- United States

- /

- Medical Equipment

- /

- NYSE:BLCO

Bausch + Lomb (BLCO) Net Losses Deepen 53.3% Annually Despite Turnaround Hopes

Reviewed by Simply Wall St

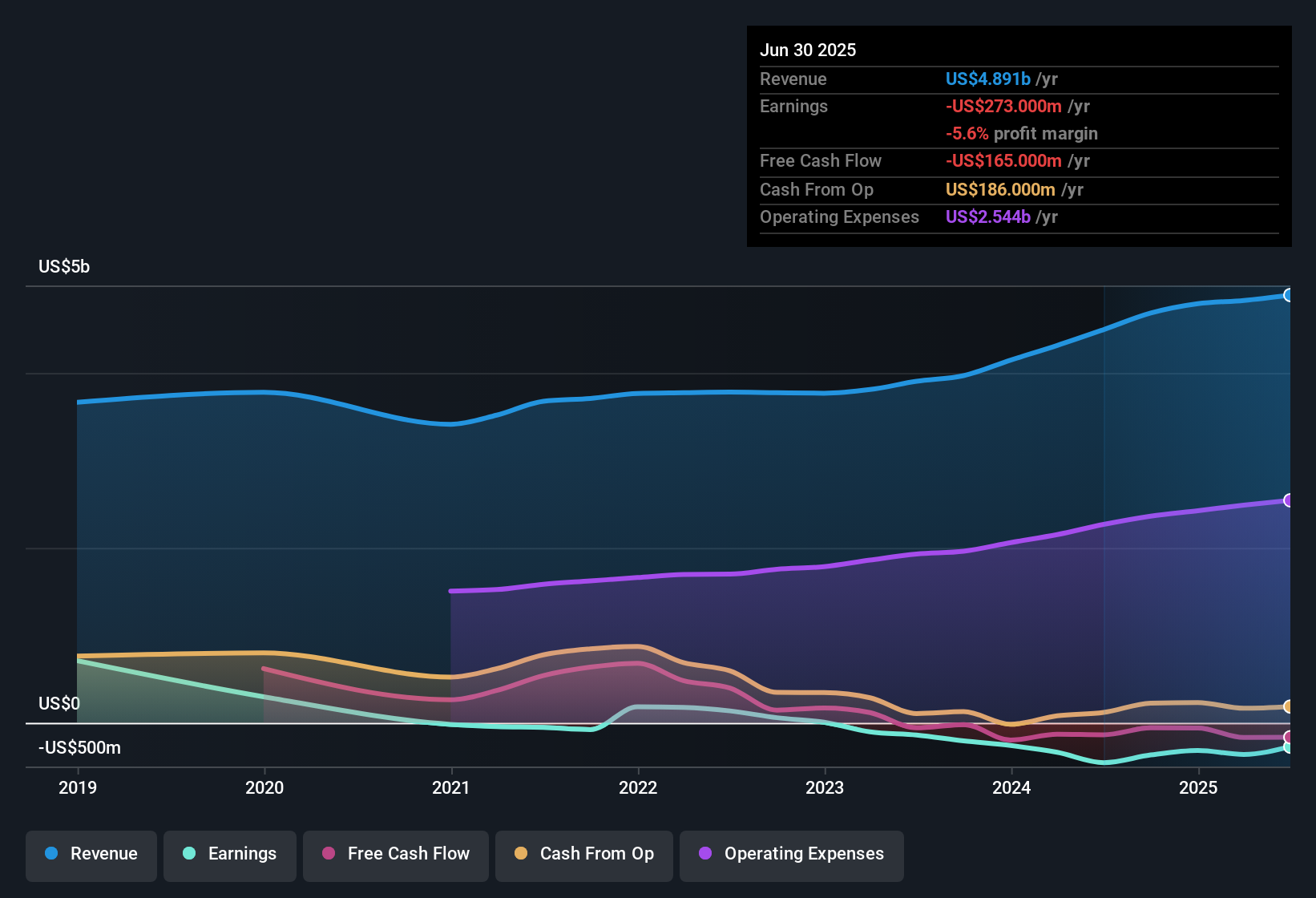

Bausch + Lomb (BLCO) reported ongoing net losses that have accelerated at a rate of 53.3% per year over the past five years, reflecting continued unprofitability with no improvement in net profit margin during the period. Despite these challenges, earnings are forecast to grow sharply at 71.13% per year, with profitability expected within the next three years. This is considered an above-average outlook compared to the broader market. Revenue growth is set at 4.9% per year, slower than the US market average of 10.3%.

See our full analysis for Bausch + Lomb.Next, we’ll see how these latest numbers align with the narratives widely followed by investors and the Simply Wall St community, highlighting whether the results match up or defy expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Valuation Metrics Signal Deep Discount

- Bausch + Lomb trades at a price-to-sales ratio of just 1.1x. This figure is materially below both the US Medical Equipment sector average of 3.1x and the direct peer average of 2.5x.

- Comparing this figure to the prevailing market view highlights a valuation opportunity, as the current share price of $14.94 is well under the calculated DCF fair value of $38.57. This suggests that despite historical challenges and unprofitability, investors may be underappreciating the potential for a turnaround.

- This discount lends support to arguments for relative value. Sector averages provide additional context for how underpricing might attract investor attention if growth targets are achieved.

- The gap between the current price and DCF fair value stands in contrast to ongoing net loss trends, fueling debate about whether low multiples reflect excessive caution or indicate potential upside.

- Curious how numbers become stories that shape markets? Curious how numbers become stories that shape markets? Explore Community Narratives

Net Losses Continue Despite Growth Outlook

- The company remains unprofitable, with net losses accelerating at a rate of 53.3% per year over the last five years while net profit margin has shown no improvement. This underlines the persistence of bottom-line pressures.

- The prevailing market analysis acknowledges that while Bausch + Lomb is forecast to deliver rapid, above-average earnings growth of 71.13% per year and reach profitability within three years, skepticism persists given the consistent pattern of deepening losses.

- Expected top-line growth of 4.9% per year falls short of the 10.3% pace for US peers. This challenges the case for a near-term profit breakthrough amid sector competition.

- Investors may be considering whether anticipated acceleration in earnings can offset the multi-year history of unprofitability highlighted in filings.

Relative Value Recognized as Key Reward

- The risk/reward framework identifies good value relative to both industry and peers. There are three explicit rewards: valuation strength, profit or revenue growth prospects, and peer-relative opportunity.

- Market analysis points out that even as Bausch + Lomb's historical performance has struggled, the combination of forecasted improvements in earnings and undemanding valuation multiples may position the company strongly if execution aligns with projections.

- With no risk factors noted in the current summary, rewards around valuation and relative growth become especially important for investor narratives.

- Peer comparisons suggest that persistent struggles have already been priced in, creating room for upside if forecasted earnings acceleration is realized.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bausch + Lomb's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Bausch + Lomb’s persistent net losses, slow revenue growth, and lack of profit margin improvements indicate ongoing financial weakness, even with an optimistic growth outlook.

If you want to focus on companies with consistent earnings expansion and less volatility, check out stable growth stocks screener (2100 results) poised to deliver steady performance through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch + Lomb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLCO

Bausch + Lomb

Operates as an eye health company in the United States, Puerto Rico, China, France, Japan, Germany, the United Kingdom, Canada, Russia, Spain, Italy, Mexico, Poland, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives