- United States

- /

- Healthcare Services

- /

- NYSE:BKD

Brookdale Senior Living (BKD): Examining Valuation Following Strong Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Brookdale Senior Living.

Brookdale Senior Living's share price momentum has been unmistakable, with an impressive 21.8% gain over the past 90 days and a year-to-date share price return of 83.2%. In addition, the company has delivered a three-year total shareholder return of over 112%. This suggests that optimism around the company’s turnaround and recovery is building, even before considering any long-term valuation questions.

If steady gains in healthcare have you interested in what else is out there, it's the perfect time to discover See the full list for free.

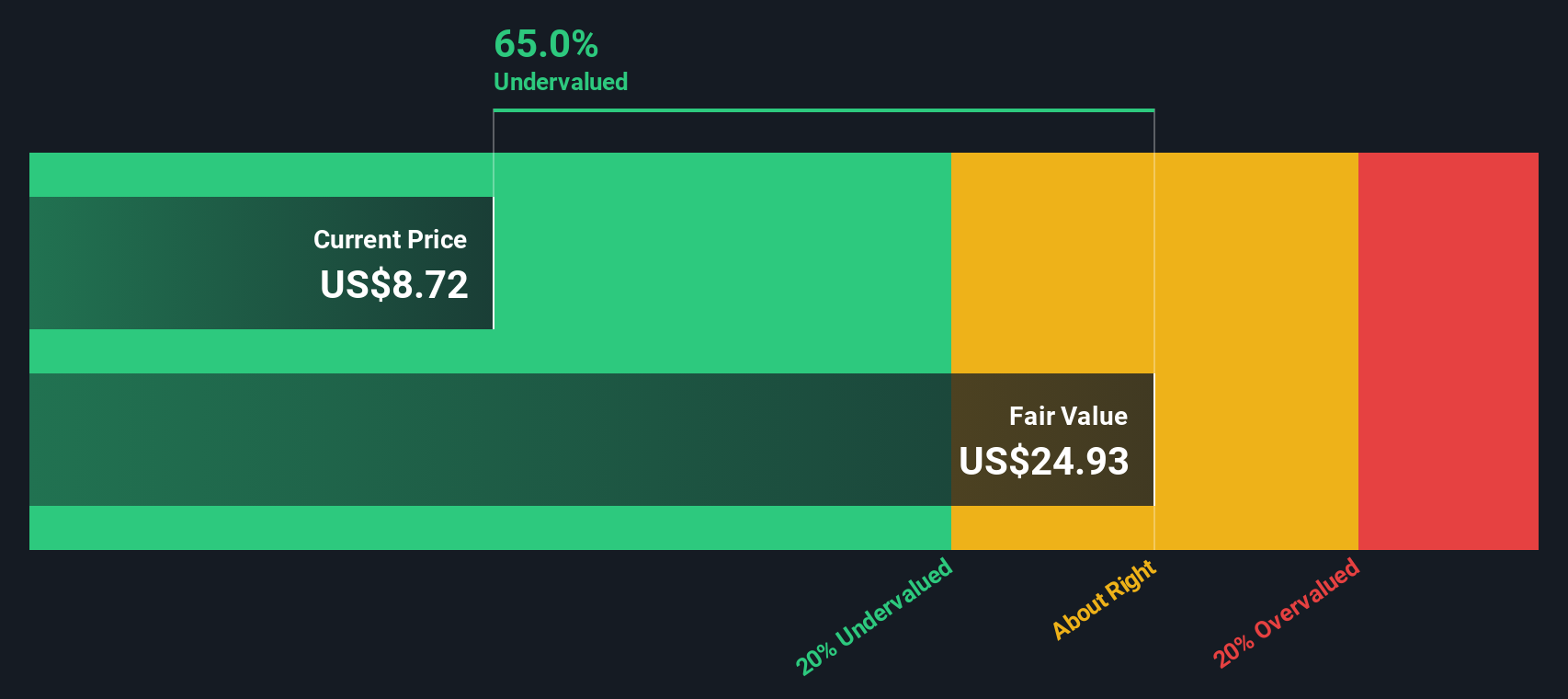

Given such strong recent gains, investors now face a crucial question: is Brookdale Senior Living currently undervalued, or has the rally already captured all the upside, leaving little room for further growth?

Most Popular Narrative: 11.7% Overvalued

With Brookdale Senior Living’s fair value from the most-followed narrative set at $8.30, below the latest closing price of $9.27, analyst expectations are priced aggressively. This setup begs for a closer look at the assumptions fueling such a call.

Brookdale is benefiting from accelerating occupancy gains as a result of operational initiatives (such as local empowerment, focused SWAT teams, and targeted incentives), and with a large and growing share of communities above the 80% occupancy threshold, rising occupancy will increasingly fall to the bottom line due to fixed-cost leverage, driving meaningfully higher margins, EBITDA, and free cash flow over the next several years.

If you want the inside edge on why Brookdale’s future value is so hotly debated, look no further. The secret? A controversial blend of operational wins and big projected margin improvements, plus profit multiples more typical of high-flying sectors. The full narrative reveals the numbers behind this bullish outlook, and you may be surprised at how the analysts get there.

Result: Fair Value of $8.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor shortages and ongoing reliance on targeted pricing incentives could still threaten Brookdale's margin expansion and future growth.

Find out about the key risks to this Brookdale Senior Living narrative.

Another Perspective: SWS DCF Model Suggests Undervaluation

Looking past analyst price targets, our SWS DCF model offers a bolder view. It suggests Brookdale Senior Living could be undervalued by a wide margin, with a fair value estimate of $18.08 per share compared to the current market price of $9.27. This stark gap raises the question: Which measure is missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookdale Senior Living for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookdale Senior Living Narrative

If you see the story differently or want to dig into the numbers yourself, you can put together your own narrative in just a few minutes, so Do it your way.

A great starting point for your Brookdale Senior Living research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Broaden your horizon and give your portfolio an edge by tapping into handpicked stocks built for growth, value, and future trends. Don’t miss your chance to get ahead!

- Unlock hidden gems with growth potential by checking out these 3584 penny stocks with strong financials that have strong financials and the potential to surprise the market.

- Tap into advancing technology by reviewing these 26 AI penny stocks, where innovation meets real-world results in artificial intelligence and automation.

- Boost your passive income stream with these 22 dividend stocks with yields > 3%, featuring robust yields and solid fundamentals to strengthen your holdings over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookdale Senior Living might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKD

Brookdale Senior Living

Owns, manages, and operates senior living communities in the United States.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives