- United States

- /

- Medical Equipment

- /

- NYSE:BSX

Is Boston Scientific’s Recent Device Launch Momentum Justifying Its 2025 Valuation?

Reviewed by Bailey Pemberton

- Wondering if Boston Scientific is priced for opportunity or already running ahead of its value? You are not alone, and that question is exactly what this guide will help you answer.

- Boston Scientific’s stock has gained an impressive 15.5% over the past year, and is up a considerable 158.7% over five years, reflecting both long-term confidence and recent positive sentiment despite a slight 2.1% dip in the past week.

- Recent headlines have highlighted the company's continued advancements in medical devices and a series of product launches that are making waves in the healthcare sector. These moves have kept Boston Scientific in the spotlight for both innovation and potential growth, giving investors plenty to digest as the market reacts.

- Currently, Boston Scientific’s valuation score sits at 1 out of 6, so there’s plenty to unpack when it comes to what’s built into the current price and what might be overlooked. We will walk through traditional and alternative valuation approaches, with a fresh perspective waiting at the end.

Boston Scientific scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Boston Scientific Discounted Cash Flow (DCF) Analysis

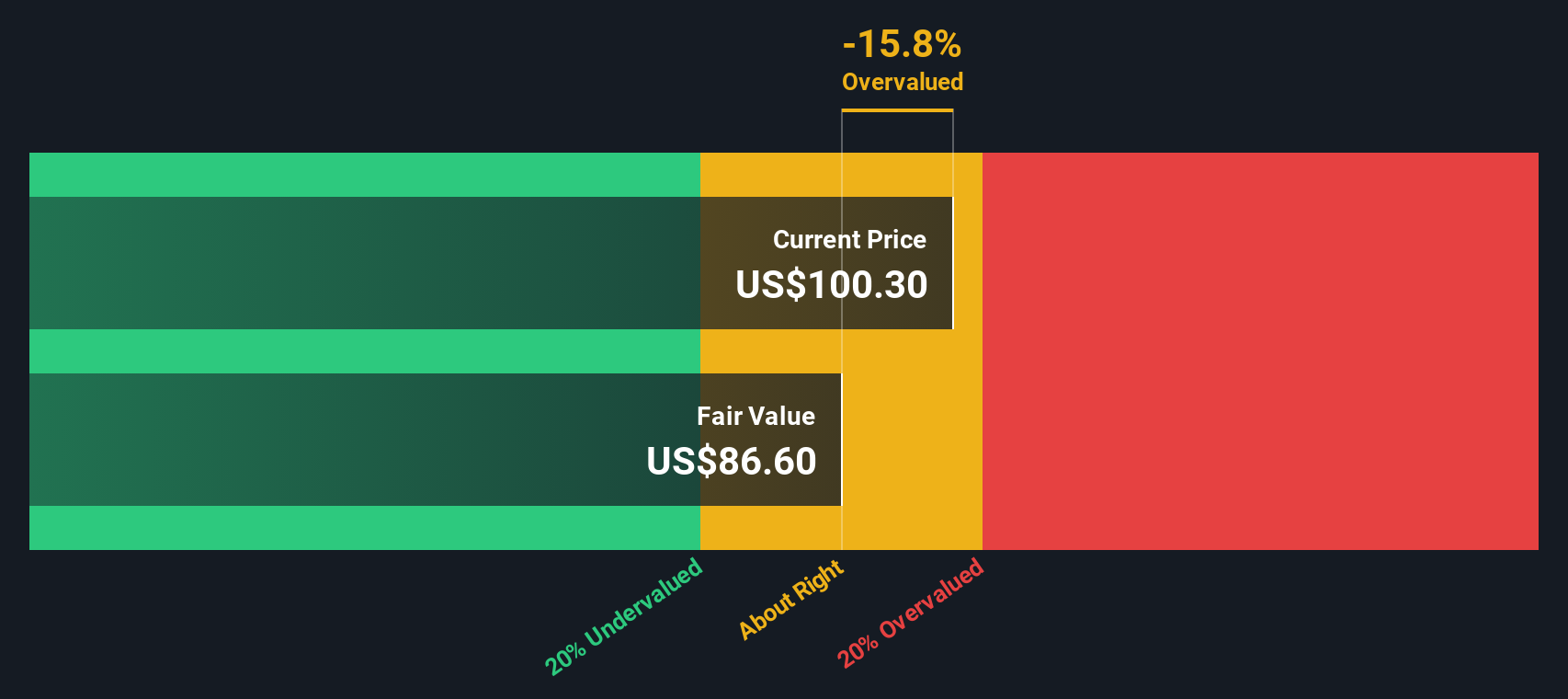

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and discounting them back to the present. This approach helps investors determine if a stock’s market price reflects its actual worth based on anticipated performance rather than market mood swings.

Boston Scientific’s current Free Cash Flow stands at approximately $3.77 billion. Analysts provide cash flow projections out to 2027, expecting FCF to reach $4.46 billion by that year. For years beyond 2027, the projections are carefully extrapolated, with cash flows expected to continue rising. By 2035, estimates put Free Cash Flow at nearly $6.2 billion. These long-range figures add context for assessing the company’s growth trajectory, with incremental gains each year according to industry and analyst insights.

The DCF model calculates an intrinsic value of $67.18 per share for Boston Scientific. However, this suggests that the current share price sits 47.1% above the estimated fair value, indicating that Boston Scientific’s stock is currently overvalued based on this cash flow analysis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Boston Scientific may be overvalued by 47.1%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

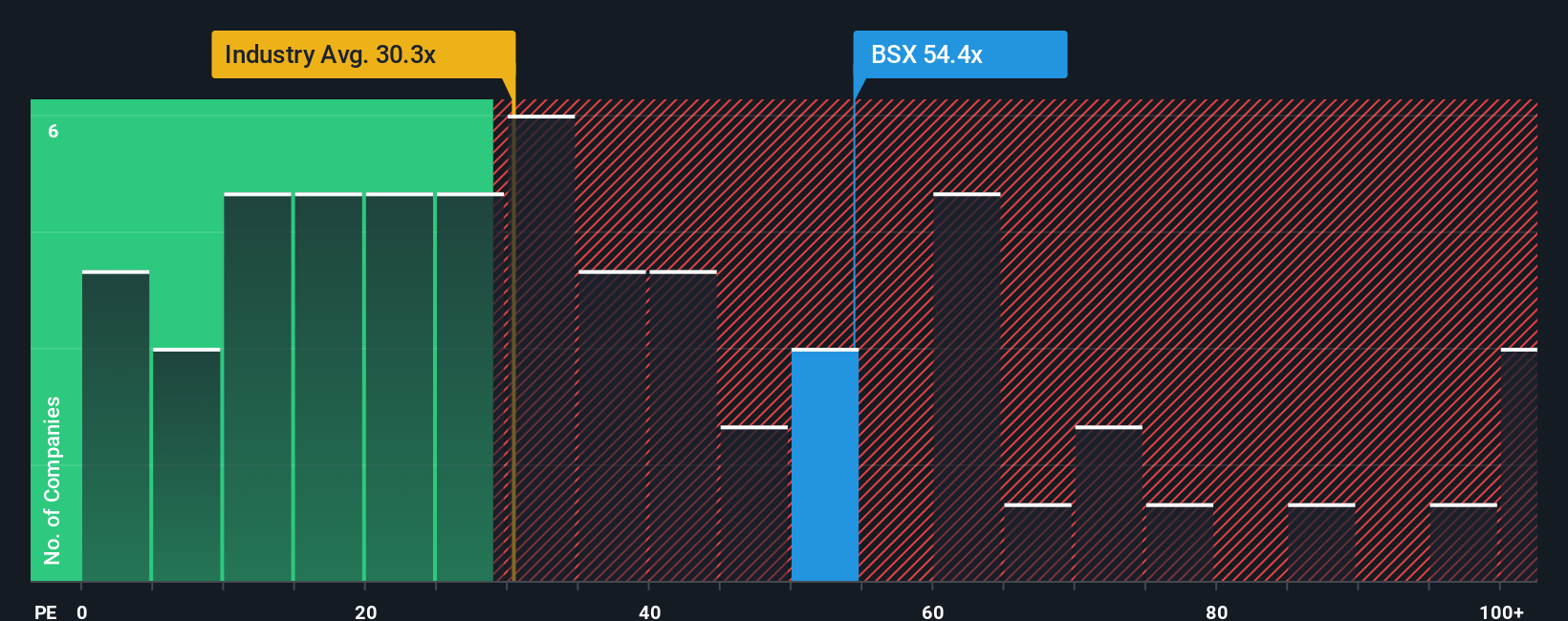

Approach 2: Boston Scientific Price vs Earnings

For companies like Boston Scientific that generate consistent profits, the Price-to-Earnings (PE) ratio is a widely used measure to assess valuation. PE offers a snapshot of how much investors are willing to pay for each dollar of earnings, making it especially useful for evaluating profitable firms in established sectors.

Growth expectations and perceived risk are major drivers of what constitutes a “normal” or “fair” PE ratio. Rapidly growing companies or those with lower risk typically command higher PE multiples, while slower-growing or riskier businesses see lower ratios. Comparing Boston Scientific on this metric reveals its current PE stands at 52.5x. For context, this is much higher than the Medical Equipment industry average of 28.1x, as well as the peer average of 39.3x.

However, Simply Wall St offers a more tailored benchmark: the Fair Ratio. This proprietary measure, calculated at 38.7x for Boston Scientific, incorporates not just industry standards and earnings growth but also considers profit margins, company size, and risk factors. Unlike simple industry or peer comparisons, the Fair Ratio is designed to adjust for the unique blend of characteristics that impact a stock’s fair value, providing a more insightful gauge for investors.

Comparing Boston Scientific’s current PE of 52.5x to the Fair Ratio of 38.7x suggests the stock is running well ahead of what fundamentals would justify. This points to a significant premium that is not fully explained by growth or quality alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

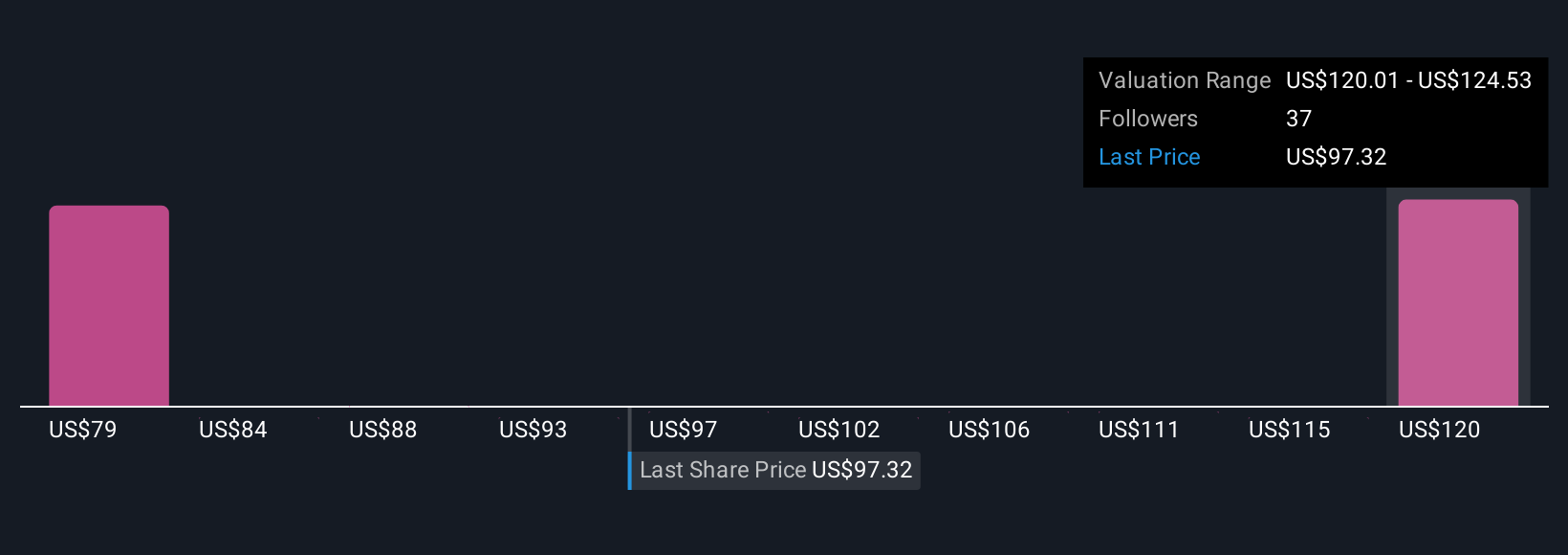

Upgrade Your Decision Making: Choose your Boston Scientific Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story you tell about a company, combining your perspective on Boston Scientific’s future growth, earnings, and margins with objective numbers. This creates a bridge between what you believe and what the financials could become.

It’s more than just crunching numbers. Narratives help you clearly state your forecast for the company, see what fair value would follow from it, and check how that compares with the current share price. On Simply Wall St’s Community page, millions of investors use Narratives to build, share, and update these viewpoints. This gives you a dynamic way to track your own assumptions as news or earnings emerge.

One investor, for example, may build an optimistic Narrative seeing Boston Scientific’s revenue growth and market expansion pushing the price as high as $140. Another, concerned about regulatory risks or margin pressures, could forecast a much lower fair value near $99. Narratives let you focus not only on what analysts or peers expect, but also on how your own story stands up. This offers an accessible, data-driven tool to decide if now is the right time to buy, hold, or sell.

Do you think there's more to the story for Boston Scientific? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives