- United States

- /

- Medical Equipment

- /

- NYSE:BLCO

Does Recent Product Launch News Signal Value in Bausch + Lomb for 2025?

Reviewed by Bailey Pemberton

- Ever looked at Bausch + Lomb stock and wondered if it might finally be offering value worth grabbing? You are not alone, especially as healthcare stocks draw more attention in shifting markets.

- The stock recently gained 1.7% over the past week and is up 5.6% in the last 30 days. However, it remains down 12.6% year-to-date and nearly 21% over the past year.

- Analysts have been buzzing as Bausch + Lomb captured attention in the financial press with updates on product launches and regulatory milestones. This has fueled debate about its growth outlook. At the same time, broader healthcare trends and investor rotation toward defensive plays have contributed to the recent movement in share price.

- Bausch + Lomb earns a 5/6 valuation score, showing strength in most value checks but suggesting there is more to consider. Let’s break down traditional valuation approaches step by step, and stay tuned for a smarter way to judge value at the end of the article.

Find out why Bausch + Lomb's -20.7% return over the last year is lagging behind its peers.

Approach 1: Bausch + Lomb Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today's value. This approach aims to reflect what Bausch + Lomb is fundamentally worth based on its long-term generating power, not just current market sentiment.

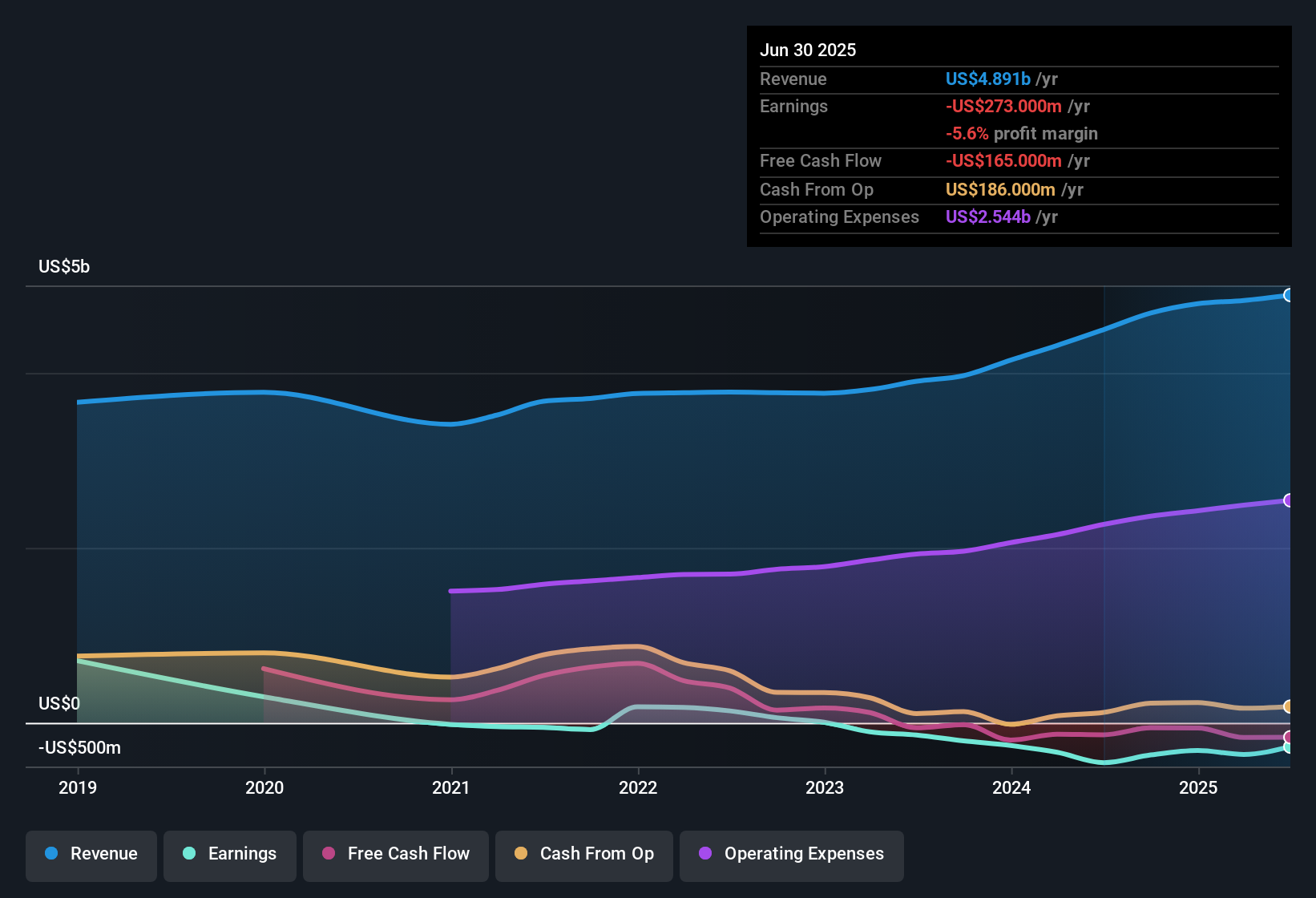

For Bausch + Lomb, the DCF uses a 2-stage Free Cash Flow to Equity method. The company's last twelve months of Free Cash Flow sits at -$121 million. Looking ahead, analysts see this turning positive, with Free Cash Flow expected to reach $496 million by 2027. Simply Wall St extrapolates even further, projecting Free Cash Flow to grow each year and potentially reach about $1.08 billion by 2035. However, projections beyond the next five years are estimates based on expected industry and company trends.

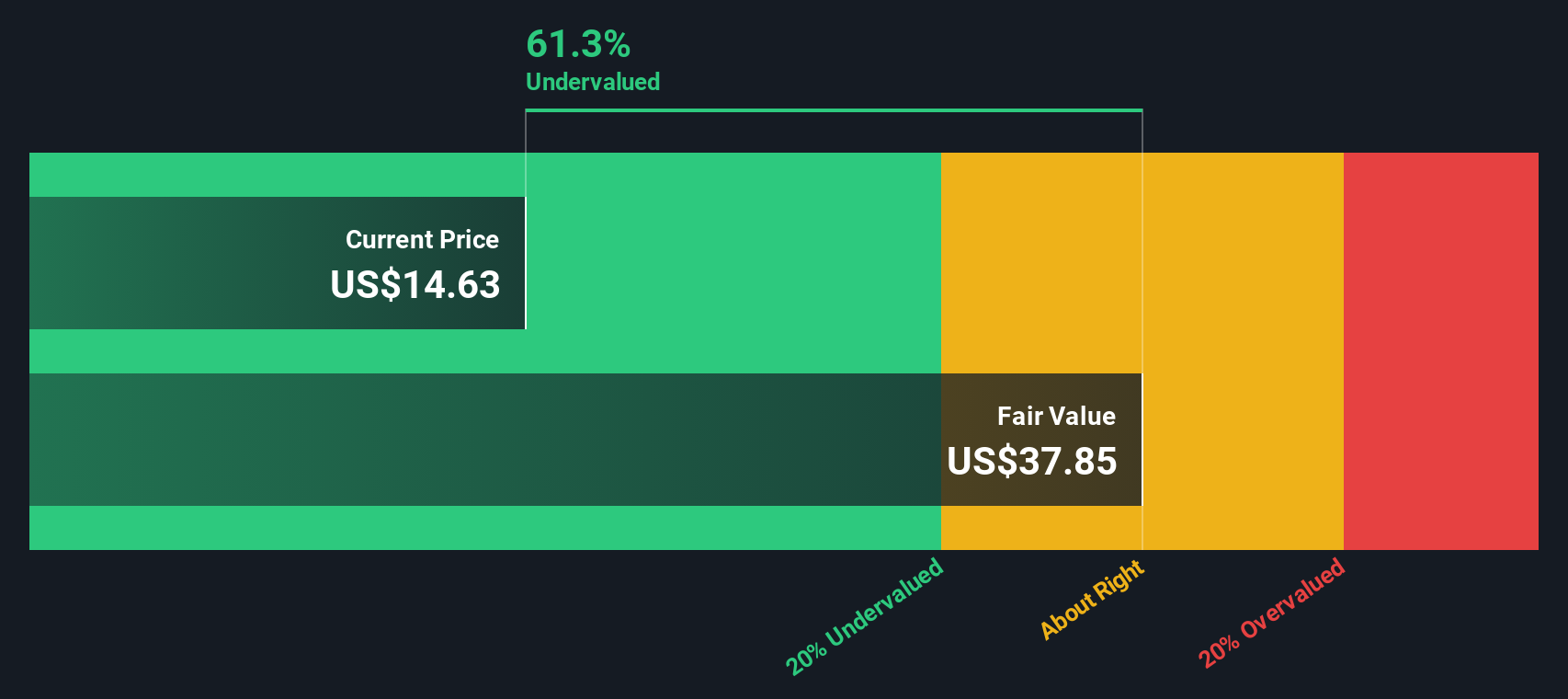

The DCF analysis calculates Bausch + Lomb’s fair value at $36.21 per share. Based on recent trading, this implies the stock is trading at a 56.6% discount to its intrinsic value. This suggests it could be significantly undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bausch + Lomb is undervalued by 56.6%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Bausch + Lomb Price vs Sales

The Price-to-Sales (P/S) ratio is especially useful for valuing healthcare and medical device companies like Bausch + Lomb, where profits may be depressed due to ongoing investment or restructuring, but revenues remain a key signal of business health. It is a preferred metric when profits are low or negative, allowing investors to assess value based on the top line, rather than earnings that can fluctuate for industry-specific reasons.

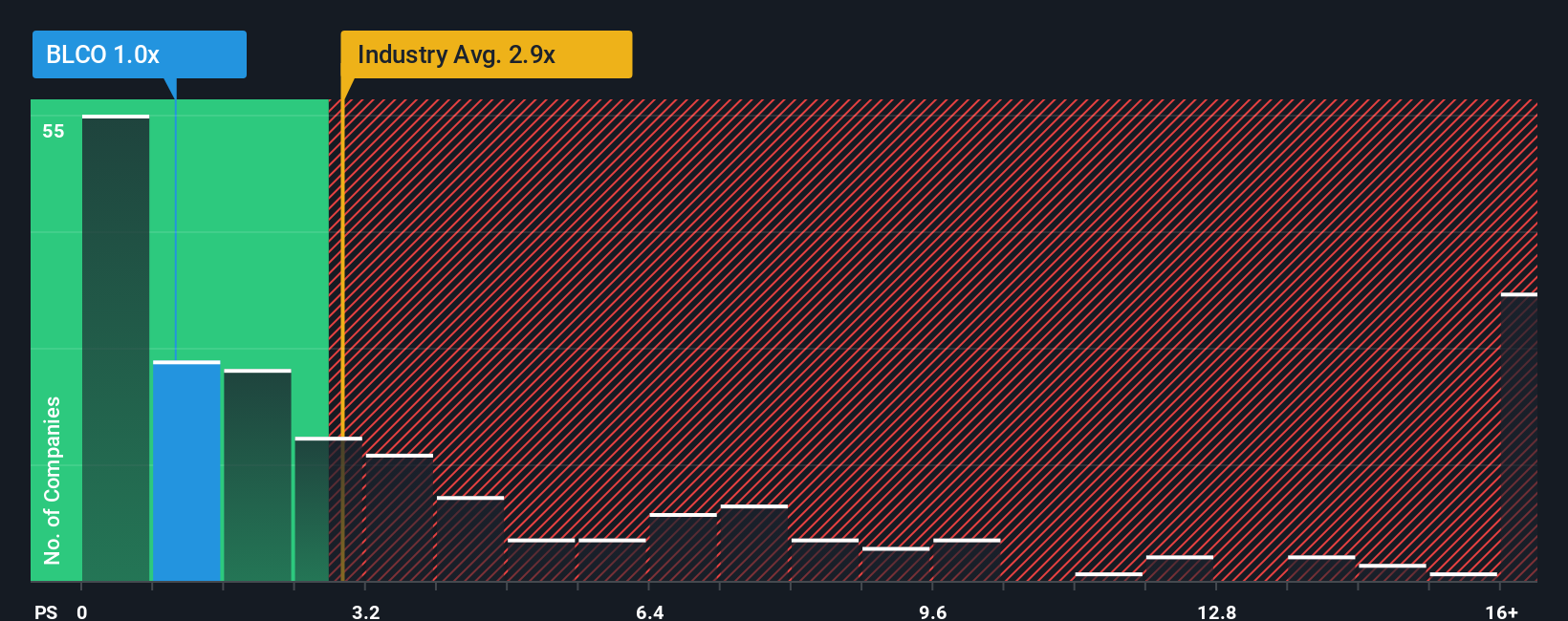

Of course, what counts as a "normal" P/S multiple is influenced by a company’s expected growth and the risks tied to its sector. Higher growth or lower risk often commands a higher multiple, while slower growth or more uncertainty generally leads to a lower mark. For Bausch + Lomb, the current P/S ratio stands at 1.12x. This is much lower than the Medical Equipment industry average of 3.02x, and also sits well below the peer average of 2.30x. This suggests shares trade at a substantial discount to both comparable groups.

Simply Wall St applies its proprietary "Fair Ratio" model to cut through all the noise. The Fair Ratio for Bausch + Lomb comes out to 2.32x, reflecting what would be reasonable based on earnings growth, profit margins, company size and industry specifics, as well as potential business risks. This approach goes beyond simple peer or industry averaging by customizing the benchmark to the company's unique situation.

Comparing the Fair Ratio of 2.32x to the actual P/S of 1.12x suggests that Bausch + Lomb stock is undervalued using this framework. It is trading at about half of what looks justified given all the evidence currently available.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bausch + Lomb Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your take on a company, a story that connects what is happening in the real world with financial estimates for future revenue, profit margins and what you believe the stock is truly worth.

Narratives bring together a company's story, your financial forecast, and a calculated fair value, helping you see the bigger picture. Think of it as a tool that allows you to document your reasoning, update your fair value as new information emerges, and make sense of the numbers in context.

On Simply Wall St's Community page, millions of investors use Narratives because they are easy to create, simple to understand, and update automatically whenever news or earnings are released. Narratives help you decide if now is the right time to buy or sell, letting you compare your view of fair value to the market price with clarity and confidence.

For Bausch + Lomb, some investors may see strong growth ahead and set a higher fair value, while others might be more cautious and choose a lower estimate. Both are instantly visualized and tracked as the story evolves.

Do you think there's more to the story for Bausch + Lomb? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch + Lomb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLCO

Bausch + Lomb

Operates as an eye health company in the United States, Puerto Rico, China, France, Japan, Germany, the United Kingdom, Canada, Russia, Spain, Italy, Mexico, Poland, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives