- United States

- /

- Medical Equipment

- /

- NYSE:BDX

Does the Recent 22% Drop Signal Opportunity in Becton Dickinson’s Share Price for 2025?

Reviewed by Bailey Pemberton

- Wondering whether Becton Dickinson is offering a bargain or trading above its worth? You are not alone, and it pays to dig deeper into what drives its share price.

- The stock has seen turbulence lately, sliding 2.8% over the past week and losing 8.1% in the last month, with the year-to-date performance down a noteworthy 22.1%.

- Recently, shares reacted to closely watched sector updates, including ongoing debates over healthcare supply chain pressures and innovation in medical devices. Headlines about regulatory changes and partnerships in the industry have also shaped investors’ expectations and added an extra layer to recent volatility.

- Digging into fundamentals, Becton Dickinson scores a 4 out of 6 on our valuation checks, signaling areas of potential value. It is the methodology behind those checks, and considering an even smarter way to think about value, that we will explore next.

Find out why Becton Dickinson's -25.0% return over the last year is lagging behind its peers.

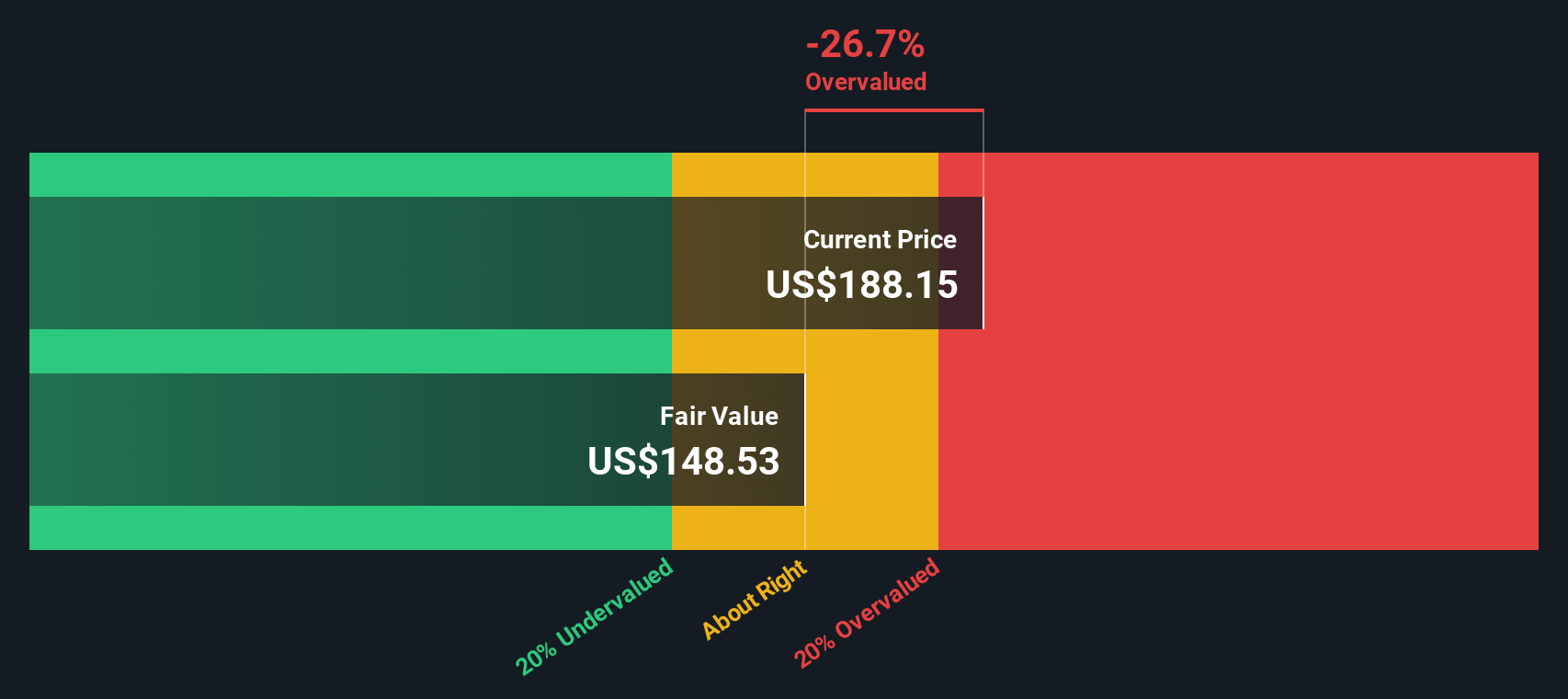

Approach 1: Becton Dickinson Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value, using current market assumptions. This approach focuses on the cash that Becton Dickinson is expected to generate for its shareholders, providing a forward-looking valuation.

Becton Dickinson’s latest reported Free Cash Flow stands at $2.43 billion, and analyst forecasts expect this to climb to $5.43 billion by 2030. These projections incorporate analyst estimates for the next five years, with later periods extrapolated using industry and company trends. Over the next decade, the company is anticipated to see a steady trajectory in its annual cash flows, reflecting both sector stability and internal investment initiatives.

According to this two-stage Free Cash Flow to Equity DCF model, the estimated intrinsic value for Becton Dickinson’s shares is $326.01. This is about 45.9% higher than the current share price. This implies that the stock is trading well below what its future cash flows warrant.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Becton Dickinson is undervalued by 45.9%. Track this in your watchlist or portfolio, or discover 838 more undervalued stocks based on cash flows.

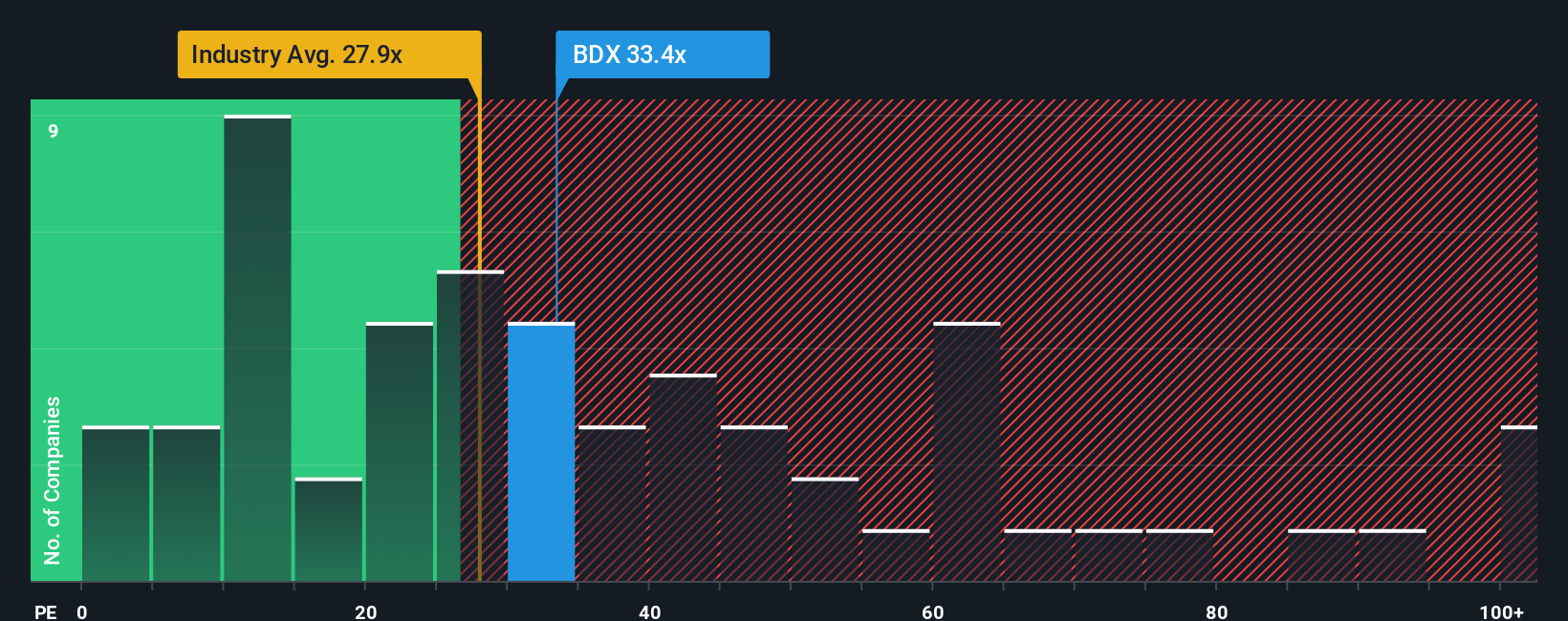

Approach 2: Becton Dickinson Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Becton Dickinson, as it directly compares the company’s share price to its earnings per share. For investors, the PE ratio helps put the company’s current price in the context of how much profit it actually generates.

What makes a "normal" or "fair" PE ratio varies depending on expectations for future growth and the risks involved. Companies with stronger profit growth or lower risk often warrant a higher PE, while slower or riskier businesses tend to trade at lower multiples.

Becton Dickinson’s current PE ratio is 31.9x, sitting above the industry average of 29.0x, but just below the peer group average of 33.2x. To put this in further perspective, Simply Wall St’s proprietary “Fair Ratio” for Becton Dickinson is 32.5x. This fair value is calculated using several factors beyond the industry or peer averages, including expected earnings growth, profit margins, market capitalization, and specific company risks.

The Fair Ratio offers a sharper lens than simply comparing to the industry, as it adapts to the nuances of Becton Dickinson’s financial profile. This means the Fair Ratio is typically a more precise guide to what the company should be worth in today’s market, considering both its performance and its sector context.

Comparing Becton Dickinson’s actual PE of 31.9x to its Fair Ratio of 32.5x, the difference is marginal, indicating the stock is trading very close to its fair value based on current earnings and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

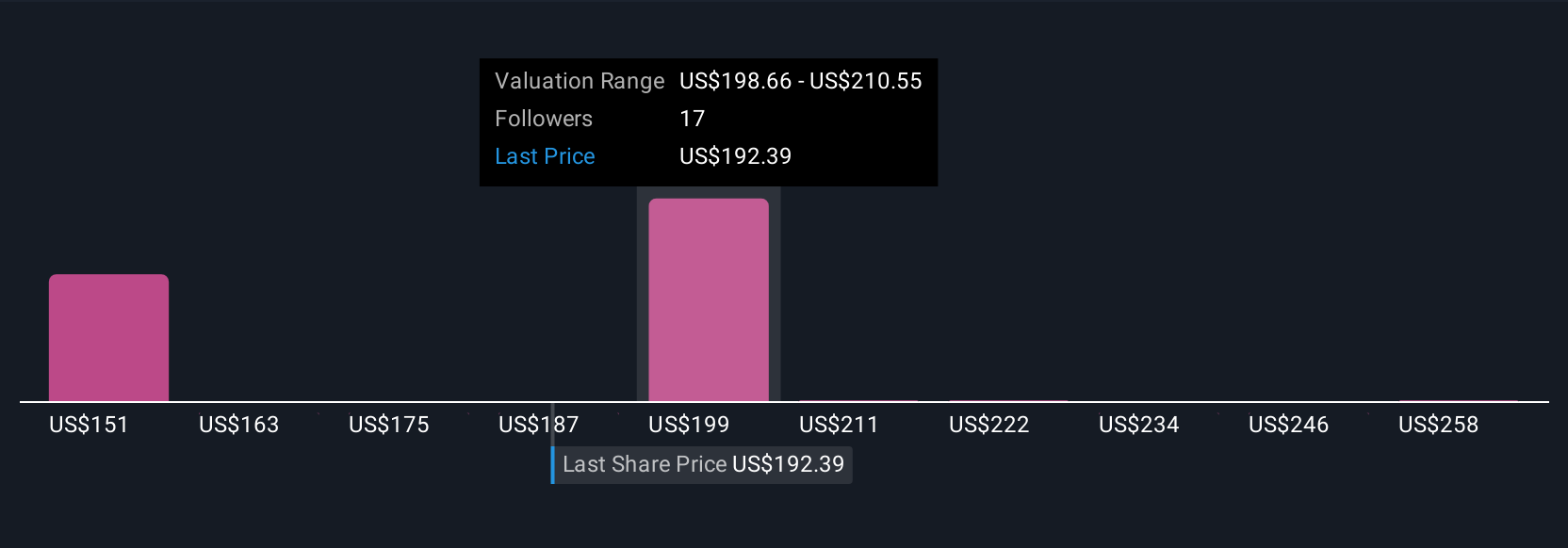

Upgrade Your Decision Making: Choose your Becton Dickinson Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives, an approach that connects your perspective (the “story”) about Becton Dickinson’s future with the numbers behind valuation.

A Narrative summarizes what you believe will drive the company’s performance, bridges your expectations for revenue, earnings, and margins, and then connects those assumptions to a fair value for the share price.

On Simply Wall St, Narratives are easy to use and accessible directly within the Community page, where millions of investors share and update their views as news unfolds or financial results are released.

Narratives help you decide if now is the right time to buy, hold, or sell by comparing what you believe is the Fair Value to the company’s current market price, and seeing how your story stacks up to the rest of the market.

Because Narratives are updated as soon as major news or earnings drop, your investment thesis always keeps pace with the latest developments, rather than relying on outdated reports.

For example, the most optimistic Narrative for Becton Dickinson puts fair value at $270 based on strong innovation and efficiency. The least confident sees only $183 as justified, emphasizing margin risks and market headwinds.

Do you think there's more to the story for Becton Dickinson? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives