- United States

- /

- Medical Equipment

- /

- NYSE:BSX

Should Boston Scientific's Strong 2025 Results and Leadership Change Prompt Action From BSX Investors?

Reviewed by Sasha Jovanovic

- Boston Scientific Corporation recently reported strong third-quarter and year-to-date 2025 financial results, including increased sales, higher net income, and the launch of new products in Peripheral Interventions and Cardiology.

- The company also raised its fourth-quarter and full-year 2025 earnings guidance, reflecting confidence in its operational performance and expansion efforts, while announcing an upcoming change to its board leadership.

- We’ll examine how the company’s robust sales and profit growth influences Boston Scientific’s investment narrative and future earnings expectations.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Boston Scientific Investment Narrative Recap

To be a shareholder in Boston Scientific, you need to believe in its ability to maintain strong revenue and profit growth through innovation and global expansion, while managing competitive and regulatory risks. The recent announcement that John E. Sununu will not seek re-election to the board does not materially affect the company's key short-term catalysts, such as robust product launches and earnings momentum, or its biggest current risk: cost headwinds from tariffs and product cycle challenges.

The most interesting recent announcement is Boston Scientific's raised guidance for fourth-quarter and full-year 2025 earnings, reflecting management's confidence in continued sales momentum and operational execution. This updated outlook highlights the company’s focus on leveraging new product launches and international growth to offset potential margin pressures and reinforces a near-term catalyst for investor attention. However, despite strong guidance, investors should keep in mind ...

Read the full narrative on Boston Scientific (it's free!)

Boston Scientific's outlook anticipates $25.4 billion in revenue and $4.8 billion in earnings by 2028. This is based on an expected 11.1% annual revenue growth rate, with earnings forecast to rise by $2.3 billion from the current $2.5 billion.

Uncover how Boston Scientific's forecasts yield a $126.14 fair value, a 28% upside to its current price.

Exploring Other Perspectives

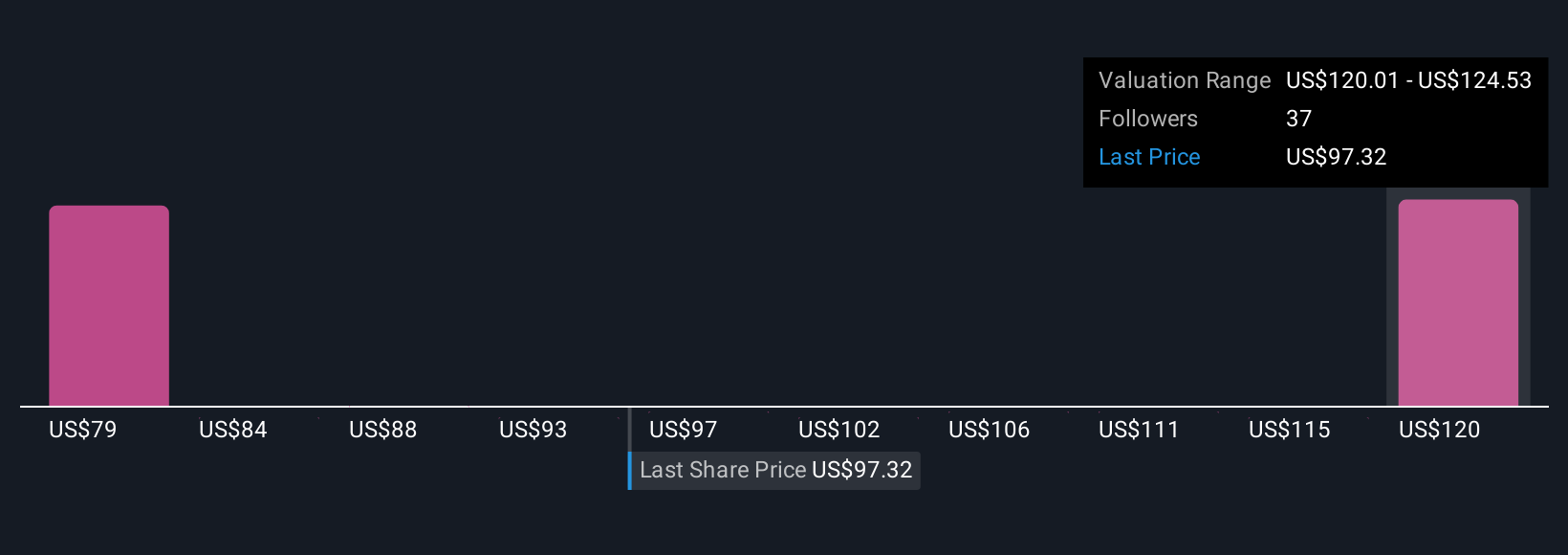

Simply Wall St Community members have estimated Boston Scientific's fair value between US$101.08 and US$126.14, across five independent forecasts. With such differing outlooks, it is important to weigh these views against the company’s raised sales and earnings guidance, which could influence expectations going forward.

Explore 5 other fair value estimates on Boston Scientific - why the stock might be worth as much as 28% more than the current price!

Build Your Own Boston Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boston Scientific research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boston Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boston Scientific's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives