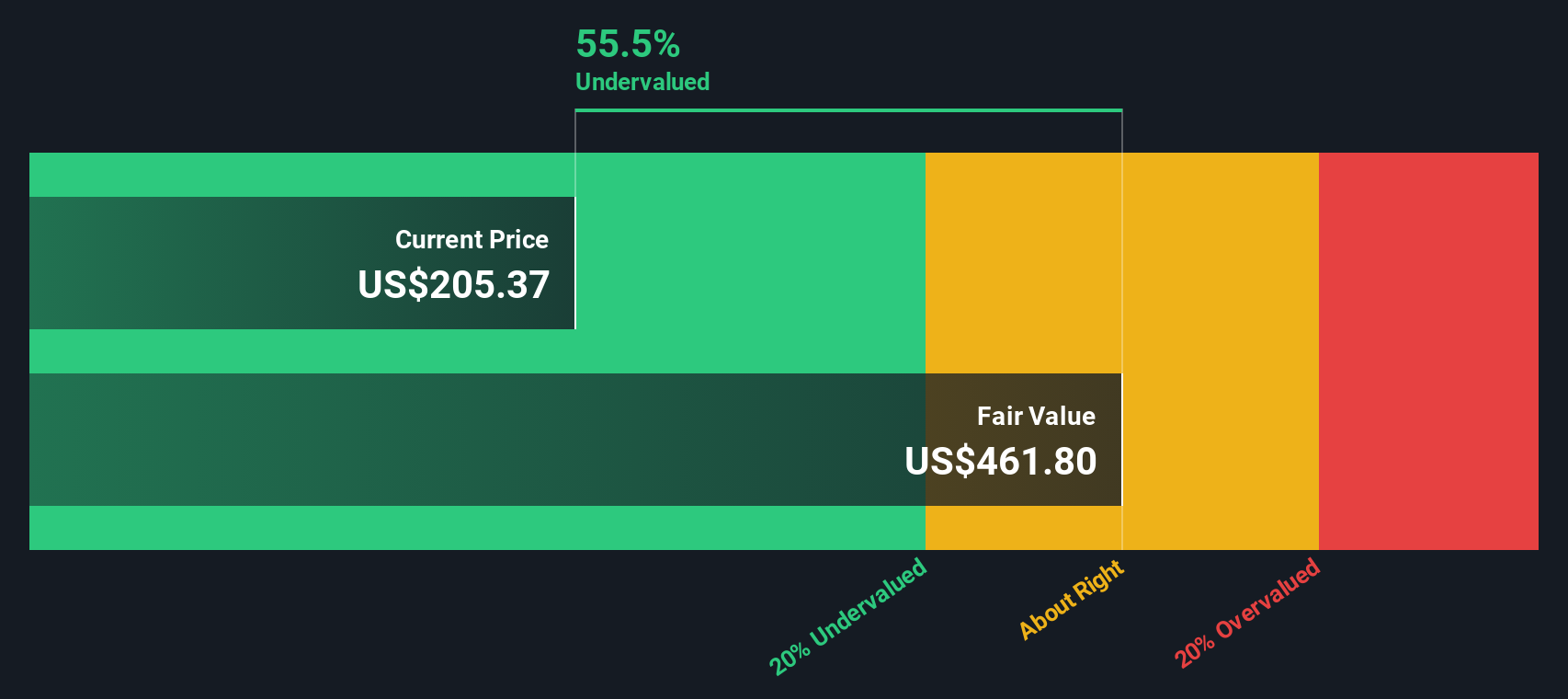

Another View: Discounted Cash Flow Paints a Different Picture

While the consensus view considers Cardinal Health overvalued based on narrative fair value, our SWS DCF model comes to the opposite conclusion. The DCF calculation suggests the stock is significantly undervalued and trading well below its estimated fair value. Could this reveal a hidden margin of safety for long-term investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cardinal Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cardinal Health Narrative

If you see things differently or want to test your own assumptions, you can craft a custom take from scratch in just a few minutes: Do it your way

A great starting point for your Cardinal Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors won’t limit themselves to just one opportunity. Give yourself the best shot at strong returns by exploring these hand-picked stock ideas before the market moves.

- Boost your portfolio’s income potential by checking out these 16 dividend stocks with yields > 3%, which features high-yield dividend payers offering stable returns in any market cycle.

- Tap into emerging technology trends and see which businesses are riding the next wave of progress with these 25 AI penny stocks.

- Position yourself for possible outsized gains by taking a look at these 3588 penny stocks with strong financials, which highlights proven up-and-comers with strong financials and big growth ambitions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAH

Cardinal Health

Operates as a healthcare services and products company in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives